Today’s an online mobile banking application arrangements offer adaptability and comfort with only a tick or tap, paying little heed to branch hours and area. What’s more, with a developing craving for banking services, customary foundations need to meet current market patterns to hold their current clients and attract newcomers.

Various monetary exchanges are currently brought out through mobile banking. The benefit of such aides is distant mode. You simply have to interface with the server. The designer’s errand is to make an application without bugs and with full usefulness, which will be reasonable for cell phone programming and will actually want to offer types of assistance connected with exchanges in no time flat. Presently an online mobile banking application development is exceptionally famous and for this Next Big Technology is the best solution.

Table of Contents

What Is A Mobile Banking App?

A mobile banking application offers an internet based platform where clients can get to web based financial administrations from their cell phones. Be it about getting bank-related data, covering bills, or making an exchange, banking application improvement has made all that could be within reach in only a tick.

Also read : Mobile Banking & Financial App Development Solutions Revealed

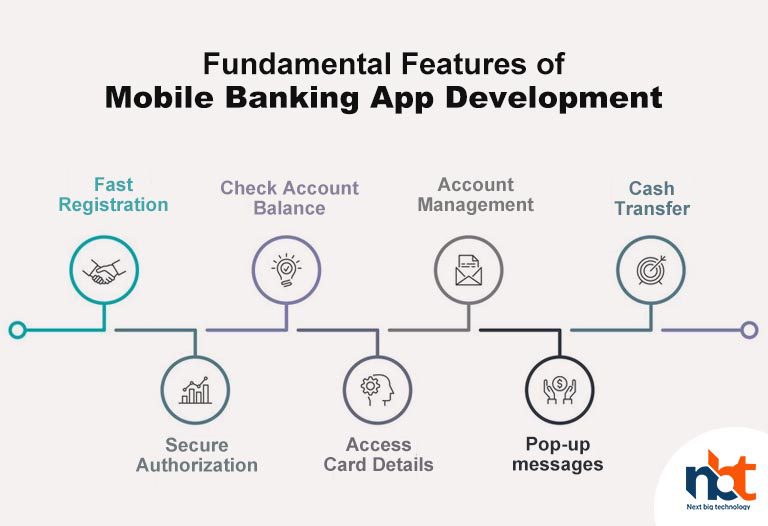

Fundamental Features of Mobile Banking App Development

Is it true or not that you are intending to develop an online mobile banking application and don’t have any idea what features to incorporate or not? Here are the features:

1. Fast Registration

Your application should have a basic and speedy enlistment process. To get to your mobile banking application, request that the clients give a ledger number, SSN, and individual data. In the wake of entering the data, the clients should acknowledge the agreements to get to the application.

2. Secure Authorization

Like each application begins with enrollment and approval, the banking application is the same. In this way, when you make an online mobile banking application, ensure it ought to satisfy security guidelines like passwords or biometrics like touch-ID or face-ID. To make your banking application safer, execute multifaceted approval by sending a code by means of SMS and requesting that clients enter the code.

3. Check Account Balance

One of the significant advantages is fast admittance to account adjusts from any side of the world. This astounding component assists the clients with realizing how much equilibrium is left prior to making the following buy. To make your banking application stick out and exceptional, you can empower clients to see account adjusts without signing into your record.

This will additionally save your versatile banking application advancement cost on other extra highlights and make your application more remarkable and solid.

4. Access Card Details

In past times, clients needed to allude to banking archives for getting to data like card subtleties. However, banking applications have settled this issue. With this feature, clients can rapidly get to card numbers, proprietor’s name, balance, installment framework, and other record subtleties on the web. Additionally, it incorporates other card-related administrations, for example, card re-giving.

5. Account Management

Like whatever other component, this is additionally one of the fundamental features. It assists the clients with getting to the data rapidly while dealing with their numerous ledgers bother free. While alluding to these highlights, clients can add or eliminate accounts, see exchange history, or view balance in one spot.

6. Pop-up messages

The most essential element of an online mobile banking application is the security. This element keeps the clients refreshed and informed about their continuous record exercises while reminding them about their forthcoming bills or programmed cash moves. Message pop-ups increment security while permitting the clients to deal with their cash. Later on, clients can set up the inclinations to pick the kind of notices they need to get.

7. Cash Transfer

Without a doubt, this is one of the obligatory highlights that empower clients to make neighborhood and worldwide installments. The versatile banking application ought to likewise incorporate the conventional strategies for UPI installment, QR scanner installment, NFC installment, and that’s only the tip of the iceberg. Not at all like whatever other element, ought this one to be consistent to allow the clients to get a superior internet banking experience.

Thus, these are some priority web based banking application includes that you shouldn’t miss consolidating while you make a portable application. Be that as it may, basically realizing the highlights doesn’t make your banking application fruitful until you follow the right portable application advancement process. Here we have referenced the bit by bit interaction to develop an online mobile banking application.

Also read : Digital Banking App Development – A Complete Guide

What amount does it cost to develop an online mobile banking application?

There is no precise response to the inquiry. This fluctuates concerning extension, intricacy, innovation, and criticalness, all impacting the last expense. A portion of the elements influencing the sensible spending plan include:

- Work breakdown structure (WBS) for portable financial application advancement

- Innovation stack

- Anticipated cutoff times

- Commitment system: fixed value, time and material, committed group, group increase, or out staffing

- Programming interface joining administrations

It might take from six to ten months to assemble a MVP. The cost of development is about to 5000-20000 USD depends on the number of features, location and so on. The specific term relies upon whether you really want a little task with minor updates to your ongoing application or a mind boggling one with custom banking application development without any preparation.

Wrapping up:

So from the above you better comprehend how quickly the significance of availability of a web based banking application for any financial organization develops. Speedy exchanges, no geological limits, the range of installments (utilities, web-based features, portable, and so on), gainful commissions, and fulfilled clients — these can be reached by making an internet banking application.

Obviously, the most common way of creating is work escalated and tedious; however the advantages you can get from it offset the expenses.

If you’re ready to develop an online mobile banking application development ventures then Next Big Technology is the best solution for your problem. In the event that you want an accomplished Tech Partner to go with you during your process go ahead and reach us and we’ll figure out how to help you!

Thanks for reading our post “How To Create An Online Mobile Banking Application? Cost And Features”, please connect with us for any further inquiry. We are Next Big Technology, a leading web & Mobile Application Development Company. We build high-quality applications to full fill all your business needs