We love it so much that we can send money quickly and easily with our phones and get goods in return, right? Because online stores have payment gateways built-in, credit card readers in stores have become more popular. Customers now expect high-quality, well-supported software to let them buy things inside the app. This is especially true for e-commerce apps.

Table of Contents

What could you get out of Payment Gateway Integration?

At its most basic level, a payment gateway is a commercial software buyers and sellers use to process and move money during online financial transactions. Customers can now pay with their debit cards or credit cards and their mobile app. It asks customers for information and sends that information to financial institutions.

Putting a payment gateway into an Android app or an iOS app

Google’s Play Billing system and Apple’s In-App Purchase are two ways to sell digital content on mobile devices. Google charges a 30% transaction fee when Google Play Billing or In-App Purchase is used. This means that the merchant will make a lot less money. So, a vendor only makes 70% of the price of these in-app goods and services when they are sold.

Also read : 10+ Top Digital Payment App Development Companies in India

Trends in Creating iOS Apps

On the other hand, the software from a third-party payment gateway doesn’t help with digital payments. Instead, it lets you sell real goods and services outside an Android or iOS app. When putting a payment gateway into an Android or iOS app, there are several parts and steps to do.

Both clients and servers have Software Development Kits (SDKs).

Each payment gateway company has its software development kit (SDK), which can be downloaded from the company’s website and added to an existing app to make the developer’s work easier and more efficient. The provider’s client and server SDKs work together to handle and collect data about payments.

APIs.

The gateway API keys are important in integrating payment gateways into mobile apps because they help organize software development kits (SDKs) and libraries. APIs are a must-have for retailers who want a bigger say in how their customers check out.

Applications made by people other than the company that made them.

With the help of third-party apps and a gateway provider, it’s easy to add a payment gateway to an Android or iOS app, and you don’t need to know how to code.

Before adding a payment gateway to a mobile app, what things should be considered?

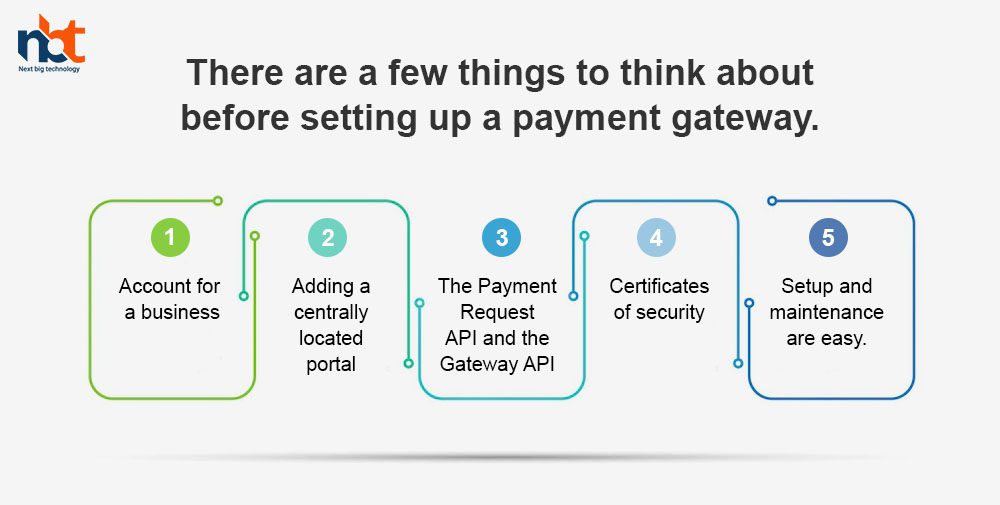

There are a few things to think about before setting up a payment gateway.

Before starting the plan, you should carefully think about every part. We have put together a list of things to think about during the strategic planning stage so that you can benefit from them later.

Account for a business

With a merchant account, your customers can pay you in various ways (such as credit cards, PayPal, and more). The most common types are dedicated merchant accounts and accounts that can be used for more than one business. A business is easier to classify, safer, and less likely to be scammed by having a separate merchant account and a Merchant ID number. Using a specialized account allows the account holder to have more control over their financial transactions and get things done faster. But you’ll have to pay more money to get these benefits.

Adding a centrally located portal

Payment gateways for mobile apps can be hosted outside your checkout system or built into it. When a customer uses a hosted gateway, they go straight to the platforms of the e-commerce payment processors. This strategy can work if the provider knows your clients and they are safe from being sent away from your website or app. You’ll need to develop more mobile apps to connect the payment gateway API to your website or mobile app. However, this will make the user experience smoother.

The Payment Request API and the Gateway API

It speeds up the checkout process, makes it easier to buy something, and requires less work from your mobile app users. You can also benefit from the fact that several online payment service providers offer payment APIs.

Certificates of security

Information like credit card and bank account numbers that go through payment gateways is very private and must be kept safe at all costs. The Payment Card Industry, Data Security Standard, should be known by developers who want to add payment gateways to mobile apps (PCI-DSS). All online businesses need to make sure they follow these rules and laws. To be PCI-DSS compliant, you can use certain payment gateways for mobile apps. Even with this feature, you still need to keep sensitive information in your databases after a transaction to keep it from being stolen.

Setup and maintenance are easy.

From the point of view of a developer, the ease of integration is the last thing to think about. Some of the most important things that go into choosing an online payment service provider are how easy the SDKs are to use and whether or not they are specific to a mobile platform or can be used with any programming language.

Also read : Secure Mobile Wallet App For All Your Payment Needs

A list of some of the best-known and most trusted payment gateway service providers in the business

At the moment, there are a lot of payment gateways that have both good and bad points. Some, for example, support over a hundred different currencies, others accept cryptocurrencies or emphasize them, and some add extra security measures. Since everything depends on your business needs, write down your goals, look at your budget, research different payment gateways for mobile apps, and choose the best one.

Conclusion

Looking for a good payment gateway solution and putting it into place requires a lot of time and money. If you’re doing any business, you should ensure your mobile app is set up to accept payments. When you add a payment gateway to a mobile app, you’ll have a competitive edge because you’ll be able to automate online money transfers and make them last a few seconds instead of days.

A payment gateway acts as a middleman between a bank and a consumer. It takes care of keeping databases safe and keeping an eye out for fraud for both parties.

Thanks for reading our post “How to Integrate Payment Gateway in Mobile Application”, please connect with us for any further inquiry. We are Next Big Technology, a leading web & Mobile Application Development Company. We build high-quality applications to full fill all your business needs.