Table of Contents

INTRODUCTION : Best Fintech Applications

Fintech is a combination of ‘Finance’ and ‘Technology’. If you have used different mobile applications to pay your bills or bought sticks or even downloaded an app to make a budget then you have used Fintech.

Nowadays everyone wants everything at their fingertips l, even using their money. And with so many people using fintech software has changed the way our financial world used to look. Fintech helps people to use their money in more than one way. Like with Fintech, they can learn different ways to share, save or invest their money and grow it.

GROWTH OF FINTECH COMPANIES

As per vantage market research, the global Fintech market has reached the value of USD 133.84 billion in the year 2022 and is projected to reach a value of USD 556.58 Billion by the year 2030 l. The global market is expected to grow a compound annual growth rate of 19.5% over the forecast period.

Over the last decade, consumers have started to use digital technology drastically and fintech has helped these people to make better progress towards their financial goals as well. And as a result Fintech has become a necessary habit of people’s day to day life.

According to Plaid’s Fintech effect, consumers report many benefits of using fintech including economic and time savings.

Also Read : Top FinTech Trends to Watch Out for

TYPES OF FINTECH APPLICATIONS

Online banking: Banking applications is one of the types of fintech mobile applications. From this cosumers don’t need to go to their banks every time they need to check their bank balance or to transfer money or even to check the transactions made in past. With some button pressed on your phone application, consumers can check these from their home and comfortable place only.

Investment: Investment apps helps consumers to grow their money by investing in different portfolios and also let them compare between more than one assets, see their growth and to manage those efficiently.

Lending: Money landing mobile applications are among the trending fintech apps. In this applications, people can lend money without any involvement of traditional financial institution. Without a third party these applications these apps let people to lend money and because of this the interest rates are also a little lower and investors gain more profit.

Budgeting and personal finance: These apps works little different from other fintech apps as they don’t come with payment services usually. By these apps people can manage their expenses, make budgets and try to save money and also can track records of all their bills as well.

Also Read : Everything You Need to Know About the Cost & Features of FinTech App!

8 BEST FINTECH APPLICATIONS OF 2023

Before going in the descriptive information of the apps , let’s check a quick summary of these 8 apps.

| Sr. No | Name of applications | Country of origin | Google play ratings | ios ratings |

| 1 | MoneyLion | USA | 4.3 | 4.7 |

| 2 | Robinhood | USA | 4.2 | 4.2 |

| 3 | Chime | USA | 3.9 | 4.8 |

| 4 | Nubank | Brazil | 3.9 | 4.8 |

| 5 | Mint | USA | 4.7 | 4.8 |

| 6 | Revolut | UK | 4.7 | 4.9 |

| 7 | Coinbase | USA | 4.2 | 4.7 |

| 8 | N26 | Germany | 3.7 | 4.6 |

Now let’s check some features and details about these 8 apps so that we can understand what makes them different from each other. Whether you are looking for an app to pay bills or to plan your budgets or invest in assets, these apps will help you to reach your goals.

If you want to develop your own financial app then it is necessary for you to know how these apps works first.

So let’s see how these 8 apps works:

-

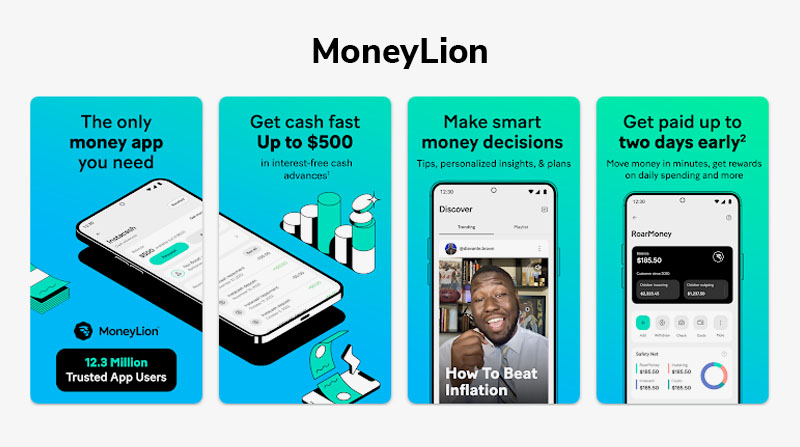

MoneyLion:

Founded in 2013, This USA based financial services company provides services like investing, cash advances, bank service and credit-builder loans at a lower interest rate to its members without credit check. Even though it has a lower interest rate, the members needs to pay a membership fee which adds to the loan amount. To become eligible to become a member you have to be atleast 18 years old and a permanent resident or citizen of the United States. This company provides access to private banking facilities to undeserved groups. As per crunchbase report, MoneyLion has raised a total of $477.5 million in funding over 7 rounds.

