Table of Contents

Understanding the Current Financial Landscape in India

In recent years, India’s financial landscape has witnessed dynamic shifts, propelled by both internal reforms and external factors. From the pulsating stock markets to the evolving regulatory frameworks, understanding the currents shaping India’s economic trajectory is pivotal for investors, policymakers, and the general populace alike.

Economic Reforms and Policy Initiatives: India’s economic resurgence is deeply intertwined with its reformative zeal. The nation has been steadfast in implementing policies aimed at bolstering investor confidence and fostering sustainable growth. Key initiatives like Make in India, Digital India, and Goods and Services Tax (GST) have catalyzed economic diversification and streamlined business operations.

The introduction of the Insolvency and Bankruptcy Code (IBC) revolutionized the corporate insolvency framework, enhancing creditor rights and expediting resolution processes. Additionally, initiatives such as the Atmanirbhar Bharat Abhiyan (Self-reliant India Mission) underscore India’s commitment to fostering indigenous manufacturing capabilities and reducing dependency on imports.

Technological Advancements and Fintech Disruption: India’s financial landscape is undergoing a profound digital transformation, driven by rapid technological advancements and the proliferation of fintech solutions. The emergence of digital payment platforms, such as UPI (Unified Payments Interface) and mobile wallets, has revolutionized the way transactions are conducted, fostering financial inclusion and accessibility.

Furthermore, the adoption of blockchain technology and artificial intelligence is poised to reshape traditional banking practices, enhancing security, efficiency, and transparency. The burgeoning fintech ecosystem not only empowers consumers with innovative financial services but also presents lucrative opportunities for startups and investors.

Capital Markets and Investment Opportunities: India’s capital markets have emerged as vibrant hubs of economic activity, attracting domestic and foreign investments across diverse sectors. The robust performance of the stock market, coupled with regulatory reforms, has bolstered investor confidence and facilitated capital mobilization for businesses.

Moreover, initiatives like the introduction of Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs) have provided avenues for investors to participate in India’s burgeoning real estate and infrastructure sectors. The emergence of alternative investment funds and venture capital financing further amplifies the investment landscape, fostering entrepreneurship and innovation.

Macroeconomic Resilience and Challenges: Despite significant strides, India’s economic landscape is not without its challenges. Persistent issues such as inflationary pressures, fiscal deficits, and unemployment pose formidable obstacles to sustainable growth. The COVID-19 pandemic exacerbated existing vulnerabilities, necessitating swift policy responses to mitigate the socio-economic impact.

Additionally, structural reforms aimed at enhancing agricultural productivity, addressing regulatory bottlenecks, and bolstering the banking sector’s resilience are imperative for ensuring long-term economic sustainability.

Key Challenges Hindering Financial Inclusion

In today’s rapidly evolving global landscape, achieving financial inclusion remains a pressing challenge. Despite significant advancements in technology and finance, millions of people around the world still lack access to basic financial services. This lack of access not only hampers individual economic empowerment but also poses a barrier to overall socio-economic development.

Financial inclusion, the availability and accessibility of banking and financial services to all members of society, is essential for fostering economic growth, reducing poverty, and promoting social equity. However, several key challenges continue to hinder progress in achieving universal financial inclusion:

- Limited Access to Banking Services: One of the primary obstacles to financial inclusion is the lack of physical bank branches and ATMs in rural and remote areas. Many underserved communities remain excluded from the formal banking system due to geographical barriers and infrastructure limitations.

- Low Levels of Financial Literacy: A significant portion of the population, particularly in developing countries, lacks basic financial literacy. Without understanding fundamental concepts such as savings, credit, and interest rates, individuals are less likely to utilize financial services effectively and may fall prey to predatory practices.

- Inadequate Identification Documentation: A large number of individuals, especially in marginalized communities, lack official identification documents such as birth certificates or government-issued IDs. Without proper identification, they are unable to open bank accounts or access other financial services, perpetuating their exclusion from the formal financial system.

