Table of Contents

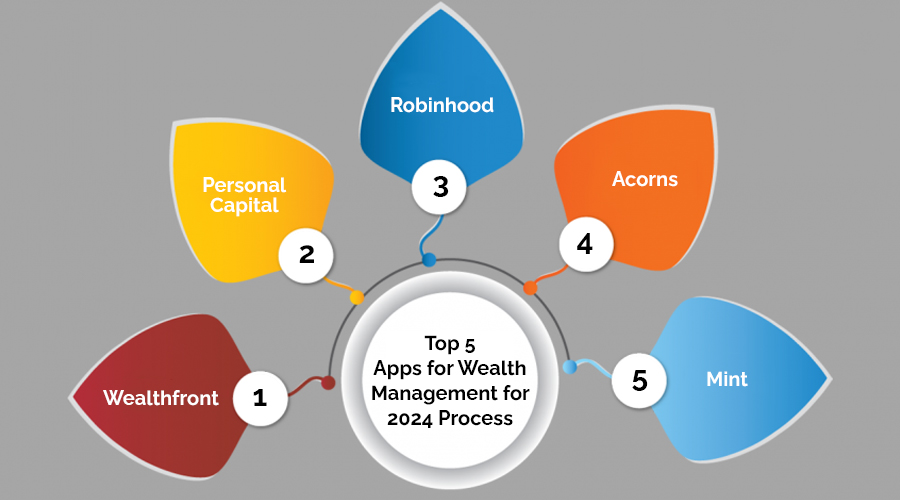

Top 5 Apps for Wealth Management for 2024 Services

In today’s fast-paced digital world, managing your wealth effectively has become easier and more convenient thanks to a plethora of innovative mobile applications. These apps not only offer financial management tools but also provide insights, advice, and services tailored to your specific financial goals. As we step into 2024, let’s explore the top five apps for wealth management that are set to revolutionize how we handle our finances.

- Wealthfront: Wealthfront continues to lead the pack in automated investing and financial planning. Utilizing advanced algorithms, Wealthfront offers personalized investment portfolios based on your risk tolerance, financial goals, and time horizon. Additionally, it provides features like tax-loss harvesting and automatic rebalancing to optimize returns and minimize tax liabilities. With a user-friendly interface and low fees, Wealthfront remains a top choice for both seasoned investors and beginners alike.

- Betterment: With its blend of robo-advisors and human financial experts, Betterment offers a comprehensive solution for wealth management. The app provides automated portfolio management, tax-efficient strategies, and retirement planning services. What sets Betterment apart is its human touch, allowing users to access certified financial planners for personalized advice and guidance. Whether you’re planning for retirement, saving for a major purchase, or building wealth, Betterment offers the tools and support needed to achieve your financial goals.

- Personal Capital: Personal Capital excels in holistic financial planning by integrating budgeting, investment tracking, retirement planning, and wealth management into a single platform. Its robust tools allow users to aggregate all their financial accounts, analyze their spending habits, and track their net worth in real-time. Moreover, Personal Capital offers access to registered financial advisors for personalized investment advice and retirement planning strategies. With its emphasis on comprehensive financial planning, Personal Capital empowers users to take control of their financial future.

- Acorns: Acorns simplifies wealth management through its unique approach of “rounding up” everyday purchases and investing the spare change. Users link their debit and credit cards to the app, and Acorns automatically invests the rounded-up amounts into diversified portfolios based on their risk preferences. Additionally, Acorns offers retirement accounts, educational savings accounts, and socially responsible investment options to cater to different financial goals and values. With its intuitive interface and hands-off approach to investing, Acorns is perfect for those looking to start investing with minimal effort.

- Robinhood: Robinhood has revolutionized the investment landscape with its commission-free trading platform and user-friendly interface. While primarily known for stock trading, Robinhood also offers features like fractional shares, options trading, and cryptocurrency trading. With no account minimums and low barriers to entry, Robinhood makes investing accessible to everyone. However, it’s essential to exercise caution and conduct thorough research before making investment decisions. With its emphasis on democratizing finance, Robinhood remains a popular choice among millennials and novice investors.

How to Create a Top 5 Apps for Wealth Management for 2024

In the dynamic landscape of personal finance, staying on top of your wealth management game is essential for securing a prosperous future. Fortunately, with the advent of technology, managing your finances has never been more accessible. In 2024, there’s a plethora of apps designed to streamline financial management, offering users intuitive interfaces, robust features, and cutting-edge tools. Let’s delve into the top 5 apps for wealth management in 2024 that can empower you to take control of your financial destiny.

- Wealthfront: Wealthfront stands out as one of the leading robo-advisor platforms, offering automated investment management tailored to your financial goals and risk tolerance. Through advanced algorithms, Wealthfront constructs diversified portfolios comprised of low-cost ETFs, optimizing your investments for long-term growth. With features like tax-loss harvesting and direct indexing, Wealthfront ensures efficient tax management, maximizing your returns while minimizing tax liabilities.

