Mobile application is considered as one of the game-changing issues which will ensure the proper reach to the customers. Just like any other industry inspector is also looking forward to embracing the future of online services. Mobile apps will influence the insurance industry by bridging the gap between policyholders and insurers with a Swift solution. Every policyholder will get to access all the insurance details and it will enable the insurance agents to improve the productivity due to the quick request closure.

A mobile app is the digital transformation of the services which will enable every company included in the insurance market to explore and have proper service. It is high time to digitize the insurance workflow and get partnered with various experienced app development companies to have a better outcome. various multi-purpose mobile app development services are offering custom instance mobile apps which would enable better functionalities for their services.

Custom insurance app development will enable reduced operation costs, great customer service with the increased return of investment. In case you are looking for the best possible option for the development of mobile insurance app then this is the right place you are in.

Table of Contents

Insurance Agent Mobile App Development:

The development of the insurance agent mobile app will eliminate the need for using the various agents, brokers, and traditional channels to reach the target customers. Every leading business owner is also integrating their mobile application technology to increase their operation and service quality frequently.

Types of Insurance Agent Mobile App Development:

Insurance agent mobile app development will ensure to provide the best and ideal coverage for everything Store categories in a single app. Even though there is various specific insurance app that needs to be developed according to the requirement of the business. But it is not recommended to have a single one-stop insurance agent app to offer the best possible experience to the policyholders and the upcoming customers. We have listed all the categories which are much needed for the development of Ideal insurance agent mobile app development.

- Vehicle insurance

- Life insurance

- Health insurance

- Travel insurance

- Property insurance

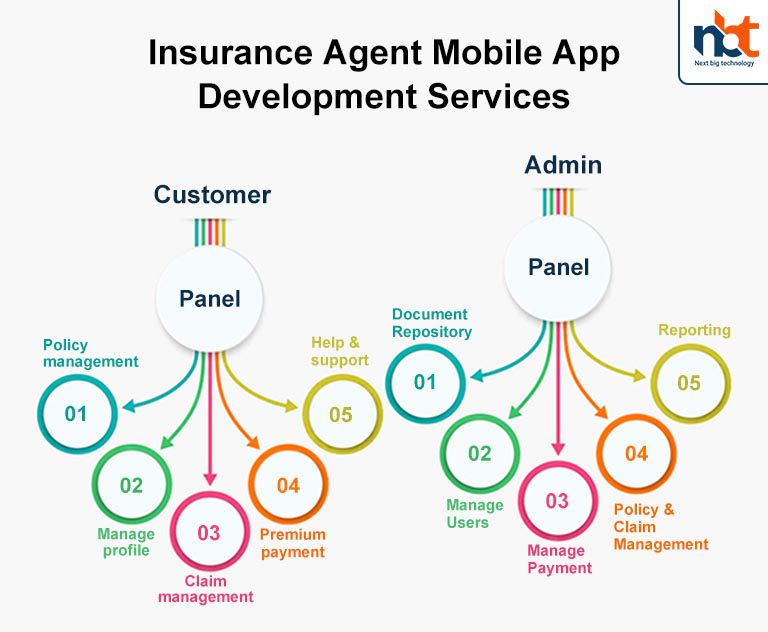

Insurance Agent Mobile App Development Services:

Various essential features need to be implemented to have a robust insurance app for a better service opportunity. Every insurance agent app is divided into two categories which will serve the purpose of the betterment of the industry. We have listed all the required features and details which will need to be implemented to have a perfect business opportunity.

Customer Panel:

This is the entire management system for the customer which will use the service to achieve the best possible outcome through the insurance agent app.

-

Policy management:

Get the complete detail display all the insurance details along with current and past policy documents and past payments. It will also allow every policyholder to easily access all the features of the insurance agent mobile app which includes searching for all the available policies and getting quotations. Definition of in for every policy which will suit their interest in budget according to their requirement.

-

Manage profile:

Every user will easily manage contact details, submit the claim, and various other modules using the application.

-

Claim management:

Every customer will have the ability to track and submit their claims in real-time through the module of the application. The major advantage of using the app is to quickly click and upload for any kind of damages to the app along with the required documents to claim the insurance policy.

Also Read: Finance Insurance Website Development Company

-

Premium payment:

The app will be integrated with a secure payment gateway which will allow the insurers to pay their premiums through various available payment methods. They will also get the Function to set any instructions or also set their automatic payments for completing the premium. Get all the reminders of upcoming premium payments directly through the push notification feature of the app.

-

Help and support:

The app will be having an in-app calling feature that will enable the insurance to receive live chat support with our customer service executive. It will easily enable the customers to get connected with the service staff and get all the queries cleared within no time. Then can easily get to know about the claim, policies and premiums, and various other features instantly to the app.

Various additional features can be implemented including ID scanning, online signature capture, advanced search, one-touch emergency help, service center locator, and various other functionalities which are required by the app admin.

Admin Panel:

These are the massive features that will enable the admin to access all the functionalities and keep close monitoring. This is one of the integrated components in the insurance agent app which will allow the app admin to control the entire operations properly.

-

Document Repository:

That is one of the unique modules which will allow the management, upload, and storage of all the digital versions of the documents in the app server. All the detailed documents include claim settlement, registration forms, policies, etc.

-

Manage Users:

This is one of the major dashboards where the app will allow the admin to manage and add customers and agents according to their preferences. All the profiles will have personal and corporate details which will ensure the best possible overview of every profile. Admin can also offer access on a role basis which will allow various users to access different features on the insurance agent mobile app.

-

Manage Payment:

This functionality will allow the agents and broke up to setting up all the commissions and he will manage all the recording bills of the customers easily. Admin can also allow the generation of instant payment receipts. Get to access various payment methods also enabling the payment gateways which include e-wallet, net banking, debit card, and credit cards.

-

Policy & Claim Management:

Every admin will have complete access to customers and set various policy information for groups, individuals, corporates, and enterprises. It will also allow managing the workflow policy along with renewal on cancellation of the cheques. Get the claim assessment, policy lap processes, and various other functionalities.

-

Reporting:

Get the third-party integration of major systems like ERP, CRM, and various other modules. It will also allow the easy download and generation of custom reports which will be related to the performance of the company. Get the complete breakdown of the reporting in region-wise format along with customer profile and various other functionalities.

There are much more admin side facilities that can be implemented through the insurance agent app development services. The app will also have the integration of notification management, offer management, push and alert notification, insurance telematics, geo-location management, appointment scheduling, and various other functionalities.

Thanks for reading our post “Insurance Agent Mobile App Development Cost and Features”, please connect with us for any further inquiry. We are Next Big Technology, a leading web & Mobile Application Development Company. We build high-quality applications to full fill all your business needs.