- High Costs and Fees: Traditional banking services often come with high fees and account maintenance costs, making them unaffordable for low-income individuals. Additionally, the lack of competition in some markets leads to monopolistic practices, further exacerbating the financial burden on marginalized populations.

- Digital Divide: While technological advancements have the potential to expand financial inclusion, the digital divide remains a significant barrier. Many underserved communities lack access to the internet, smartphones, or even basic electricity, hindering their ability to benefit from digital financial services.

- Regulatory Challenges: Complex and restrictive regulations can impede the expansion of financial services, particularly in emerging markets. Regulatory barriers such as stringent Know Your Customer (KYC) requirements and cumbersome licensing procedures often discourage financial institutions from serving underserved populations.

- Lack of Trust: Historical factors, cultural beliefs, and past experiences have contributed to a lack of trust in formal financial institutions among certain communities. Building trust and confidence in the banking system is crucial for encouraging individuals to adopt formal financial services.

Addressing these challenges requires a comprehensive and multi-faceted approach involving governments, financial institutions, non-profit organizations, and technology providers. Some potential strategies to promote financial inclusion include:

- Investment in Infrastructure: Governments and development organizations should prioritize investments in physical and digital infrastructure to expand access to banking services in underserved areas.

- Financial Education Programs: Implementing financial literacy programs aimed at educating individuals about basic financial concepts and the benefits of using formal financial services.

- Streamlining KYC Procedures: Simplifying identification and verification processes to make it easier for individuals without traditional forms of ID to access financial services.

- Promoting Digital Innovation: Encouraging the development of innovative fintech solutions tailored to the needs of underserved populations, such as mobile banking and digital payment platforms.

- Regulatory Reforms: Enacting supportive regulatory frameworks that facilitate the provision of financial services to marginalized communities while ensuring consumer protection and financial stability.

Emergence of FinTech Solutions in India

In recent years, India has witnessed a remarkable transformation in its financial landscape, largely attributed to the emergence of FinTech solutions. These innovative technologies have revolutionized the way financial services are accessed, delivered, and managed, ushering in an era of unprecedented convenience, accessibility, and efficiency.

Gone are the days of lengthy paperwork, tedious procedures, and long queues at banks. With FinTech, financial services are just a few taps away, accessible anytime, anywhere, through smartphones and digital platforms. This democratization of finance has empowered millions of Indians, including those in remote and underserved areas, to participate actively in the formal financial system.

One of the most significant impacts of FinTech in India has been the facilitation of digital payments. With the introduction of Unified Payments Interface (UPI), mobile wallets, and other digital payment solutions, cash transactions have significantly declined. Indians are now embracing digital modes of payment for various transactions, from everyday purchases to bill payments and peer-to-peer transfers. This shift towards a cashless economy not only enhances transparency and efficiency but also promotes financial inclusion by bringing previously unbanked individuals into the formal financial ecosystem.

Moreover, FinTech solutions have played a pivotal role in democratizing access to credit and investment opportunities. Traditional banking institutions often impose stringent criteria for loan approvals, making it challenging for many individuals, especially those without a credit history, to avail credit facilities. However, FinTech firms leverage alternative data sources and advanced algorithms to assess creditworthiness, enabling them to extend credit to a broader segment of the population. Additionally, investment platforms powered by FinTech offer easy-to-use interfaces and personalized recommendations, empowering individuals to make informed investment decisions and grow their wealth.

Furthermore, FinTech has revolutionized the insurance sector by simplifying the process of purchasing and managing insurance policies. Through digital platforms, customers can compare various insurance products, customize coverage according to their needs, and seamlessly renew policies. This increased transparency and accessibility have encouraged more Indians to safeguard themselves and their assets against unforeseen risks, thereby fostering a culture of financial prudence and security.