- Personal Capital: Personal Capital revolutionizes wealth management by providing a comprehensive suite of financial tools under one roof. From budgeting and expense tracking to investment management and retirement planning, Personal Capital offers a holistic approach to financial management. Its robust analytics and dashboard provide real-time insights into your financial health, empowering informed decision-making. Additionally, Personal Capital’s team of financial advisors offers personalized guidance to help you achieve your financial objectives.

- Robinhood: Robinhood has democratized investing, making it accessible to novice investors with its user-friendly interface and commission-free trading. With its intuitive mobile app, Robinhood allows users to buy and sell stocks, ETFs, options, and cryptocurrencies seamlessly. Moreover, Robinhood offers fractional shares, enabling investors to diversify their portfolio with small amounts of money. While it caters primarily to DIY investors, Robinhood’s educational resources and research tools assist users in making informed investment decisions.

- Mint: Mint simplifies budgeting and expense tracking, helping users take control of their finances effortlessly. By syncing all your financial accounts in one place, Mint provides a comprehensive overview of your income, expenses, and net worth. Through customizable budget categories and alerts, Mint empowers users to set financial goals and stay on track. Furthermore, Mint’s credit monitoring feature enables users to monitor their credit score and detect any suspicious activity, enhancing financial security.

- Acorns: Acorns revolutionizes saving and investing by leveraging spare change to build wealth gradually. Through its “round-up” feature, Acorns automatically invests your spare change from everyday purchases into a diversified portfolio of ETFs. Additionally, Acorns offers automated recurring contributions and cashback rewards, accelerating your path towards financial goals. With its user-friendly interface and educational content, Acorns makes investing accessible and engaging for users of all backgrounds.

Why Should You Go for Top 5 Apps for Wealth Management for 2024

In today’s fast-paced digital age, managing your finances effectively is more crucial than ever. With an array of financial commitments and investment opportunities, staying on top of your wealth can be overwhelming. Fortunately, technology has paved the way for innovative solutions to streamline wealth management processes. Among the plethora of options available, the top five apps for wealth management in 2024 stand out as game-changers, offering unparalleled convenience, security, and functionality.

- Wealthfront: Wealthfront is revolutionizing wealth management with its automated investment platform. By leveraging advanced algorithms and expert financial advice, Wealthfront creates personalized investment portfolios tailored to your unique goals and risk tolerance. With features like tax-loss harvesting and automatic rebalancing, Wealthfront optimizes your investment strategy for maximum returns while minimizing tax liabilities.

- Betterment: As one of the pioneering robo-advisors, Betterment continues to set the standard for accessible and affordable wealth management. With its user-friendly interface and goal-based investing approach, Betterment makes it easy for users to set financial goals, track progress, and adjust strategies accordingly. Whether you’re saving for retirement, a home, or education, Betterment offers diversified investment portfolios designed to help you achieve your objectives efficiently.

- Personal Capital: Personal Capital combines cutting-edge technology with personalized financial advisory services to empower users in managing their wealth comprehensively. With its intuitive dashboard, Personal Capital provides a holistic view of your financial life, including investments, savings, spending, and net worth. Additionally, its wealth management services offer tailored investment strategies and retirement planning guidance to optimize your financial well-being.

- Robinhood: Robinhood has democratized investing by offering commission-free trading and intuitive investment tools to users of all experience levels. With its mobile-first approach, Robinhood makes investing accessible anytime, anywhere, empowering individuals to build their investment portfolios effortlessly. From stocks and ETFs to cryptocurrencies, Robinhood offers a diverse range of investment options, allowing users to diversify their holdings easily.

- Mint: Mint is a comprehensive financial management app that helps users take control of their finances by providing budgeting, expense tracking, and bill payment features in one convenient platform. By syncing with your bank accounts and credit cards, Mint offers real-time insights into your spending habits and helps you identify areas where you can save money. Additionally, Mint’s investment tracking feature allows users to monitor their investment performance and stay informed about market trends.

Market Prospects of Top 5 Apps for Wealth Management for 2024 and Platforms

In the rapidly evolving landscape of personal finance, the role of technology in wealth management has become increasingly prominent. With a plethora of apps and platforms available, individuals now have unprecedented access to tools and resources to manage their finances efficiently. As we delve into 2024, let’s explore the market prospects of the top five wealth management apps and platforms shaping the financial landscape.

- Robinhood: Robinhood revolutionized the investment landscape with its commission-free trading model. Despite facing regulatory challenges in recent times, Robinhood remains a dominant force in the market. Its user-friendly interface and intuitive design continue to attract millennials and first-time investors. With the addition of features like fractional share investing and cryptocurrency trading, Robinhood is well-positioned to capitalize on the evolving investment trends of 2024.