How does MoneyLion make money?

Money lion makes money form:

a)its subscription based mobile banking like charging $1 per month for service as an administration fee, with out-of-network ATM withdrawals a fee of $2.50 from its custoers

b) its cash advance service like for a cash advance of $20 has a fee of $1.99 for RoarMoney account holders and $ 2.99 for customers having external debit cards.

c) its investment account management fees

d)loan interest and membership fees.

Top features of MoneyLion

- Zero fee checking account

- Upto 12% cashback rewards

- Free credit monitoring

- 0% APR Instacash cash advances

Pros of using MoneyLion

- Mostly free with no account minimums

- Customizable investment portfolios

- Integrated digital personal financial services

Cons of using MoneyLion

- No dedicated financial planning

- No IRA management options

- Limited investment options

-

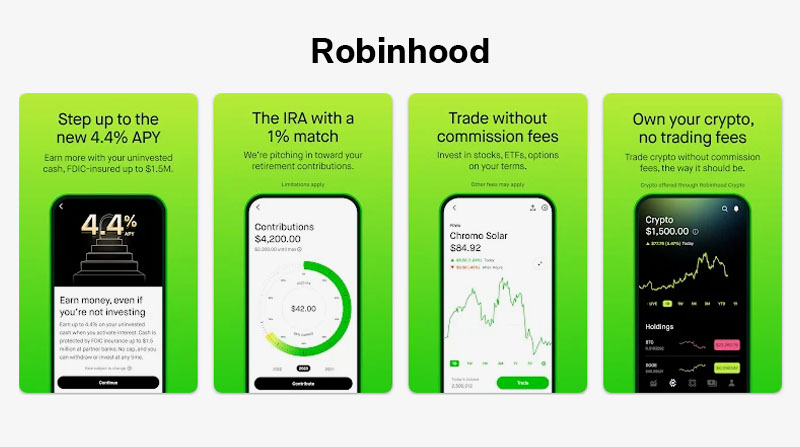

Robinhood:

Founded on 18th April,2013, this American financial company provides services like investing in stocks, ETFs , options and crypto currencies without charging any commission. Robinhood’s mission is to “democratize access to American financial system.” As per crunchbase report, Robinhood has raised a total of $6.2 billion in funding over 28 rounds.

How does Robinhood make money?

Robinhood makes money in an asymmetric way. It makes money on the transactions placed by its customers by charging payment for order flow. This transaction based revenue represented 77% of company’s revenue in 2021.

Top features of Robinhood

- Easy to use

- Best for beginner traders

- Intuitive and responsive mobile app

- Fee free trading

Pros of using Robinhood

- Buy and sell crypto currency

- Streamlined interface

Cons of using Robinhood

- Less analysis tools

- No mutual funds or bonds

-

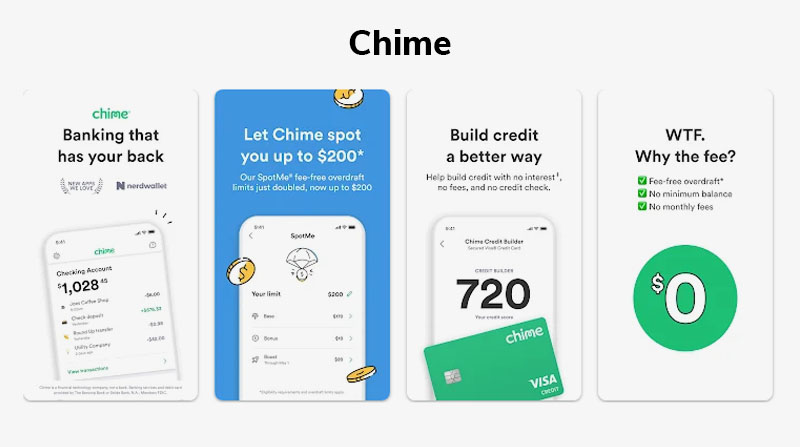

Chime:

This USA based company is a mobile-only bank. It is considered as a neo bank or challenger bank more than a financial institution. Chime offers checking accounts and saving accounts without any transaction fees. This app also allows its customers to access to the user’s paycheck 2 days sooner with the direct deposit feature. It also provides online banking service to over 300,000 fee free moneypass ATMs

How does chime make money?

Chime makes majority of its money via interchange fee which is paid by the merchants when consumers use their debit cards and ATM fees if the consumer makes an withdrawal outside of the VPA and MoneyPass network.

Chime also makes money by lending customer money to other banks and collecting interest.

Features of chime

- No ridiculous fee

- 100% digital banking

- Deposit instant checks

Pros of using chime

- Easy transfer between accounts

- Fee-free banking

- 24*7 service and support

Cons of using Chime

- No branches for those who prefer in-person banking

- Savings account having low interest rate

-

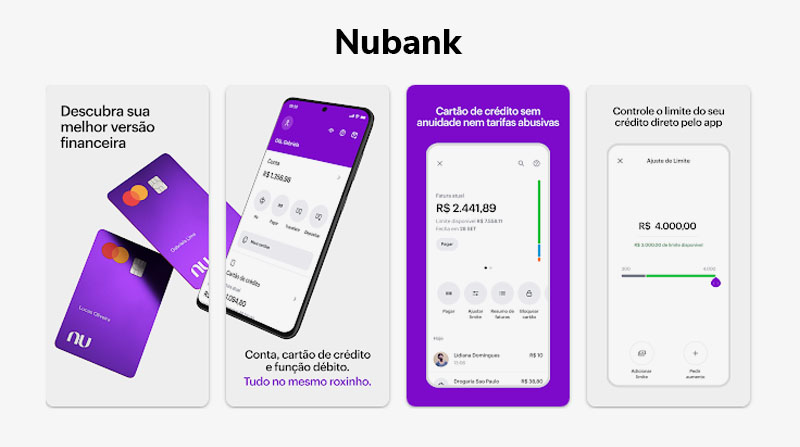

Nubank:

This Brazilian neobank is the largest fintech bank in Latin America. Nubank has its customers in brazil, Mexico and Columbia. It offers digital credit cards, transfers and payments. It also offers loans and insurances to individuals and small business customers.

How does Nubank make money?

Nubank makes money from the loan interest, fee on various transactions such as client deposits, overdraft ATM withdrawals. It also makes money from subscription services and insurance rates

Features of nubank

- Digital personal and business accounts

- Informative blogs

- Rewarding point program

Pros of using Nubank

- Free account with no maintenance fee

- Strong corporate culture backed by extensive industry experience.

- Simple and easy user interface

Cons of using Nubank

- Fixed fees at the time of cash withdrawals regardless the amount

- Limited products offerings

-

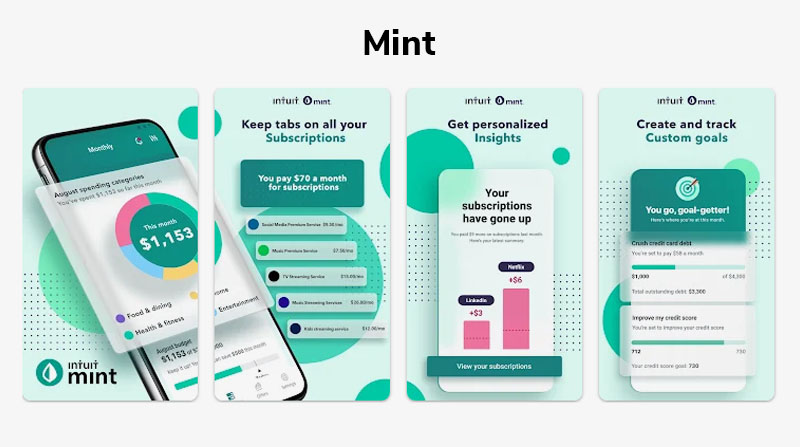

Mint:

Founded in 2006,this USA based company is one of the most popular budgeting apps. Mint was bought by software company intuit in 2009. Mint provides services like tracking bank, loan, investment and credit card balances in a single place. Consumers can also set financial goals to find ways to save money for future.