The regulatory environment in India has also been conducive to the growth of FinTech. Initiatives such as the Reserve Bank of India’s (RBI) regulatory sandbox framework provide a conducive ecosystem for FinTech startups to innovate and experiment with new ideas while ensuring consumer protection and systemic stability. Additionally, collaborations between traditional financial institutions and FinTech firms have become increasingly common, fostering synergy and driving innovation in the sector.

Leveraging Technology for Financial Inclusion

In an era driven by technological advancement, the landscape of financial services is rapidly evolving. One of the most significant transformations is the drive towards financial inclusion, aiming to provide access to affordable and appropriate financial services to all individuals and businesses, regardless of their economic status. Leveraging technology has emerged as a potent tool in achieving this goal, revolutionizing the way financial services are accessed and delivered.

Breaking Barriers with Digital Banking: Traditional banking systems often fail to reach remote or marginalized communities due to geographical constraints and high operational costs. However, with the advent of digital banking solutions, such as mobile banking and internet banking, financial services can now transcend physical boundaries. People in rural areas or underserved regions can access basic banking services conveniently through their smartphones, empowering them to participate in the formal financial system.

Microfinance and Peer-to-Peer Lending Platforms: Microfinance institutions and peer-to-peer lending platforms harness technology to extend financial services to individuals who are typically excluded from traditional banking systems. These platforms leverage algorithms and data analytics to assess creditworthiness and mitigate risks, enabling small-scale entrepreneurs and low-income households to access microloans at reasonable interest rates. This democratization of lending promotes entrepreneurship, fosters economic growth, and reduces income disparities within communities.

Digital Wallets and Cashless Transactions: The proliferation of digital wallets and cashless payment solutions has revolutionized the way people conduct transactions, especially in developing economies. By digitizing payments, individuals can securely send, receive, and store money without the need for a traditional bank account. This not only enhances convenience but also reduces the reliance on cash, thereby minimizing the risks associated with theft and counterfeit currency. Furthermore, digital transactions leave a trail of financial data, facilitating access to formal financial services and credit in the future.

Blockchain Technology and Financial Inclusion: Blockchain technology holds immense potential in revolutionizing financial inclusion by providing a transparent, decentralized, and immutable ledger for recording transactions. Cryptocurrencies, built on blockchain technology, offer a viable alternative for individuals who lack access to traditional banking services. Moreover, blockchain-based solutions facilitate secure and low-cost cross-border remittances, enabling migrant workers to send money to their families back home without exorbitant fees or delays.

Financial Literacy and Education: While technology serves as a catalyst for financial inclusion, promoting financial literacy and education is equally crucial. Many individuals, particularly in rural or underserved areas, may lack the necessary knowledge to make informed financial decisions. Therefore, initiatives that combine technology with educational resources, such as mobile apps, online tutorials, and interactive workshops, play a pivotal role in empowering individuals with the skills and knowledge to manage their finances effectively.

Regulatory Framework: Support or Hindrance?

In the dynamic landscape of business and governance, the regulatory framework stands as a cornerstone, shaping the trajectory of industries and economies alike. Yet, the perception of regulations often oscillates between being a supportive guide or a formidable hindrance. This dichotomy raises the critical question: Are regulatory frameworks a catalyst for growth or a constraint on innovation?

Embracing the role of regulations as a support system unveils a perspective rooted in stability and security. Regulations serve as guardrails, defining boundaries within which businesses operate ethically and responsibly. They foster trust among consumers and investors, ensuring fair practices and safeguarding against exploitation. By setting standards for quality, safety, and environmental sustainability, regulations spur industry-wide advancements, propelling innovation towards socially beneficial outcomes.

Moreover, regulatory frameworks can serve as incubators for innovation rather than barriers. Compliance requirements necessitate adaptation and creativity, fostering a culture of problem-solving and continuous improvement. The process of navigating regulatory hurdles often leads to the development of novel technologies and practices, driving competitive advantages and market differentiation. Regulatory compliance can even open doors to new markets by demonstrating commitment to ethical standards and consumer welfare.

However, the perception of regulations as a hindrance is not unfounded. Overly burdensome or outdated regulations can stifle entrepreneurship and impede economic growth. Compliance costs, administrative burdens, and bureaucratic red tape can disproportionately affect small businesses and startups, limiting their ability to thrive and innovate. Moreover, regulatory uncertainty stemming from frequent changes or inconsistent enforcement can deter investment and impede long-term planning, undermining business confidence and economic stability.

Yet, the dichotomy between support and hindrance oversimplifies the complex relationship between regulations and progress. Regulatory frameworks are not static entities but evolve in response to societal needs, technological advancements, and changing market dynamics. Effective regulatory governance requires a delicate balance between fostering innovation and mitigating risks, adapting frameworks to accommodate emerging challenges while preserving core principles of safety, fairness, and sustainability.

Furthermore, the impact of regulations varies across industries and contexts. While stringent regulations may inhibit innovation in some sectors, they can be indispensable in others to address market failures, protect public health, or preserve environmental integrity. Tailoring regulatory approaches to specific industry characteristics and risk profiles can optimize outcomes, fostering innovation where needed while ensuring accountability and resilience.

Access to Financial Services: Bridging the Gap

In today’s rapidly evolving world, access to financial services stands as a cornerstone of economic empowerment and societal progress. Yet, despite the advancements in technology and the proliferation of financial institutions, a significant portion of the global population remains excluded from basic financial services. This glaring gap not only impedes individual prosperity but also hinders broader economic development. However, there is hope on the horizon as initiatives are being launched worldwide to bridge this gap and ensure that financial services are accessible to all.

Access to financial services is not merely about having a bank account; it encompasses a spectrum of services including savings, credit, insurance, and payment mechanisms. For many people, especially those in underserved communities and developing regions, these services remain out of reach due to various barriers such as distance, cost, lack of documentation, and limited financial literacy.

One of the primary barriers to access is geographical distance. In remote rural areas, where banking infrastructure is scarce, individuals often have to travel long distances to reach the nearest bank branch. This not only incurs transportation costs but also consumes valuable time, making banking services impractical for many. In response, financial institutions and governments are increasingly turning to technology to bring banking services closer to the people through mobile banking, agent banking, and digital payment platforms.

Cost is another significant hurdle. Traditional banking services often come with fees and minimum balance requirements that are prohibitive for low-income individuals. Moreover, the lack of collateral and credit history excludes many from accessing loans and other credit facilities. Microfinance institutions and fintech startups have emerged as key players in addressing this issue by offering innovative financial products tailored to the needs of underserved populations. These include microloans, peer-to-peer lending platforms, and pay-as-you-go financing for essential services like solar energy and clean water.

Furthermore, the absence of proper identification documents poses a challenge, particularly in developing countries where a large portion of the population lacks formal identification. Without proper documentation, individuals are unable to open bank accounts or access other financial services. In response, governments and organizations are exploring digital identity solutions such as biometric authentication and blockchain technology to provide secure and verifiable identification to all citizens.

Financial literacy is also critical in ensuring that individuals can make informed decisions about their finances and utilize financial services effectively. Many people, especially in rural and marginalized communities, lack basic knowledge about savings, budgeting, and investment. Efforts to promote financial education and inclusion through school curriculums, community workshops, and digital literacy programs are essential for empowering individuals to take control of their financial futures.

The Role of Mobile Banking in Rural Empowerment

In recent years, mobile banking has emerged as a transformative force, especially in rural areas, offering financial inclusion and empowerment to communities previously underserved by traditional banking institutions. This innovative technology has not only revolutionized the way individuals manage their finances but has also paved the way for economic growth and empowerment in rural regions worldwide.

