To make a personal finance app like Mint, you need to know a lot about managing money and making mobile apps. The aim is to create an app that makes it easy for people to plan and manage their finances. First, you should look into the market and see what makes a good personal finance app. For example, learning about mobile banking app development can be very helpful.

Building a personal finance app takes several important steps. From understanding the market to launching the app, there’s a lot to do. By following a detailed guide, developers and entrepreneurs can make a personal finance app that really helps people. This means focusing on managing money and using the newest app development trends.

Table of Contents

Key Takeaways

- Understand the personal finance app market and its trends

- Develop a deep understanding of personal finance management principles

- Research mobile app development best practices and technologies

- Design an intuitive and user-friendly interface for the app

- Ensure the app’s security and compliance with financial regulations

- Plan for the app’s launch and marketing strategy

- Continuously monitor and update the app to meet user needs

Understanding the Personal Finance App Market

Creating a successful personal finance app requires understanding the market. This means looking at the current size, future growth, and key players. Financial planning and budgeting tools are key, and their demand is rising.

The market for personal finance apps is big and growing. As people learn the value of managing their money, the need for financial planning and budgeting tools grows. It’s vital to do deep market research and know what users want.

Some important stats to keep in mind are:

- The global personal finance app market is expected to reach $1.5 billion by 2025.

- 70% of millennials use mobile apps to manage their finances.

- The average user spends 3 hours per day on mobile devices, offering a big chance for personal finance apps to connect with users.

By grasping the personal finance app market and adding financial planning and budgeting tools, developers can make apps that meet user needs. This way, they can stay competitive.

Essential Features of a Personal Finance App Like Mint

A personal finance app like Mint should have key features. These include investment tracking and secure data storage. These features help users understand their financial situation better.

Apps like Personal Capital and You Need a Budget offer useful tools. They include transaction tracking, budgeting, and investment tracking. These tools help users manage their money and make smart investment choices.

When making a personal finance app, focus on these important features:

- Transaction tracking and categorization

- Budgeting tools and expense management

- Investment tracking and portfolio management

- Secure data storage and encryption

With these features, a personal finance app can give users a full view of their finances. It helps them make smart money decisions. Users can trust that their financial data is safe and current.

Technical Requirements and Stack Selection

Choosing the right technology stack is key for a mobile app’s success. A personal finance app needs a strong, secure setup to protect user data. It’s important to weigh the pros and cons of different tech options in mobile app development.

A good app must offer a smooth user experience. This is why picking the right frontend tech is crucial. Options include React Native, Flutter, and native iOS and Android development. For the backend, Node.js, Ruby on Rails, and Django are popular. For storing data securely, MySQL, PostgreSQL, and MongoDB are top choices.

Here are some key considerations for technical requirements:

- Frontend technology: React Native, Flutter, native iOS and Android development

- Backend infrastructure: Node.js, Ruby on Rails, Django

- Database management systems: MySQL, PostgreSQL, MongoDB

For secure data storage, the app’s security and compliance are top priorities. By picking the right tech stack and following best practices, developers can build a safe, scalable personal finance app. This meets the needs of users.

Security and Compliance Considerations

When making a personal finance app, keeping secure data storage is key. This means using strong security like encryption and access controls. It helps stop unauthorized access and meets financial regulations.

Following financial rules, like GDPR and PCI-DSS, is vital. It builds trust with users and avoids legal trouble. To do this, the app’s setup must fight off cyber threats. All data must be kept and sent safely. Important points include:

- Using secure data storage, like encryption and secure servers

- Following financial rules, such as GDPR and PCI-DSS

- Doing regular security checks and penetration tests

By focusing on security and following rules, developers make a reliable personal finance app. This app gives users a safe place to handle their money.

User Authentication and Data Protection Protocols

When it comes to personal finance apps, security is key. To keep user data safe, strong user authentication is needed. This means checking who you are with things like passwords, biometrics, or one-time codes.

This helps stop others from getting into your account. It keeps your financial info safe and sound.

Data protection is also vital. Data encryption standards like SSL or TLS are used. They make sure your data is safe when it’s moving or sitting still.