How does mint make money?

Mint makes money from referral fees, in-app

advertising and credit monitoring services.

Features of mint

- Free access of credit score and credit monitoring tools to its customers

- Secured sign up

- Budget suggestions based on spendings

Pros of using Mint

- Easily downloadable transactions

- Free app

- Allows to set up notifications and alerts

Cons of using mint

- No joint account

- Doesn’t support multiple currencies

-

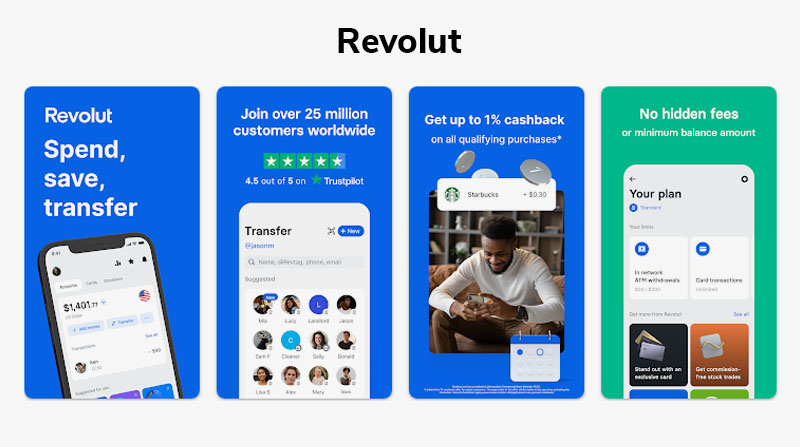

Revolut:

Founded in 2015 this English fintech company offers services like Britain and European bank accounts, debit cards, currency exchange, stock trading, crypto currency exchange etc. In 2020 Revolut was launched in the US market as well.

How does Revolut make money?

Like Robinhood, Revolut also makes money from payment for order flow. It also makes money by subscription fees, transaction fees, insurance and loan interest. The company also earns commission through its cashback and reward schemes.

Features of Revolut

- Crypto purchase

- Virtual cards

- Instant notification after every payment

Pros of using Revoult

- Free account

- Several currencies

- Vast range of features

Cons of using Revolut

- Poor customer service

- Customer accounts can be frozen temporarily due to security reasons

-

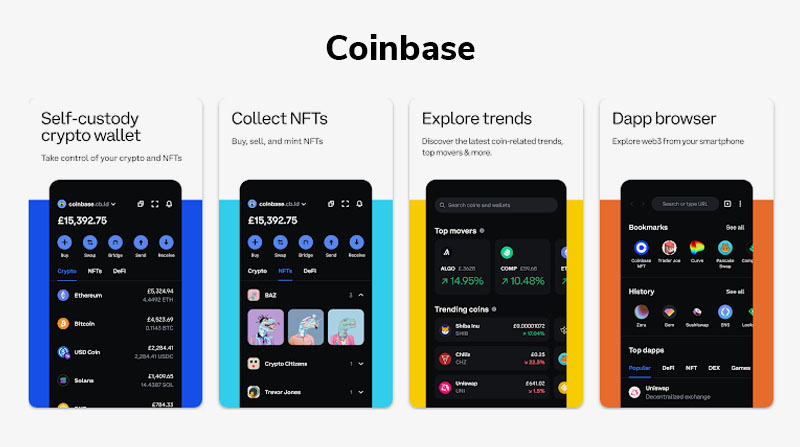

Coinbase:

Founded in 2012, this American company is one of the most popular platforms for trading and crypto currencies. The mission of this company is “to create an open financial system for the world” by enabling customers to trade crypto currencies.

How does coinbase make money?

The company makes money by transactions fees, custodial services, loan interest and subscription services.

Features of coinbase

- Managing portfolios of the customers

- Simple platform which is easy to use

- Best for new crypto currency traders.

