Is it true that you are a Financial Service Provider, Start-Up, SMB, or, Entrepreneur, searching for a digital application development organization? Next Big Technology has the solution for your question. Your quest for that ‘thought’ closes here. In this blog, you will come to know a total aide on Digital Banking App Development, According to Statist’s new figure; a colossal number of 196 billion applications are projected to be downloaded by customers from the simple Google Play Store. What’s more, according to data reported, there are around 5.22 billion remarkable versatile clients the world over, which legitimizes your choice to go for a digital banking application for your business. This application deals with all the inside financial cycles and activities implied for banks’ fluctuated client-base dispersed across the globe.

Table of Contents

How to create a digital banking app?

Except if there is a construction in how development process is drawn closer, finishing one on request won’t be a wonderful encounter. Underneath you can track down the standard steps to develop a digital banking application. Contingent upon the undertaking the means could change. Here is the overall development structure we follow at Next Big Technology.

Also read : Mobile Banking & Financial App Development Solutions Revealed

Step 1: Conceptualize

The more granular and substantial the way to deal with conveyance is, the less opportunity there is that you will be disheartened or fooled into paying for an interminable undertaking.

Step 2: Build an MVP

Basically, a MVP contains barely an adequate number of features, in this manner assisting you with approving the item market fit and generally speaking origination of the application. At this stage, looking for all suitable wellsprings of client feedback is significant.

The more you will gain from your MVP, the better confirmation you will have that your completely evolved application will be a triumph.

Step 3: Get security in order

This step requires additional checks from you and the advancement group chipping away at it. Ensure the security features recorded above make it to your application and work faultlessly – you can’t think twice about save money on application security.

Step 4: Get the application constructed!

Screen the achievements, the expectations, and keep your hands on the application conveyance process. This step will take a nice while to finish. The new application assemble will require testing, escalated input, and most likely a few things could change along the way.

Step 5: App design

Once the application is fabricated, now is the right time to put a layer of paint on it. The application will have in some measure half of its connection point work done right now, yet at the same time, you will require a UI designer make it truly pleasant looking.

Step 6: Release, integrations, good-to-haves

Now the application is fit to be shipped, and any remaining work done on it won’t essentially influence its course. Plan API mixes with other applications that you could view as gainful for your clients.

Step 7: Maintenance

Presently, you should simply focus on client criticism, fix anything troublesome bugs advance toward the surface, and guarantee the best client experience conceivable. Get help from Next Big Technology- they will assist you and support to have it in advance.