- Wealthfront: Wealthfront, a pioneer in robo-advisory services, continues to gain traction among investors seeking automated investment solutions. Its algorithm-driven approach to portfolio management appeals to tech-savvy individuals looking for a hands-off approach to wealth management. With the integration of tax-loss harvesting and high-yield cash accounts, Wealthfront is poised to attract a broader audience in 2024, including high-net-worth individuals seeking efficient wealth preservation strategies.

- Betterment: Similar to Wealthfront, Betterment offers automated portfolio management and financial planning services. However, Betterment distinguishes itself with its focus on personalized advice and goal-based investing. In 2024, Betterment’s emphasis on holistic financial planning and retirement solutions is expected to resonate with individuals prioritizing long-term financial wellness. With the growing demand for sustainable investing options, Betterment’s socially responsible portfolio offerings could further enhance its market prospects.

- Acorns: Acorns pioneered the concept of micro-investing by rounding up everyday purchases and investing the spare change. This approach has proven popular among millennials and individuals looking to start investing with minimal capital. In 2024, Acorns’ emphasis on simplicity and accessibility is likely to attract a new wave of investors, particularly as financial literacy initiatives continue to gain momentum. Additionally, Acorns’ expansion into retirement planning and debit card offerings could broaden its appeal among diverse demographics.

- Personal Capital: Personal Capital offers a hybrid approach to wealth management, combining automated investing with access to human financial advisors. This blend of technology and personalized guidance appeals to individuals seeking a comprehensive wealth management solution. In 2024, Personal Capital’s focus on financial education and retirement planning services is expected to resonate with baby boomers and Gen Xers nearing retirement age. As the need for retirement income planning grows, Personal Capital’s integrated approach could drive significant growth in the coming year.

Essential Features of a Top 5 Apps for Wealth Management for 2024

In today’s fast-paced digital age, managing personal finances efficiently has become paramount. With the plethora of wealth management apps available in the market, it can be overwhelming to choose the right one that suits your financial needs. However, there are certain essential features that top-notch wealth management apps offer to help users navigate their financial journey seamlessly in 2024.

- Comprehensive Portfolio Tracking: One of the fundamental features of a top wealth management app is its ability to provide comprehensive portfolio tracking. Users should be able to effortlessly monitor all their investments, including stocks, bonds, mutual funds, and other assets, in real-time. This feature enables users to stay informed about their financial positions and make informed decisions accordingly.

- Personalized Financial Planning Tools: Every individual has unique financial goals and aspirations. Therefore, the best wealth management apps for 2024 should offer personalized financial planning tools. These tools analyze users’ financial situations, risk tolerance, and objectives to create tailored investment strategies and retirement plans. Whether it’s saving for a house, planning for a child’s education, or building a retirement fund, these tools provide customized recommendations to help users achieve their goals.

- Robust Security Measures: Security is paramount when it comes to managing personal finances online. Top wealth management apps prioritize the security of users’ sensitive financial information through robust encryption techniques and multi-factor authentication. Additionally, they adhere to stringent regulatory standards to ensure the safety and confidentiality of users’ data, giving them peace of mind while managing their wealth.

- Access to Professional Advice: While some users prefer to manage their finances independently, others may seek professional advice from financial advisors. The best wealth management apps for 2024 offer access to certified financial planners or robo-advisors who can provide expert guidance and recommendations tailored to users’ financial objectives. Whether it’s asset allocation, tax planning, or retirement strategies, users can leverage professional advice within the app to optimize their financial decisions.

- User-Friendly Interface and Seamless Integration: A user-friendly interface is essential for enhancing the overall user experience of a wealth management app. Intuitive navigation, clear visualizations, and easy-to-understand analytics make it easier for users to manage their finances effectively. Moreover, seamless integration with bank accounts, investment accounts, and other financial platforms streamlines the process of tracking expenses, monitoring investments, and executing transactions, saving users valuable time and effort.

Advanced Features of a Top 5 Apps for Wealth Management for 2024

In the fast-paced world of finance, managing wealth efficiently and effectively has become increasingly vital. Fortunately, technological advancements have led to the development of sophisticated apps tailored to streamline wealth management processes. As we step into 2024, let’s delve into the advanced features offered by the top five wealth management apps that are revolutionizing the way individuals handle their finances.

- AI-Powered Investment Insights: Leading wealth management apps in 2024 harness the power of artificial intelligence (AI) to provide users with personalized investment insights. These apps analyze vast amounts of financial data, market trends, and user preferences to offer tailored investment recommendations. Whether it’s optimizing portfolio allocations or identifying lucrative investment opportunities, AI-driven insights empower users to make informed decisions, ultimately maximizing their wealth accumulation potential.

- Robo-Advisory Services: Robo-advisors have gained significant traction in recent years, and top wealth management apps continue to enhance their robo-advisory services in 2024. These intelligent algorithms assess users’ financial goals, risk tolerance, and time horizons to construct diversified investment portfolios automatically. Moreover, they continuously monitor market conditions and rebalance portfolios accordingly, ensuring optimal performance while minimizing risk.

- Cryptocurrency Integration: With the surge in popularity of cryptocurrencies, leading wealth management apps have integrated support for digital assets in 2024. Users can seamlessly manage their traditional investments alongside cryptocurrencies within a single platform. These apps provide real-time market data, advanced charting tools, and secure storage solutions, empowering users to navigate the dynamic world of digital currencies with confidence.

- Personalized Financial Planning: Recognizing the importance of comprehensive financial planning, top wealth management apps offer advanced tools for personalized financial planning in 2024. Users can set specific financial goals, such as retirement planning, saving for education, or buying a home, and leverage intuitive calculators to chart their progress. Moreover, these apps factor in variables like inflation, taxes, and life events to provide tailored recommendations and actionable insights, ensuring users stay on track to achieve their financial aspirations.

- Enhanced Security Measures: Security remains paramount in wealth management, and top apps prioritize robust security measures in 2024 to safeguard users’ sensitive financial information. From multi-factor authentication and biometric recognition to end-to-end encryption and secure data storage protocols, these apps employ cutting-edge technologies to fortify their defenses against cyber threats and unauthorized access, instilling confidence and peace of mind among users.

Top 5 Apps for Wealth Management for 2024 Timelines

In today’s fast-paced world, managing your finances effectively is crucial for securing your financial future. Fortunately, with the advancement of technology, we now have access to a plethora of wealth management apps that can help us take control of our money like never before. Whether you’re looking to budget, invest, save for retirement, or simply track your expenses, there’s an app out there to suit your needs. In this article, we’ll explore the top 5 wealth management apps for the year 2024.

- Wealthfront: Wealthfront is an automated investment service that offers a range of features to help users grow their wealth effortlessly. With its sophisticated algorithms, Wealthfront constructs and manages personalized investment portfolios tailored to your financial goals and risk tolerance. The app also offers tax-loss harvesting, automatic rebalancing, and financial planning tools to optimize your investment strategy.

- Betterment: Similar to Wealthfront, Betterment is a robo-advisor that provides automated investment solutions to users. It offers goal-based investing, tax-efficient portfolio management, and personalized advice to help users achieve their financial objectives. Betterment’s user-friendly interface and low fees make it an attractive option for both novice and experienced investors alike.

- Personal Capital: Personal Capital is more than just an investment app; it’s a comprehensive financial management tool that offers budgeting, investment tracking, retirement planning, and wealth management services. With its intuitive dashboard, users can get a holistic view of their financial health, analyze their investment performance, and receive personalized recommendations to optimize their finances.

- Mint: Mint is a popular budgeting app that helps users track their expenses, create budgets, and manage their money more effectively. It automatically categorizes transactions, provides insights into spending habits, and alerts users to unusual account activity. Mint also offers personalized tips and advice to help users save more and spend less.

- Robinhood: Robinhood revolutionized the investment industry with its commission-free trading platform, making investing accessible to everyone. With its user-friendly interface and no account minimums, Robinhood allows users to buy and sell stocks, ETFs, options, and cryptocurrencies with ease. The app also offers educational resources and tools to help users make informed investment decisions.

How Much Does It Cost to Build a Top 5 Apps for Wealth Management for 2024?

In the rapidly evolving landscape of finance, the demand for efficient wealth management solutions has never been higher. As we navigate through 2024, the importance of accessible and user-friendly wealth management apps continues to soar. For businesses and entrepreneurs eyeing this sector, understanding the costs involved in developing top-notch wealth management apps is paramount.

- Research and Development: Before diving into the development phase, extensive research is crucial. This involves analyzing market trends, competitor apps, and user preferences. Depending on the scope and depth of research, costs can vary significantly. Expect to allocate a substantial portion of your budget to this phase to ensure your app meets the evolving demands of users in 2024.

- Design and User Experience: Aesthetics and user experience play a pivotal role in the success of any app, especially in the competitive realm of wealth management. Investing in talented designers and UX/UI experts is essential to create visually appealing interfaces that offer seamless navigation. Costs for design and UX/UI development can range from moderate to high, depending on the complexity of your app’s features and functionalities.

- Development and Programming: The development phase encompasses coding, programming, and integration of various features such as account management, investment tracking, financial analytics, and security protocols. Hiring experienced developers proficient in the latest technologies such as blockchain, AI, and machine learning can be costly but is indispensable for building a robust wealth management app that stands out in 2024.

- Security Measures: Given the sensitive nature of financial data, implementing robust security measures is non-negotiable. This includes encryption protocols, multi-factor authentication, biometric verification, and regular security audits. Investing in cutting-edge security infrastructure adds to the overall cost but is imperative to earn users’ trust and ensure compliance with stringent data protection regulations.

- Integration of Advanced Technologies: To stay ahead of the curve, integrating advanced technologies like artificial intelligence, predictive analytics, and robo-advisory services can elevate the functionality and appeal of your wealth management app. While incorporating these features may incur additional expenses, they enhance user engagement, personalize financial recommendations, and streamline decision-making processes.

- Testing and Quality Assurance: Thorough testing and quality assurance are vital to identify and rectify any glitches, bugs, or compatibility issues before the app goes live. Allocating resources for extensive testing across various devices, operating systems, and scenarios ensures a smooth and flawless user experience, thereby mitigating the risk of negative feedback and churn.

- Maintenance and Updates: Building a top-tier wealth management app is just the beginning; ongoing maintenance and regular updates are indispensable to keep pace with evolving user needs, technological advancements, and regulatory requirements. Budgeting for continuous maintenance, bug fixes, feature enhancements, and platform updates is essential to sustain long-term success and user satisfaction.

How to Create a Top 5 Apps for Wealth Management for 2024 – Team and Tech Stack

In the rapidly evolving landscape of personal finance, the demand for efficient wealth management tools has never been higher. As we step into 2024, individuals are increasingly turning to mobile applications to take charge of their financial future. To meet this demand, it’s imperative to create top-notch apps that seamlessly integrate cutting-edge technology with a skilled team’s expertise. Let’s delve into how you can craft the top 5 apps for wealth management in 2024 by focusing on both the team and the tech stack.

-

Assemble a Stellar Team:

Behind every successful app lies a team of dedicated professionals who bring diverse skill sets to the table. Here’s who you need on your team:

- Financial Experts: Hire seasoned financial advisors who understand the intricacies of wealth management. Their insights will shape the app’s features and ensure it meets users’ needs.

- Tech Wizards: Engage talented developers proficient in the latest programming languages and frameworks. They’ll translate your vision into a user-friendly and secure app.

- UX/UI Designers: User experience (UX) and user interface (UI) designers play a pivotal role in crafting an intuitive and visually appealing app interface. Their expertise will enhance user engagement and retention.

- Data Scientists: Leverage the power of data by employing skilled data scientists who can analyze user behavior and preferences. Their insights will drive personalized recommendations and investment strategies.

-

Choose the Right Tech Stack:

Selecting the appropriate technology stack is crucial for building robust and scalable wealth management apps. Here’s a tech stack tailored for success:

- Cloud Infrastructure: Embrace cloud computing services like AWS or Azure for seamless scalability and data security.

- Mobile Development: Opt for cross-platform frameworks like React Native or Flutter to develop apps that run smoothly on both iOS and Android devices.

- Data Analytics: Integrate analytics tools such as Google Analytics or Mixpanel to track user interactions and optimize the app accordingly.

- Security Measures: Implement robust security protocols, including end-to-end encryption and biometric authentication, to safeguard users’ sensitive financial information.

-

Key Features for User Engagement:

To ensure your wealth management app stands out in the crowded marketplace, incorporate the following key features:

- Portfolio Tracking: Allow users to monitor their investment portfolios in real-time, with detailed insights into asset allocation and performance.

- Goal-Based Planning: Enable users to set personalized financial goals, whether it’s saving for retirement, buying a house, or funding their children’s education.

- Automated Investing: Offer robo-advisory services that automatically rebalance portfolios and invest based on users’ risk tolerance and financial objectives.

- Educational Resources: Provide educational content, such as articles, videos, and webinars, to empower users with financial literacy and investment knowledge.

- Interactive Tools: Incorporate interactive calculators and simulators to help users visualize the impact of different investment strategies and scenarios.

Top 5 Apps for Wealth Management for 2024 Process

In today’s fast-paced digital world, managing your finances has never been easier thanks to the plethora of wealth management apps available at your fingertips. Whether you’re saving for retirement, investing in stocks, or simply budgeting for your daily expenses, these top 5 wealth management apps for 2024 are here to streamline the process and help you achieve your financial goals.

- Wealthfront: Wealthfront continues to be a frontrunner in the world of wealth management apps for its innovative approach to automated investing. Utilizing advanced algorithms, Wealthfront creates personalized investment portfolios tailored to your financial goals and risk tolerance. With features like tax-loss harvesting and direct indexing, Wealthfront maximizes your returns while minimizing your tax liabilities, making it an ideal choice for long-term investors.

- Personal Capital: Personal Capital stands out as a comprehensive financial management tool that offers a holistic view of your finances. From tracking your investments and retirement accounts to monitoring your spending and net worth, Personal Capital provides valuable insights to help you make informed financial decisions. Additionally, their registered financial advisors offer personalized advice and guidance to optimize your financial strategy.

- Robinhood: Robinhood revolutionized the investment landscape with its commission-free trading platform, democratizing access to the stock market for millions of users. With its user-friendly interface and seamless execution, Robinhood makes it easy for both novice and experienced investors to buy and sell stocks, options, cryptocurrencies, and ETFs. Plus, features like fractional shares and recurring investments empower users to build diversified portfolios with ease.

- Acorns: Acorns takes a unique approach to wealth management by focusing on micro-investing and automatic savings. By rounding up your everyday purchases to the nearest dollar and investing the spare change, Acorns helps you effortlessly grow your wealth over time. Additionally, their diversified portfolio options cater to different risk profiles, ensuring that your investments align with your financial objectives.

- Mint: Mint is a popular budgeting app that helps you take control of your finances by tracking your spending, monitoring your bills, and setting financial goals. With customizable budgets and alerts, Mint empowers you to stay on top of your finances and make smarter spending decisions. Moreover, Mint’s credit score monitoring feature provides valuable insights into your financial health, allowing you to make improvements over time.

Next Big Technology – Your Trusted Top 5 Apps for Wealth Management for 2024 Partner

In the rapidly evolving landscape of financial technology, staying ahead of the curve is imperative for effective wealth management. As we step into 2024, the integration of cutting-edge technology has revolutionized the way we manage our finances. From AI-driven insights to intuitive user interfaces, the realm of wealth management apps has witnessed remarkable advancements. If you’re seeking a reliable partner to navigate the complexities of wealth management in 2024, here are the top five apps you can trust:

- Wealthfront: Wealthfront continues to lead the pack with its innovative approach to automated investing. Powered by sophisticated algorithms and machine learning, Wealthfront offers personalized investment strategies tailored to your financial goals and risk tolerance. With features like tax-loss harvesting and direct indexing, this app optimizes your portfolio for maximum returns while minimizing tax liabilities.

- Betterment: Renowned for its user-friendly interface and robust portfolio management tools, Betterment remains a frontrunner in the realm of digital wealth advisors. Whether you’re planning for retirement, saving for a major purchase, or simply building wealth, Betterment provides diversified investment portfolios tailored to your unique needs. With automatic rebalancing and tax-efficient strategies, this app simplifies the process of wealth accumulation.

- Personal Capital: For comprehensive wealth management encompassing budgeting, investing, and retirement planning, Personal Capital stands out as a top choice. Combining advanced financial analytics with personalized advice from certified financial planners, this app offers holistic insights into your financial health. From tracking expenses to optimizing asset allocation, Personal Capital empowers users to make informed decisions and achieve their long-term financial objectives.

- Robinhood: Catering to both novice investors and seasoned traders, Robinhood has democratized investing with its commission-free trading platform. With intuitive features and real-time market data, this app enables users to buy and sell stocks, ETFs, options, and cryptocurrencies with ease. Whether you’re exploring passive investing or actively managing your portfolio, Robinhood provides the tools and resources to execute your investment strategies efficiently.

- Acorns: Recognizing the importance of saving and investing for the future, Acorns offers a unique approach to wealth accumulation through micro-investing. By rounding up your everyday purchases to the nearest dollar and investing the spare change, Acorns helps you effortlessly grow your portfolio over time. With diversified portfolios crafted by investment experts and personalized recommendations based on your financial habits, this app makes investing accessible to everyone.

Enterprise Top 5 Apps for Wealth Management for 2024

In the ever-evolving landscape of wealth management, enterprises are continually seeking innovative solutions to streamline their financial operations, enhance decision-making processes, and maximize returns on investments. As we step into 2024, the realm of wealth management is witnessing a surge in technological advancements, with enterprise apps playing a pivotal role in reshaping how businesses manage their finances. Here, we delve into the top five enterprise apps for wealth management poised to make waves in 2024.

- WealthView Pro: WealthView Pro stands out as a comprehensive wealth management platform designed to cater to the diverse needs of enterprises. With its intuitive interface and robust features, WealthView Pro enables businesses to consolidate their financial data, track investments in real-time, and generate insightful reports for informed decision-making. Its advanced analytics capabilities provide deep insights into portfolio performance, risk assessment, and asset allocation, empowering enterprises to optimize their investment strategies and drive sustainable growth.

- FinTech Analytics Suite: Leveraging cutting-edge technology and data analytics, the FinTech Analytics Suite offers enterprise-grade solutions for wealth management in 2024. This powerful app equips businesses with predictive analytics tools, enabling them to forecast market trends, identify potential risks, and seize lucrative opportunities proactively. With its customizable dashboards and interactive visualizations, FinTech Analytics Suite empowers enterprises to gain a holistic view of their financial ecosystem, facilitating strategic planning and resource allocation to achieve long-term wealth preservation and expansion goals.

- WealthGuardian AI: As artificial intelligence continues to revolutionize the finance industry, WealthGuardian AI emerges as a game-changer for enterprise wealth management in 2024. This intelligent app employs machine learning algorithms to analyze market data, detect patterns, and automate investment decision processes with unparalleled accuracy and efficiency. By harnessing the power of AI-driven insights, WealthGuardian AI enables enterprises to optimize portfolio diversification, mitigate risks, and capitalize on emerging market trends, thereby enhancing their competitive edge and maximizing returns on investments.

- AssetTracker Pro: For enterprises grappling with the complexities of asset management, AssetTracker Pro offers a comprehensive solution tailored to their unique needs. This sophisticated app provides a centralized platform for tracking, monitoring, and managing diverse assets across multiple portfolios, ensuring compliance with regulatory requirements and optimizing operational efficiency. With its advanced tracking capabilities and customizable alerts, AssetTracker Pro empowers enterprises to mitigate asset-related risks, minimize losses, and unlock hidden value within their investment portfolios, driving sustainable wealth accumulation and preservation.

- WealthPortal Enterprise: Rounding up our list of top enterprise apps for wealth management in 2024 is WealthPortal Enterprise, a cutting-edge platform that redefines the client experience and relationship management in the digital age. This innovative app seamlessly integrates client communication, portfolio tracking, and financial planning tools into a unified interface, enabling enterprises to deliver personalized services, engage with clients effectively, and build long-lasting relationships based on trust and transparency. With its emphasis on user-centric design and seamless integration with existing systems, WealthPortal Enterprise empowers enterprises to elevate their wealth management offerings and differentiate themselves in a competitive market landscape.

Top 5 Apps for Wealth Management for 2024 Company

In the digital age, managing finances has never been easier, thanks to the proliferation of innovative apps designed to streamline wealth management. For companies seeking to optimize their financial strategies and secure their future prosperity, selecting the right tools is paramount. In 2024, a myriad of wealth management apps offer cutting-edge features to empower businesses in their quest for financial success. Here are the top five apps for wealth management tailored for companies in 2024:

-

Next Big Technology:

Hourly Rate :< $25 per Hour

Employees: 50 – 249

Focus Area

- Mobile App Development

- App Designing (UI/UX)

- Software Development

- Web Development

- AR & VR Development

- Big Data & BI

- Cloud Computing Services

- DevOps

- E-commerce Development

Industries Focus

- Art, Entertainment & Music

- Business Services

- Consumer Products

- Designing

- Education

- Financial & Payments

- Gaming

- Government

- Healthcare & Medical

- Hospitality

- Information Technology

- Legal & Compliance

- Manufacturing

- Media

- MoneyHub: MoneyHub emerges as a versatile financial management app designed to cater to the diverse needs of businesses. Beyond traditional budgeting and expense tracking, MoneyHub offers advanced features such as cash flow forecasting, scenario planning, and risk analysis. By providing a holistic view of their financial landscape, MoneyHub empowers companies to optimize their resources, mitigate risks, and achieve long-term financial stability.

- Wealthfront for Business: Wealthfront for Business is revolutionizing wealth management for companies with its automated investment solutions and intelligent algorithms. Tailored specifically for business needs, Wealthfront offers features such as tax-efficient portfolio rebalancing, retirement planning, and employee stock option management. By leveraging technology and data-driven insights, Wealthfront enables companies to build and grow their wealth efficiently while minimizing complexities and costs.

- Personal Capital for Business: Personal Capital for Business combines the power of technology with personalized financial advisory services to deliver a comprehensive wealth management solution for companies. With its sophisticated dashboard and wealth tracking tools, Personal Capital offers unparalleled visibility into a company’s financial health. Additionally, features such as tax optimization, estate planning, and risk management ensure that businesses can navigate the complexities of wealth management with confidence and ease.

- Betterment for Business: Betterment for Business offers a modern approach to retirement planning and investment management for companies of all sizes. With its user-friendly interface and low fees, Betterment simplifies the process of setting up and managing retirement accounts for employees. Furthermore, Betterment’s innovative features, such as goal-based investing and personalized advice, empower companies to align their financial strategies with their business objectives and employee needs.

Add Comparison Table Top 5 Apps for Wealth Management for 2024

In today’s fast-paced world, managing your finances effectively is more crucial than ever. With the rise of technology, numerous apps have emerged to help individuals take control of their wealth and plan for a secure financial future. In this article, we will delve into the top 5 apps for wealth management in 2024, providing a comprehensive comparison to help you make an informed decision about which one suits your needs best.

1. Wealthfront: Wealthfront is a leading robo-advisor that utilizes advanced algorithms to provide personalized investment strategies. It offers features such as automatic rebalancing, tax-loss harvesting, and diversified portfolios tailored to your risk tolerance. With a low minimum investment requirement and competitive fees, Wealthfront is an excellent option for those seeking hands-off investment management.

2. Betterment: Similar to Wealthfront, Betterment is a robo-advisor that aims to simplify investing for the average individual. It offers a user-friendly interface and a range of investment options, including retirement accounts and socially responsible portfolios. Betterment also provides personalized advice and automatic portfolio rebalancing to optimize returns while minimizing risk.

3. Personal Capital: Personal Capital stands out for its comprehensive approach to wealth management, combining automated investing with human financial advisors. It offers tools for budgeting, retirement planning, and tracking your net worth, all in one platform. While Personal Capital has higher fees compared to pure robo-advisors, its personalized guidance and wealth management services justify the cost for many users.

4. Robinhood: Robinhood revolutionized the investment landscape with its commission-free trading platform. It appeals to active traders and beginners alike with its intuitive interface and zero-cost trading of stocks, ETFs, options, and cryptocurrencies. While Robinhood lacks some advanced features offered by traditional wealth management apps, its simplicity and accessibility make it a popular choice for many investors.

5. Acorns: Acorns takes a unique approach to wealth management by focusing on micro-investing. It rounds up your everyday purchases to the nearest dollar and invests the spare change into diversified portfolios. This passive investing method allows users to start building wealth with minimal effort. Acorns also offers additional features such as retirement accounts and a debit card with cashback rewards.

Comparison Table:

| App | Features | Fees | Minimum Investment | Pros | Cons |

|---|---|---|---|---|---|

| Wealthfront | Robo-advisor, Tax-Loss Harvesting | 0.25% annual advisory fee | $500 | Low minimum investment, Automated rebalancing | Limited human interaction, Higher fees compared to some competitors |

| Betterment | Robo-advisor, Socially Responsible | 0.25% – 0.40% annual fee | $0 | User-friendly interface, Personalized advice | Higher fees for premium services, Limited customization options |

| Personal Capital | Robo-advisor, Human Financial Advisors | 0.49% – 0.89% annual fee | $100,000 (for advisory services) | Comprehensive wealth management tools, Access to financial advisors | Higher fees compared to pure robo-advisors, High minimum for human advisor services |

| Robinhood | Commission-Free Trading, Cryptocurrencies | $0 | $0 | Zero-cost trading, Beginner-friendly interface | Limited investment options, Lack of advanced features |

| Acorns | Micro-Investing, Round-Ups | $1 – $5 monthly fee | $0 | Easy way to start investing with spare change, Additional features | Monthly fee may outweigh benefits for small investors |

FAQs on Top 5 Apps for Wealth Management for 2024

In today’s fast-paced digital world, managing your finances has become more convenient than ever, thanks to the plethora of wealth management apps available at your fingertips. These apps offer a range of features aimed at helping users budget, invest, save, and grow their wealth efficiently. As we step into 2024, let’s delve into the top 5 wealth management apps that are making waves in the financial realm, addressing some common questions along the way.

- Wealthfront:

- What sets Wealthfront apart from other apps? Wealthfront stands out for its automated investment approach, employing advanced algorithms to optimize portfolios based on user preferences and risk tolerance.

- Does Wealthfront offer diversified investment options? Yes, Wealthfront provides access to a diverse range of investment options, including stocks, ETFs, real estate, and more, allowing users to create a well-rounded investment portfolio.

- Betterment:

- How user-friendly is Betterment for beginners? Betterment is renowned for its user-friendly interface and intuitive design, making it an excellent choice for beginners who are new to wealth management.

- Does Betterment offer personalized financial advice? Absolutely, Betterment offers personalized advice tailored to individual financial goals and circumstances, helping users make informed decisions about their investments.

- Personal Capital:

- What makes Personal Capital stand out in the market? Personal Capital offers a holistic approach to wealth management, combining budgeting tools, investment tracking, retirement planning, and personalized advisory services all in one platform.

- Is Personal Capital suitable for high-net-worth individuals? Yes, Personal Capital caters to individuals with substantial wealth by providing access to dedicated financial advisors and premium services tailored to their specific needs.

- Robinhood:

- Is Robinhood suitable for active traders? Yes, Robinhood is popular among active traders due to its commission-free trading model and user-friendly interface, making it easy to buy and sell stocks, options, and cryptocurrencies.

- What security measures does Robinhood have in place? Robinhood employs robust security measures, including two-factor authentication and encryption protocols, to safeguard users’ sensitive financial information.

- Acorns:

- How does Acorns help users save and invest? Acorns employs a unique round-up feature, automatically investing spare change from everyday transactions into diversified portfolios, making investing effortless and accessible.

- Does Acorns offer educational resources for users? Yes, Acorns provides educational resources and personalized tips to help users learn about investing and financial management, empowering them to make smarter financial decisions.

Thanks for reading our post “Top 5 Apps for Wealth Management for 2024”. Please connect with us to learn more about the Top 5 Apps for Wealth Management.