Pros of using coinbase

- Easy to operate

- Instant transfers between coinbase users

- Online and mobile wallet service

Cons of using coinbase

- Higher fees than competitors

- Deposits and withdrawals are delayed for 3 days

-

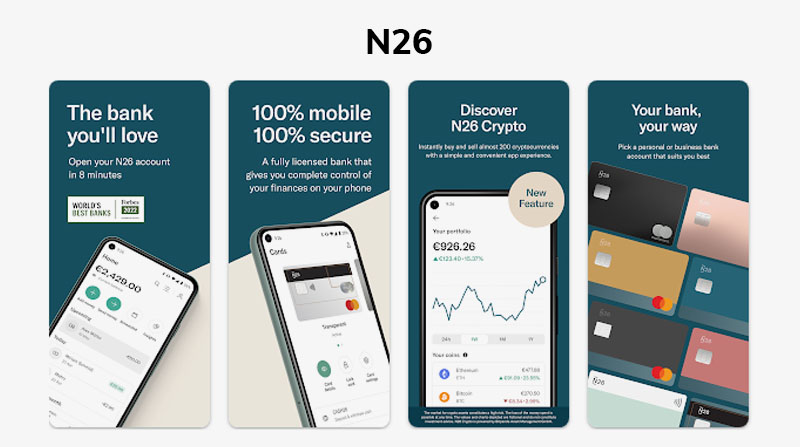

N26:

Founded in 2013, this German based company offers its services in 24 European countries. From Instant payments to guaranteed deposits, N26 offers 100% secure mobile banking. It also enables fast and flexible money management tools to control finances. It also allows 2 free nationwide ATM withdrawals every month.

How does N26 make money?

It basically makes money from its subscription services. Other than that the company offers business accounts where they make additional revenue based on value added services.

Features of N26

- Instant money transfer

- Biometric security

- Automatic generation of expense statistics

Pros of using N26

- Easy to use

- Has banking license in the EU

- Premium subscription with handy perks

Cons of using N26

- Holds only a single currency

- Lacks phone support

- Chat support is slow

FINTECH INDUSTRY GROWTH

As per the reports of Golbal Fintech Market Outlook

“The global Fintech market attained a value of approximately USD 194.2 billion in 2022 and is expected to grow in the forecast period of 2023-28 at a CAGR of 16.8% to reach USD of 492.8 billion by 2028.”

The recommendation of limited physical contact at the time of covid-19 has helped the fintech industry to grow unconditionally.

The rise of e-commerce sector has also increased the demand of fintech applications

As per statista report, “The market’s largest segment will be Digital Investment with a total transaction value of USD $ 112.90 billion in 2023”

ESTIMATED COST OF DEVELOPING A FINTECH APPLICATION

There is no fixed cost to develop a fintech application. Every company has unique features and requirements which determines the cost to develop it.

A custom fintech application development cost might start at a minimum value of $25000.

For a more clear idea, we have prepared a formula to get a rough estimation to develop the app

Estimated Development hours * Developer’s hourly cost= total mobile app development cost

By this formula you can atleast have a estimation to know your budget.

COMMON FEATURES FOR FINTECH APPLICATIONS

- Sign In : users should be able to sign in effortlessly and with appropriate security precautions. Two factor authentication is a must

- Quick scan feature : There should be QR barcode scanner so that users don’t have to input data manually everytime users need to take a quick action

- Biometric security: There should be Biometric security option so that not everyone can open one’s fintech application

- Notification : personalisation of notifications so that get a freedom to unsubscribe from annoying alerts

- Live spendings and trackings: This feature should be included in the app so that the users can keep track where they have used their money and keep a track of their spendings.

CONCLUSION

If you are a fintech company and want to launch your own application, we hope that our this article can help you to understand the core features that are needed in an app and what you should or should not keep in your app so that it can become a successful app.

However a mere idea is not what makes an app successful, but constant updates and current technological opportunities is what makes you application the best app in this highly competitive market.

If you need any kind of help in developing your fintech application, we are a team of expert developers who can help you with your vision to make it from a dream to reality.

Thanks for reading our post “Best Fintech Applications of 2024“. Please connect with us to know more about Fintech application development.