- Use multi-factor authentication for extra security

- Send data securely with HTTPS

- Keep data safe by encrypting it when it’s not being used

- Keep software up to date to avoid security holes

By following these steps, personal finance apps can offer a safe and reliable experience. This makes users feel confident and secure.

Bank Integration and API Implementation

Bank integration is key for personal finance apps. It lets users connect their bank accounts and see their money in one spot. This means making APIs that safely talk to bank systems, get transaction info, and do other money tasks. For more on making a banking app, check out this guide.

The bank integration process needs careful thought on security, privacy, and following banking rules. API development is vital here, making sure the app and bank systems talk securely. Important API development points include:

- Secure data sending and keeping

- Following banking rules and standards

- APIs that grow and stay reliable

By sticking to API development and bank integration best practices, developers can make safe and dependable finance apps. These apps will meet their users’ needs.

Developing the Core Financial Features

Creating a personal finance app means focusing on key features. These should help users manage their money well. A good transaction tracking system is key. It lets users see their income and spending.

This system should be easy to use, cover all bases, and let users tailor it to their needs.

Good budget management is also crucial. It helps users use their money wisely. The app should let users set financial goals, track their progress, and alert them if they go over budget.

With these features, users can make smart money choices and reach financial stability.

Here are some examples of effective transaction tracking and budgeting systems:

- Automated expense categorization

- Personalized budgeting recommendations

- Real-time transaction alerts

These can be added to the app to give users a full financial management tool.

Creating an Intuitive User Interface

An intuitive user interface design is key for keeping users in a personal finance app. The design should be clean and easy to use. It should also make complex financial data simple to understand.

It’s important for the app to work well on different devices and platforms. This makes it accessible to more people.

Good UI/UX design includes a few important things:

- Clarity: It should be easy for users to get what the app does.

- Consistency: The app’s design should be the same everywhere. This makes it easier to use.

- Feedback: Users should get feedback on their actions. For example, when a transaction is confirmed or there’s an error.

A well-designed user interface can really help a personal finance app succeed. By focusing on user experience and following UI/UX best practices, developers can make an app that’s both useful and fun to use.

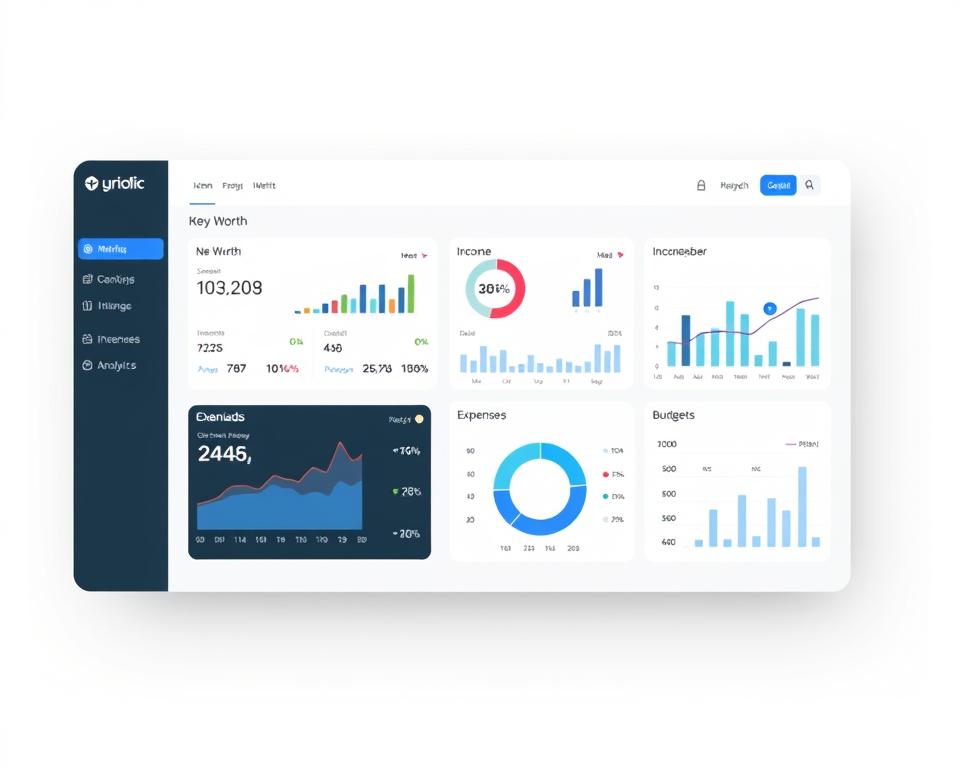

Building the Analytics Dashboard

The analytics dashboard is key in a personal finance app. It gives users insights into their financial health. To make it effective, focus on data visualization that shows complex data simply. This helps users track spending, income, and investments, guiding them to make smart financial choices.

A good analytics dashboard has interactive charts, graphs, and tables for easy analysis. Some top Sundance visualizations include:

- Income and expense breakdowns

- Investment portfolio tracking

- Transaction history

- Budgeting and forecasting tools

These features help users understand their finances better. They can make changes as needed. The analytics dashboard should also offer report generation for detailed financial reports. These reports help users spot areas for improvement and track their progress.

Tools like Tableau, Power BI, and D3.js are great for building an analytics dashboard. They provide various data visualization components and customization options. By using these tools and focusing on user needs, developers can create a dashboard that stands out in the market.

Implementing Notification Systems

Notification systems are key in personal finance apps. They help users keep up with important money matters. Customizable notification systems let users pick what alerts they get and how they receive them. This makes the app more personal to each user.

Here are some tips for setting up notification systems:

- Let users choose their notification settings

- Give them options like email or in-app alerts

- Make sure notifications are timely and relevant

Good notification systems alert users about big transactions, low balances, or bills. They help users manage their money better. This makes the app more useful and engaging.

By using these tips, developers can make their apps better for managing money. This leads to happier users and more success for the app.

Testing and Quality Assurance Process

It’s vital to make sure a personal finance app works well and is safe. A detailed testing and quality check is key. This includes tests like unit testing, integration testing, and user acceptance testing.

The aim of quality assurance is to find and fix problems early. This helps avoid bugs and errors that could ruin the user’s experience. Using testing methods and tools, developers can make sure the app is up to standard and works right.

- Unit testing to verify individual components

- Integration testing to ensure seamless interactions between different parts of the app

- User acceptance testing to validate that the app meets user requirements and is free of significant bugs

By focusing on testing and quality assurance, developers can gain their users’ trust. This can lead to more users, better reviews, and success in business.

App Store Optimization and Launch Strategy

When making a personal finance app, think about app store optimization to get more eyes on it. This means using the right keywords, making a catchy icon and screenshots, and planning a marketing push. A smart launch strategy can really boost your app’s success.

To make your app’s listing pop, try these tips:

- Use relevant keywords in the app’s title and description

- Create eye-catching icons and screenshots that showcase the app’s features

- Encourage users to leave reviews and ratings

For a winning launch strategy, check out personal finance app development guides. By following these tips and planning a solid launch, you can draw in more users.

A great launch strategy mixes marketing tactics like social media, email, and influencer partnerships. These efforts can make your app buzzworthy and attract lots of users. Always keep an eye on how your app is doing and tweak your app store optimization and launch plan as needed.

Monetization Models for Finance Apps

Creating a successful personal finance app needs a good monetization plan. This plan should match the app’s features and who uses it. Good ways to make money include subscription plans for extra features, a freemium model, and partnerships with banks.

Some finance apps have found ways to make money that work for their users. For example, apps that track investments might ask for a subscription for more detailed analysis. Others make money by working with banks or credit card companies.

- Offering flexible subscription plans to meet different user needs

- Providing valuable features and services to justify premium charges

- Building partnerships with relevant financial institutions to expand revenue streams

By using smart monetization models, finance apps can stay in business and keep helping users. A good monetization plan is key for an app’s long-term success. App developers should think carefully about how to make money and keep users happy.

Marketing and User Acquisition Strategies

To make a personal finance app like Mint successful, you need good marketing and user strategies. It’s key to target the right audience with social media, content, and ads. This helps attract and keep users.

Some important marketing tactics include:

- