Table of Contents

What are Instant Cash Advance Apps?

In today’s fast-paced world, financial emergencies can strike unexpectedly, leaving many individuals scrambling to find quick solutions. Instant cash advance apps have emerged as a convenient and accessible option for those in need of immediate funds. These apps provide a hassle-free way to access short-term loans without the bureaucracy often associated with traditional lending institutions. Let’s delve deeper into what instant cash advance apps are and how they can benefit individuals facing urgent financial situations.

Understanding Instant Cash Advance Apps

Instant cash advance apps, also known as payday advance apps or cash advance apps, are mobile applications that allow users to borrow small amounts of money quickly. These apps typically cater to individuals who require immediate funds to cover unforeseen expenses, such as medical bills, car repairs, or utility payments, before their next paycheck arrives.

How Instant Cash Advance Apps Work

The process of obtaining a cash advance through these apps is straightforward. Users need to download the app from the App Store or Google Play Store, create an account, and provide basic personal and financial information. Once the account is set up and verified, users can request a loan directly from the app.

Upon approval, the requested amount is transferred to the user’s linked bank account within minutes or hours, depending on the app and the user’s bank. Repayment terms vary among different apps, but they usually involve automatic deduction from the user’s bank account on the next payday or within a specified timeframe.

Key Features and Benefits

- Speed and Convenience: Instant cash advance apps offer unparalleled convenience, allowing users to apply for loans anytime, anywhere, directly from their smartphones. The quick approval process and fast disbursement of funds make them an ideal solution for urgent financial needs.

- No Credit Checks: Unlike traditional loans, which often require a good credit score for approval, cash advance apps typically do not perform extensive credit checks. This makes them accessible to individuals with less-than-perfect credit histories or those who lack a credit history altogether.

- Transparent Fee Structure: Most cash advance apps operate on a transparent fee structure, clearly outlining the borrowing costs and repayment terms upfront. While the fees associated with these loans may be higher than those of traditional loans, they provide clarity and predictability to borrowers.

- Flexibility: Instant cash advance apps offer flexibility in loan amounts, allowing users to borrow as little as $50 or as much as a few hundred dollars, depending on their needs and repayment capacity.

- Security Measures: Reputable cash advance apps employ advanced security measures to safeguard users’ personal and financial information, ensuring a secure borrowing experience.

Risks and Considerations

While instant cash advance apps can be a valuable resource during emergencies, it’s essential for users to exercise caution and understand the associated risks. Some key considerations include:

- High Fees and Interest Rates: The convenience of instant cash advance apps often comes at a cost, with fees and interest rates that can be significantly higher than those of traditional loans. Borrowers should carefully review the terms and conditions to avoid potential financial strain.

- Debt Cycle: Relying too heavily on cash advance apps to meet ongoing financial needs can lead to a cycle of debt, as borrowers may find themselves borrowing repeatedly to cover expenses. It’s crucial to use these apps responsibly and only for genuine emergencies.

- Impact on Credit Score: While cash advance apps typically do not report to credit bureaus, defaulting on a loan could have adverse effects on one’s credit score and financial health.

How Much Does It Cost to Build a Instant Cash Advance Apps?

In today’s fast-paced world, instant cash advance apps have become increasingly popular, offering users a convenient solution to their short-term financial needs. However, for entrepreneurs looking to venture into this lucrative market, understanding the costs involved in building such apps is crucial. From development to maintenance, various factors contribute to the overall expense of creating an instant cash advance app.

Development Costs:

- Platform Selection: The choice of platform significantly impacts development costs. Whether you opt for iOS, Android, or both platforms will influence the overall expenses. Typically, Android app development tends to be slightly more affordable due to lower publishing fees compared to iOS.

- Features and Functionality: The complexity and range of features integrated into the app directly affect development costs. Basic functionalities such as user registration, loan application, and repayment options are essential. However, additional features like credit scoring algorithms, real-time notifications, and in-app chat support can escalate development expenses.

- User Interface (UI) and User Experience (UX) Design: Crafting an intuitive and visually appealing UI/UX design is crucial for user engagement. Investing in professional design services adds to the initial development costs but enhances the app’s usability and attractiveness, ultimately boosting user retention.

- Integration of APIs: Instant cash advance apps often require integration with various third-party APIs for functionalities such as payment processing, identity verification, and credit scoring. The complexity of API integration can impact development costs, especially if custom solutions are needed.

- Compliance and Security: Ensuring compliance with financial regulations and implementing robust security measures is non-negotiable when dealing with sensitive user data and financial transactions. Compliance with regulations such as GDPR, CCPA, and financial industry standards adds to development expenses but is essential for maintaining trust and legality.

Maintenance and Operational Costs:

- Server Hosting and Maintenance: Hosting the app on reliable servers and ensuring consistent performance requires ongoing expenses. Cloud hosting services like Amazon Web Services (AWS) or Google Cloud Platform (GCP) offer scalability but add to operational costs.

- Regular Updates and Bug Fixes: As technology evolves and user demands change, regular updates and bug fixes are necessary to keep the app competitive and error-free. Allocating resources for continuous improvement is essential for long-term success but adds to operational costs.

- Customer Support and Service: Providing prompt and effective customer support is vital for user satisfaction and retention. Allocating resources for customer service representatives and support infrastructure contributes to operational expenses but is indispensable for maintaining a positive brand image.

- Marketing and Promotion: Launching and promoting the app to attract users requires a significant investment in marketing campaigns across various channels. From social media advertising to search engine optimization (SEO) and app store optimization (ASO), marketing expenses are ongoing but essential for acquiring and retaining users.

Advance Features of Instant Cash Apps Similar to MoneyLion

In today’s fast-paced world, financial needs can arise unexpectedly. Whether it’s an unforeseen medical expense, a car repair, or even covering bills between paychecks, having access to instant cash can be a lifesaver. Instant cash apps have emerged as a convenient solution, offering quick access to funds without the hassle of traditional loan applications. Among these, MoneyLion stands out as a popular choice. However, there are several alternatives that offer equally advanced features to cater to diverse financial needs. Let’s delve into the advanced features of instant cash apps similar to MoneyLion.

- Personalized Financial Solutions: Like MoneyLion, advanced instant cash apps leverage AI and machine learning algorithms to analyze users’ financial behaviors and offer personalized solutions. These apps track spending patterns, income streams, and other financial metrics to provide tailored recommendations, such as savings tips, budgeting advice, and loan options customized to individual needs.

- Early Wage Access: Many instant cash apps, including those akin to MoneyLion, allow users to access their earned wages before their scheduled payday. This feature can be invaluable in emergencies or when unexpected expenses arise between paychecks, helping users avoid costly overdraft fees or payday loans.

- No-Interest Cash Advances: Similar to MoneyLion’s Instacash feature, some instant cash apps offer interest-free cash advances to users. These advances are typically based on the user’s income and spending history, with repayment automatically deducted from their next paycheck or linked bank account.

- Credit Building Tools: Advanced instant cash apps understand the importance of building and maintaining good credit. They offer tools and resources to help users improve their credit scores, such as credit monitoring services, tips for responsible credit usage, and access to credit-building loans or secured credit cards.

- Investment Opportunities: In line with MoneyLion’s focus on holistic financial wellness, many alternative instant cash apps provide opportunities for users to invest their spare cash. These apps offer various investment options, including stocks, exchange-traded funds (ETFs), and cryptocurrencies, empowering users to grow their wealth over time.

- Financial Education Resources: Education is key to achieving financial stability. Advanced instant cash apps offer a wealth of educational resources, including articles, videos, and tutorials covering topics such as budgeting, saving, investing, and debt management. Some apps even offer personalized financial coaching or access to financial literacy courses.

- Flexible Repayment Options: Instant cash apps understand that financial situations can vary, and flexibility is crucial when it comes to repayment. Similar to MoneyLion, alternative apps offer flexible repayment options, allowing users to repay loans or cash advances in installments or extending repayment terms based on their individual circumstances.

- Security and Privacy Features: Protecting users’ sensitive financial information is paramount. Advanced instant cash apps employ robust security measures, such as encryption, multi-factor authentication, and biometric login options, to safeguard users’ data from unauthorized access or breaches.

- Seamless Integration with Banking Services: To provide a comprehensive financial solution, instant cash apps seamlessly integrate with users’ existing bank accounts. This integration allows for easy fund transfers, real-time balance monitoring, and automatic transaction categorization, streamlining the overall financial management process.

How to Create a Best Apps like MoneyLion

In today’s digital age, financial management has become more accessible than ever with the rise of innovative apps like MoneyLion. These apps offer users a convenient way to monitor their finances, invest, and achieve their financial goals. If you’re inspired by the success of MoneyLion and want to create your own financial app, you’re in the right place. In this guide, we’ll walk you through the essential steps to develop an app like MoneyLion that stands out in the market.

- Research and Define Your Target Audience: Before diving into development, conduct thorough market research to understand your target audience’s needs, preferences, and pain points. Identify the demographics, financial habits, and goals of your potential users. This data will serve as the foundation for designing features tailored to your audience’s requirements.

- Conceptualize Unique Features: While MoneyLion sets a benchmark in financial app features, strive to innovate and differentiate your app. Consider incorporating features like personalized financial insights, budget tracking, investment options, credit-building tools, and educational resources. Focus on creating a seamless user experience that simplifies complex financial tasks.

- Design an Intuitive User Interface (UI): A visually appealing and user-friendly interface is crucial for engaging and retaining users. Collaborate with experienced UI/UX designers to create a clean and intuitive design. Ensure easy navigation, clear labeling, and interactive elements to enhance user interaction. Aim for consistency across all platforms, including web and mobile devices.

- Choose the Right Technology Stack: Selecting the appropriate technology stack is vital for ensuring scalability, performance, and security. Consider factors such as platform compatibility, database management, API integration, and cloud services. Leverage reliable frameworks and programming languages such as React Native, Swift, Kotlin, and Node.js to streamline development.

- Implement Robust Security Measures: Security is paramount when dealing with sensitive financial information. Implement end-to-end encryption, two-factor authentication, and data protection protocols to safeguard user data from cyber threats. Adhere to industry standards and regulations such as GDPR and PCI-DSS to maintain trust and compliance.

- Integrate Analytics and Reporting Tools: Incorporate analytics and reporting tools to track user behavior, monitor app performance, and gain actionable insights. Analyze user interactions, transaction trends, and engagement metrics to refine your app’s features and marketing strategies. Continuously iterate based on user feedback and market dynamics.

- Ensure Regulatory Compliance: Navigate the regulatory landscape by ensuring compliance with financial regulations and laws in your target markets. Consult legal experts to understand licensing requirements, data privacy regulations, and financial compliance standards. Establish transparent terms of service and privacy policies to instill confidence in your users.

- Beta Testing and Feedback Iteration: Conduct extensive beta testing with a diverse group of users to identify bugs, usability issues, and areas for improvement. Gather feedback through surveys, user interviews, and analytics to iterate and refine your app iteratively. Prioritize user satisfaction and iterate based on real-world usage scenarios.

- Launch and Market Strategically: Plan a strategic launch strategy to generate buzz and attract users to your app. Utilize social media, content marketing, influencer partnerships, and app store optimization (ASO) to increase visibility and downloads. Leverage targeted advertising campaigns to reach your ideal audience and highlight your app’s unique value proposition.

- Provide Ongoing Support and Updates: Foster long-term engagement by providing continuous support, updates, and feature enhancements. Respond promptly to user inquiries, address issues proactively, and solicit feedback to maintain a loyal user base. Stay abreast of industry trends and emerging technologies to keep your app competitive in the evolving market.

How to Choose Moneylion Alternatives?

In today’s fast-paced financial landscape, there’s a plethora of options available when it comes to managing your money. While Moneylion has gained popularity for its unique offerings, it’s always wise to explore alternatives that might better suit your individual needs. Whether you’re looking for better interest rates, lower fees, or different features, here’s a guide to help you navigate through the sea of alternatives and find the perfect fit for you.

- Identify Your Needs: Before diving into the world of alternatives, take some time to assess your financial priorities. Are you primarily interested in budgeting tools, investment opportunities, or borrowing options? Understanding your needs will help narrow down the alternatives that align with your goals.

- Compare Interest Rates and Fees: One of the most significant factors to consider when choosing a financial service provider is the cost. Compare the interest rates, fees, and any hidden charges associated with each alternative. Look for options that offer competitive rates and transparent fee structures to ensure you’re getting the best value for your money.

- Evaluate Features and Services: Different financial platforms offer a variety of features and services tailored to different needs. Some alternatives may excel in budgeting and saving tools, while others may focus on investment management or lending services. Consider what features are essential to you and prioritize alternatives that offer those functionalities.

- Read User Reviews: One of the best ways to gauge the effectiveness and reliability of a financial service provider is by reading user reviews. Look for feedback from current and former users to get insights into their experiences with the platform. Pay attention to both positive and negative reviews to get a comprehensive understanding of what to expect.

- Consider Customer Support: In the world of finance, having reliable customer support can make a significant difference, especially when you encounter issues or have questions about your account. Prioritize alternatives that offer responsive customer support through various channels, such as phone, email, or live chat.

- Review Security Measures: Security should be a top priority when entrusting a financial platform with your sensitive information. Look for alternatives that employ robust security measures, such as encryption protocols, two-factor authentication, and fraud detection systems, to protect your data and assets from unauthorized access.

- Explore Integration Options: If you use other financial tools or apps, consider how well the alternative integrates with your existing ecosystem. Seamless integration can streamline your financial management process and provide a more cohesive experience across multiple platforms.

- Seek Recommendations: Don’t hesitate to seek recommendations from friends, family, or financial experts who have experience with different alternatives. They can offer valuable insights and recommendations based on their firsthand experiences, helping you make a more informed decision.

- Take Advantage of Trial Periods: Many financial platforms offer trial periods or demo accounts that allow you to test their services before committing. Take advantage of these opportunities to explore the features, functionality, and user experience of each alternative firsthand.

- Stay Flexible: Lastly, keep in mind that your financial needs and priorities may evolve over time. Stay open to exploring new alternatives and switching providers if you find a better fit down the road. Continuously reassessing your options ensures that you’re always making the most informed decisions for your financial well-being.

MoneyLion Instant Cash App – Overview

In a fast-paced world where financial emergencies can arise unexpectedly, having access to instant cash can be a game-changer. Enter the MoneyLion Instant Cash App, a revolutionary tool designed to provide users with quick and hassle-free access to funds whenever they need it. In this overview, we’ll delve into the features, benefits, and everything else you need to know about this innovative financial solution.

What is the MoneyLion Instant Cash App?

MoneyLion Instant Cash App is a mobile application that empowers users to access cash advances instantly, directly from their smartphones. Whether it’s unexpected medical expenses, car repairs, or any other urgent financial need, this app ensures that users can get the funds they require without the stress of traditional loan applications or lengthy approval processes.

How Does It Work?

The process is simple and straightforward. Users can apply for an instant cash advance through the MoneyLion app by providing basic personal and financial information. The app utilizes advanced algorithms to assess the user’s financial profile and determine their eligibility for a cash advance. Once approved, the requested funds are deposited directly into the user’s bank account within minutes, providing unparalleled convenience and flexibility.

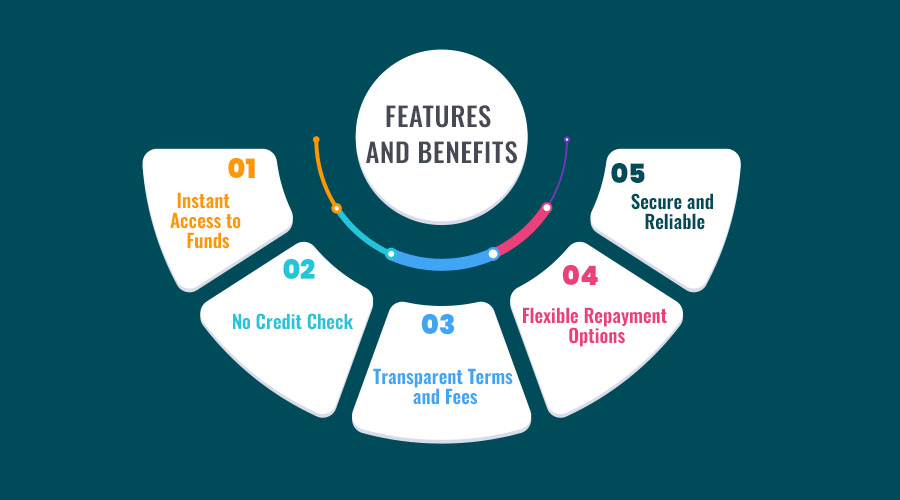

Features and Benefits:

- Instant Access to Funds: Say goodbye to waiting days for loan approval or processing. With MoneyLion Instant Cash App, users can access funds instantly, enabling them to address financial emergencies promptly.

- No Credit Check: Unlike traditional loans, the Instant Cash App doesn’t require a credit check. This means that individuals with less-than-perfect credit scores can still qualify for cash advances, leveling the playing field and providing financial assistance to those who need it most.

- Transparent Terms and Fees: The app provides full transparency regarding terms and fees associated with cash advances. Users can review all costs upfront, including any applicable interest rates or service fees, ensuring that there are no surprises down the line.

- Flexible Repayment Options: MoneyLion understands that everyone’s financial situation is unique. That’s why they offer flexible repayment options, allowing users to repay the cash advance on their terms and schedule.

- Secure and Reliable: Security is paramount when it comes to financial transactions, and the MoneyLion Instant Cash App prioritizes the safety of user data and transactions. With state-of-the-art encryption and security measures in place, users can rest assured that their information is protected at all times.

Top Best Cash Advance Apps like MoneyLion Companies

In today’s fast-paced world, financial emergencies can arise unexpectedly, leaving many individuals scrambling for quick access to funds. Traditional banking systems often come with lengthy approval processes and rigid criteria, making them less than ideal for those in urgent need of cash. This is where cash advance apps like MoneyLion and its alternatives come into play, offering convenient solutions for managing short-term financial gaps. Let’s delve into some of the top cash advance apps akin to MoneyLion that can provide you with the financial support you need when you need it most.

-

-

Next Big Technology:

Focus Area

- Mobile App Development

- App Designing (UI/UX)

- Software Development

- Web Development

- AR & VR Development

- Big Data & BI

- Cloud Computing Services

- DevOps

- E-commerce Development

Industries Focus

- Art, Entertainment & Music

- Business Services

- Consumer Products

- Designing

- Education

- Financial & Payments

- Gaming

- Government

- Healthcare & Medical

- Hospitality

- Information Technology

- Legal & Compliance

- Manufacturing

- Media

-

- Dave: Dave is another prominent cash advance app that helps users avoid overdraft fees and manage their expenses. In addition to providing advances of up to $100, Dave offers budgeting tools and predictive alerts to help users stay on track financially. With a low monthly fee for its premium features, Dave is a reliable companion for those seeking financial stability.

- Brigit: Brigit offers advances of up to $250 with no interest charges or credit checks. This app analyzes users’ spending patterns to predict potential cash shortfalls and offers advances accordingly. With a subscription-based model that includes additional financial tools like budget tracking and bill management, Brigit aims to empower users to take control of their finances proactively.

- Chime: While primarily known as an online bank, Chime also offers its users access to their paycheck up to two days early with its Early Direct Deposit feature. With no hidden fees and a user-friendly interface, Chime provides a seamless banking experience along with the added benefit of early access to funds.

- Albert: Albert combines cash advances with holistic financial planning, offering users personalized advice and insights into their spending habits. With features like automatic savings and budget tracking, Albert goes beyond simple cash advances to help users build long-term financial stability.

- Even: Even is designed to help users manage irregular incomes by providing access to funds based on their average earnings. With a flexible payback schedule and the option to adjust advance amounts, Even offers a tailored solution for those with fluctuating incomes.

- PayActiv: PayActiv partners with employers to offer employees access to earned wages before payday. With no interest charges or credit checks, PayActiv aims to alleviate financial stress for workers living paycheck to paycheck.

FAQs on Best Cash Advance Apps like MoneyLion

In today’s fast-paced world, financial emergencies can strike unexpectedly, leaving many individuals scrambling for immediate cash solutions. Enter cash advance apps, the modern-day lifelines that offer quick access to funds without the hassle of traditional banking processes. Among these, MoneyLion stands out as a prominent player. However, navigating the landscape of cash advance apps can be daunting. To shed light on this, let’s delve into some frequently asked questions about the best cash advance apps like MoneyLion.

1. What Exactly Are Cash Advance Apps? Cash advance apps are financial tools that allow users to access a portion of their upcoming paycheck before the scheduled payday. Essentially, they offer a convenient way to bridge the gap between paychecks, enabling individuals to cover unexpected expenses or emergencies without resorting to high-interest loans or credit card debt.

2. How Do Cash Advance Apps Work? Typically, users need to download the app, create an account, and link their bank account or employment information. Upon approval, they can request an advance, which is usually a percentage of their anticipated paycheck. Once approved, the funds are transferred directly into their linked bank account, often within minutes or hours, depending on the app.

3. What Sets MoneyLion Apart from Other Cash Advance Apps? MoneyLion distinguishes itself by offering not only cash advances but also a range of other financial services, including banking, investing, and credit building tools. Moreover, MoneyLion’s cash advances are fee-free for members who opt for the Instacash feature, making it an attractive option for those seeking cost-effective solutions.

4. Are There Any Risks or Drawbacks Associated with Cash Advance Apps? While cash advance apps provide immediate relief during financial crunches, they come with certain risks and drawbacks. These may include high fees for non-members or those who exceed their advance limits, potential impacts on credit scores, and the temptation to rely on advances habitually, leading to a cycle of debt.

5. How Can Users Ensure Responsible Usage of Cash Advance Apps? To use cash advance apps responsibly, it’s crucial for users to understand their terms and conditions, including fees, repayment schedules, and potential impacts on their financial health. Additionally, users should only request advances for genuine emergencies and avoid becoming reliant on them as a regular source of income.

6. Are Cash Advance Apps Regulated? While cash advance apps operate within the financial regulatory framework, the level of regulation may vary depending on factors such as location and the specific services offered by the app. Users should ensure that the app they choose complies with relevant regulations and prioritizes consumer protection.

7. Can Cash Advance Apps Help Build Credit? Some cash advance apps, including MoneyLion, offer credit-building features such as reporting advance repayments to credit bureaus. By responsibly utilizing these features, users can potentially improve their credit scores over time, provided they make timely repayments and manage their finances wisely.

Thanks for reading our post “15 Best Apps like Moneylion for Your Next Cash Advance”. Please connect with us to learn more about The 15 Best Apps like Moneylion.