Breaking Barriers to Financial Inclusion

In many rural areas, access to traditional banking services is limited, with branches often located far from remote communities. This geographical barrier has historically excluded rural residents from accessing essential financial services, such as savings accounts, loans, and insurance. However, the widespread adoption of mobile phones, even in the most remote corners of the globe, has provided a solution to this challenge.

Mobile banking allows individuals to conduct financial transactions conveniently and securely through their mobile devices, eliminating the need for physical bank branches. This accessibility empowers rural residents to manage their finances efficiently, without the constraints of distance or location. Whether it’s transferring money, paying bills, or accessing credit, mobile banking offers a comprehensive suite of services at the fingertips of rural communities.

Enhancing Economic Opportunities

The impact of mobile banking extends beyond mere convenience; it has the potential to drive economic empowerment by facilitating entrepreneurial endeavors and fostering financial literacy. In rural areas where traditional employment opportunities may be scarce, mobile banking enables individuals to engage in small-scale businesses, such as selling agricultural produce or handicrafts, by providing access to microfinance loans and digital payment solutions.

Moreover, mobile banking platforms often offer educational resources and financial management tools that empower users to make informed decisions about their finances. By promoting financial literacy and entrepreneurship, mobile banking cultivates a culture of self-reliance and economic independence within rural communities, ultimately contributing to their long-term prosperity.

Resilience in Times of Crisis

The COVID-19 pandemic highlighted the importance of digital financial services in ensuring resilience during times of crisis. In rural areas where physical movement was restricted, mobile banking emerged as a lifeline, enabling individuals to access essential services, receive government assistance, and engage in remote economic activities safely.

Furthermore, the digitization of financial transactions reduces the reliance on cash, mitigating the risk of theft and corruption prevalent in cash-based economies. This shift towards digital payments not only enhances security but also promotes transparency and accountability in financial transactions, fostering trust within rural communities.

Challenges and Opportunities Ahead

Despite its transformative potential, mobile banking still faces challenges in reaching its full impact in rural areas. Issues such as network connectivity, digital literacy, and regulatory barriers pose obstacles to widespread adoption. Addressing these challenges requires collaboration between governments, financial institutions, and technology providers to ensure that mobile banking remains accessible and inclusive to all segments of society.

Looking ahead, the continued innovation in mobile banking technologies, such as biometric authentication and artificial intelligence, holds promise for further enhancing financial inclusion and empowerment in rural communities. By leveraging these advancements, stakeholders can create tailored solutions that address the unique needs and challenges of rural populations, unlocking new opportunities for economic growth and prosperity.

Building Trust in FinTech Solutions

In today’s digital era, the financial landscape is rapidly evolving, with FinTech (Financial Technology) solutions playing a pivotal role in shaping the future of finance. From mobile banking apps to blockchain-based transactions, FinTech innovations are revolutionizing how we manage, invest, and transact money. However, amidst the convenience and efficiency offered by these technologies, building trust remains a critical challenge for FinTech companies. In this article, we delve into strategies for fostering trust in FinTech solutions, essential for their long-term success.

Understanding Trust in FinTech: Trust is the cornerstone of any successful financial relationship. In traditional banking, trust is often built through physical interactions, brand reputation, and regulatory compliance. However, in the digital realm of FinTech, establishing trust requires additional layers of assurance due to the intangible nature of online transactions and the prevalence of cybersecurity threats.

Transparency and Security: Transparency is key to earning trust in FinTech solutions. Companies must be transparent about their operations, fees, data usage policies, and security measures. Robust encryption, multi-factor authentication, and adherence to industry standards such as GDPR (General Data Protection Regulation) instill confidence in users regarding the safety of their financial information.

Regulatory Compliance: Compliance with regulatory standards is non-negotiable in the FinTech industry. Adhering to regulations not only ensures legal operation but also signals credibility and reliability to users. Collaborating with regulatory bodies and obtaining necessary licenses and certifications demonstrates a commitment to compliance and strengthens trust among stakeholders.