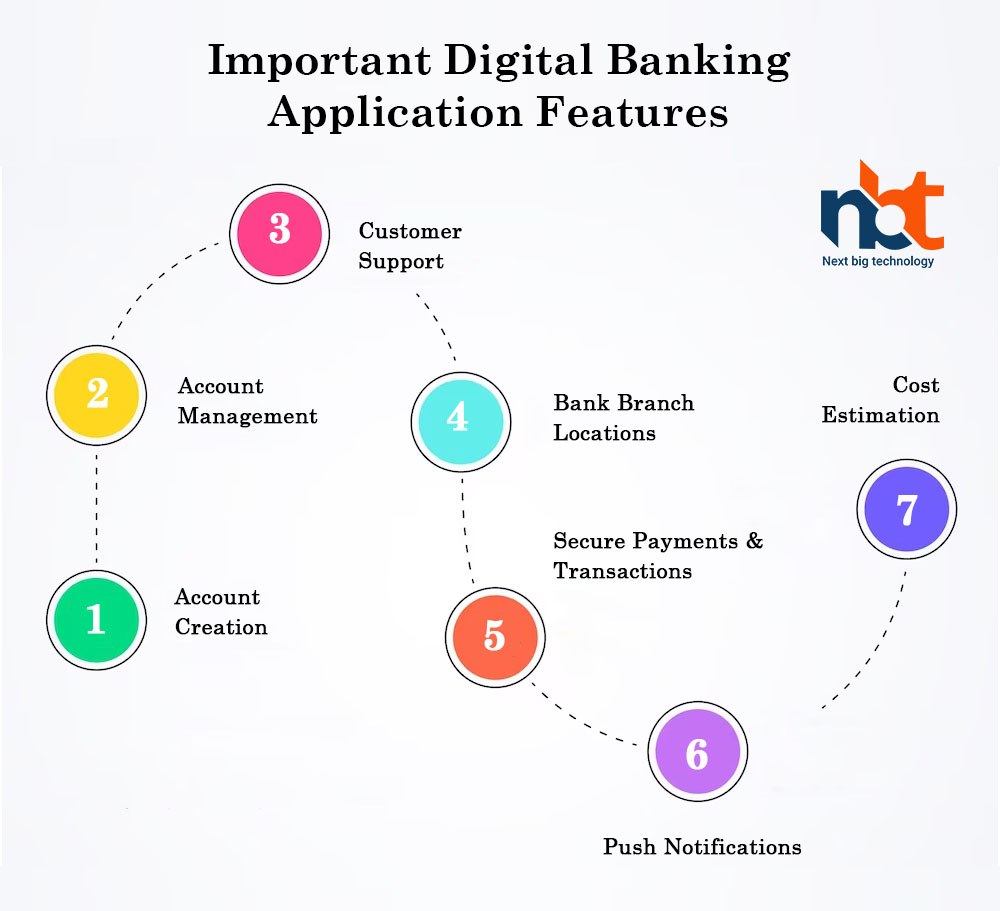

Important Digital Banking Application Features

The general features that are essential are as below:

-

Account Creation

It is really critical to create a protected and quick approval process. Multifaceted verification is a safeguarded sign-in choice; be that as it may, it requires an investment to fill in the fundamental data. Also, biometric validation utilizing actual client measurements is quicker and more fun.

-

Account Management

This might incorporate a scope of digital banking features. Clients can check their ledgers, cards; audit account adjusts and record history, and so on. Applying some additional functionality is likewise conceivable. This empowers clients to make growth strategies, perform rehash installments, and put forth an investment funds objective.

-

Customer Support

This is one of the indispensable elements since the client ought to address a bank rep and pose inquiries 24*7. Besides, it is feasible to progress and customize the client experience by involving AI in a chatbot.

-

Bank Branch Locations

The essential element of digital banking application development should not be deserted. To propel the experience, executing VR technology is conceivable. This is a selective component of versatile banking applied by RBC. It allowed the bank to become the quantity of its application introduces definitely.

-

Secure Payments & Transactions

One more option in contrast to this element is utilizing QR codes for merchandise and administrations installments. QR code filtering is a speedy and simple method for playing out these tasks inside the application. Just a few banks have offered this element to their clients.

-

Push Notifications

Digital banking application ought to utilize updates and warnings to help client commitment and application advancement. It is fundamental to deal with this perspective and plan the correspondence procedure with your clients in advance.

Also read : Secure Mobile Wallet App For All Your Payment Needs

-

Cost Estimation

An application with a full set-up of features and additional intense security, obviously, is something that would certainly merit paying a decent amount for. As per estimation, the cost of digital banking application development might range from 5000-20000 USD.

Factors that affect cost estimation are-

- Development premise like hybrid, native and so on.

- Type, area of the merchant.

- Features and application intricacy.

- UI/UX design intricacy.

- Infrastructure at the back-end associated APIs.

- Exceptional GUI, visual components.

- Kinds of platforms (Android, iOS, cross-stage, web, and so forth.)

End

Financial dealings and exchanges include among the highest needs all over, all businesses. These are unmatched to Bank administrations. What’s more, while banking organizations are accessible on the applications of each and every client’s cell phone, the consistent experience is ensured for the reasons referenced all through the blog. It’s the ready time for you to precede your digital banking application development to make that delightful, helpful stage for every one of the clients. Connect with Next Big Technology and look for sufficient direction for the application development meeting wanted business objectives.

Wish to claim an amazing banking application for your organization? We can assist you with a banking application that gives a client driven encounter that is helpful and drawing in for your clients. Go ahead and request a demo.

Thanks for reading our post “Digital Banking App Development – A Complete Guide”, please connect with us for any further inquiry. We are Next Big Technology, a leading web & Mobile Application Development Company. We build high-quality applications to full fill all your business needs.