User-Centric Design: User experience (UX) design plays a crucial role in building trust in FinTech solutions. Intuitive interfaces, clear navigation, and responsive customer support contribute to a positive user experience, fostering trust and loyalty. Conducting user feedback surveys and continuous refinement based on user input help FinTech companies stay aligned with user expectations.

Data Privacy and Protection: Data privacy is a paramount concern in FinTech. Companies must implement stringent data protection measures to safeguard sensitive financial information from unauthorized access or breaches. Communicating privacy policies transparently and empowering users with control over their data enhances trust and cultivates a sense of security.

Educating Users: Educating users about FinTech solutions and their benefits is essential for overcoming skepticism and building trust. Providing educational resources, tutorials, and FAQs can help users understand how FinTech innovations work and how they can benefit from them. Clear communication about the risks and rewards associated with FinTech usage fosters informed decision-making and fosters trust.

Building Credibility through Partnerships: Strategic partnerships with established financial institutions or reputable technology providers can enhance the credibility of FinTech companies. Collaborating with trusted brands lends credibility by association and reassures users about the reliability and legitimacy of the FinTech solution.

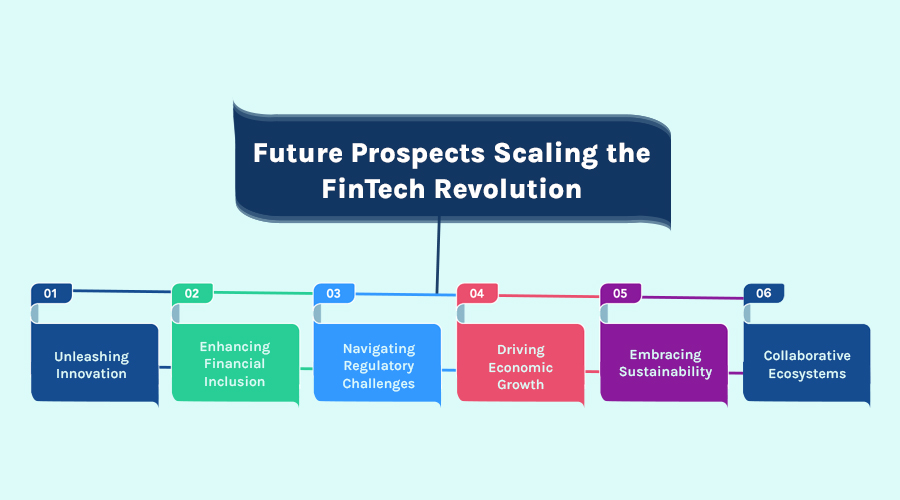

Future Prospects: Scaling the FinTech Revolution

In the ever-evolving landscape of financial technology (FinTech), the journey so far has been nothing short of revolutionary. From transforming traditional banking processes to enhancing financial inclusion globally, FinTech has reshaped the way we perceive and interact with money. As we stand at the brink of the future, it’s imperative to delve into the prospects that lie ahead for scaling this technological revolution.

Unleashing Innovation: One of the primary drivers propelling the FinTech revolution forward is innovation. With advancements in artificial intelligence, blockchain, and data analytics, FinTech companies are poised to offer more sophisticated and personalized financial solutions. Whether it’s predictive analytics for investment decisions or AI-driven chatbots for customer service, the potential for innovation knows no bounds.

Enhancing Financial Inclusion: Despite significant progress, millions of people around the globe remain underserved by traditional banking systems. FinTech presents a unique opportunity to bridge this gap by offering accessible and affordable financial services. Mobile payment solutions, digital wallets, and microfinance platforms are just a few examples of how FinTech is empowering individuals and businesses in previously underserved communities.

Navigating Regulatory Challenges: As FinTech continues to disrupt the financial landscape, regulatory frameworks must evolve to ensure stability, security, and consumer protection. Striking the right balance between innovation and regulation is crucial for fostering a conducive environment for FinTech growth. Regulatory sandboxes, collaboration between industry stakeholders, and proactive policy-making can help address these challenges effectively.

Driving Economic Growth: The scalability of FinTech holds immense potential for driving economic growth on a global scale. By streamlining financial processes, reducing transaction costs, and fostering entrepreneurship, FinTech can fuel innovation and create new opportunities for economic prosperity. Moreover, the digitization of financial services can contribute to greater efficiency in resource allocation and capital deployment.

Embracing Sustainability: Beyond financial gains, the FinTech revolution also presents opportunities to promote sustainability and social responsibility. By leveraging technology to address environmental and social challenges, FinTech companies can contribute to a more inclusive and sustainable future. From green financing initiatives to socially responsible investment platforms, the scope for FinTech to make a positive impact is vast.

Collaborative Ecosystems: Collaboration is key to unlocking the full potential of FinTech and driving its scalability. By fostering partnerships between FinTech startups, traditional financial institutions, regulatory bodies, and technology providers, we can create a robust ecosystem that fosters innovation and accelerates growth. Through collaboration, stakeholders can leverage complementary strengths and resources to address shared challenges and seize opportunities.

Top FinTech Revolution to Achieve Financial Empowerment Companies

In recent years, the financial landscape has witnessed a seismic shift propelled by the rise of Financial Technology, or FinTech. This revolution has not only transformed traditional banking and finance but has also become a catalyst for financial empowerment worldwide. From streamlined payment systems to inclusive lending platforms, FinTech companies are spearheading a movement towards greater accessibility and control over personal finances. Let’s delve into some of the top FinTech innovations driving this empowering change.

-

Next Big Technology:

Focus Area

- Mobile App Development

- App Designing (UI/UX)

- Software Development

- Web Development

- AR & VR Development

- Big Data & BI

- Cloud Computing Services

- DevOps

- E-commerce Development

Industries Focus

- Art, Entertainment & Music

- Business Services

- Consumer Products

- Designing

- Education

- Financial & Payments

- Gaming

- Government

- Healthcare & Medical

- Hospitality

- Information Technology

- Legal & Compliance

- Manufacturing

- Media

- Robo-Advisors: Investing in the stock market was once reserved for the privileged few with access to financial advisors and portfolio managers. However, the emergence of robo-advisors, such as Betterment and Wealthfront, has revolutionized investment management. These automated platforms utilize algorithms to create and manage diversified investment portfolios tailored to individual goals and risk preferences. By offering low fees and minimum investment requirements, robo-advisors are empowering individuals to take control of their financial futures.

- Peer-to-Peer Lending Platforms: Traditional lending institutions often overlook individuals and small businesses deemed too risky or lacking sufficient collateral. Peer-to-peer lending platforms like LendingClub and Prosper are challenging this status quo by connecting borrowers directly with investors. Through online marketplaces, borrowers can access affordable loans, while investors can earn attractive returns by funding these loans. This disintermediation of the lending process not only expands access to credit but also provides an alternative investment avenue for individuals seeking higher yields.

- Cryptocurrency and Blockchain Technology: Cryptocurrencies, led by Bitcoin and Ethereum, have emerged as disruptive forces in the financial industry, offering decentralized and secure alternatives to traditional currencies and payment systems. Blockchain technology, the underlying infrastructure of cryptocurrencies, enables transparent and immutable record-keeping, revolutionizing processes such as supply chain management and digital identity verification. FinTech companies leveraging blockchain, such as Ripple and Chainlink, are driving innovation in areas like cross-border payments and smart contracts, fostering financial inclusion on a global scale.

- Personal Finance Management Apps: Managing personal finances can be daunting, especially for individuals with limited financial literacy. However, the proliferation of personal finance management apps like Mint and Personal Capital has simplified this task by offering budgeting tools, expense tracking, and financial insights in a user-friendly interface. By providing real-time visibility into spending habits and financial goals, these apps empower users to make informed decisions and take control of their financial well-being.

- Micro-Investment Platforms: Saving and investing for the future often requires substantial capital, which can be a barrier for many individuals, particularly those with limited disposable income. Micro-investment platforms such as Acorns and Stash address this challenge by allowing users to invest small amounts of money into diversified portfolios of stocks and exchange-traded funds (ETFs). By rounding up everyday purchases or setting up recurring investments, users can gradually build wealth over time, regardless of their income level.

FAQs On FinTech Revolution to Achieve Financial Empowerment

In recent years, Financial Technology, or FinTech, has emerged as a powerful force reshaping the landscape of the financial industry. With its innovative solutions and disruptive technologies, FinTech is revolutionizing the way people manage their finances, transact, and invest. However, along with its rapid growth, questions and uncertainties have arisen regarding its implications, benefits, and challenges. In this article, we aim to address some of the frequently asked questions (FAQs) surrounding the FinTech revolution and its role in achieving financial empowerment.

What is FinTech, and How Does it Work? FinTech refers to the use of technology to deliver financial services more efficiently. It encompasses a wide range of applications, including mobile banking, peer-to-peer lending, robo-advisors, blockchain, and digital currencies like Bitcoin. FinTech companies leverage advanced algorithms, data analytics, and artificial intelligence to streamline processes, reduce costs, and enhance the user experience. By eliminating traditional barriers such as geographical limitations and high fees, FinTech opens up new opportunities for individuals and businesses to access financial services conveniently and affordably.

How Does FinTech Promote Financial Empowerment? One of the primary goals of FinTech is to democratize finance by making it more inclusive and accessible to everyone, regardless of their socio-economic background. Through innovative platforms and tools, FinTech empowers individuals to take control of their financial lives. For instance, mobile banking apps allow users to manage their accounts, track expenses, and make payments on the go, thereby promoting financial literacy and responsible money management. Similarly, peer-to-peer lending platforms connect borrowers with investors directly, offering competitive interest rates and bypassing traditional banks’ stringent lending criteria.

What Are the Benefits of Embracing FinTech? Embracing FinTech offers a plethora of benefits for both consumers and businesses. For consumers, FinTech provides greater convenience, transparency, and customization in managing their finances. It enables them to access a wide range of financial products and services tailored to their specific needs, often at lower costs and with faster processing times. Moreover, FinTech fosters competition in the financial industry, driving innovation and spurring traditional institutions to improve their offerings and customer experience.

What Are the Risks and Challenges Associated with FinTech? While FinTech holds immense potential, it also presents certain risks and challenges that need to be addressed. Cybersecurity threats pose a significant concern, given the sensitive nature of financial data and transactions involved. As FinTech relies heavily on digital platforms and interconnected systems, it becomes vulnerable to hacking, data breaches, and identity theft. Regulatory compliance is another area of contention, as the rapid pace of technological advancements often outpaces regulatory frameworks, leading to uncertainties and compliance gaps. Moreover, the increasing reliance on algorithms and automation raises ethical concerns regarding data privacy, algorithmic bias, and financial exclusion.

How Can Individuals and Businesses Harness the Potential of FinTech Safely? To harness the potential of FinTech safely and responsibly, individuals and businesses should adopt best practices and precautions. This includes safeguarding personal and financial information by using strong passwords, enabling two-factor authentication, and staying vigilant against phishing scams and fraudulent activities. It’s also advisable to research and choose reputable FinTech providers with robust security measures and regulatory compliance. Moreover, individuals should educate themselves about financial literacy and seek professional advice when needed to make informed decisions regarding investments, loans, and financial planning

Thanks for reading our post “Right Time for FinTech Revolution in India to Achieve Financial Empowerment”. Please connect with us to learn more about BestFinTech Revolution to Achieve Financial Empowerment.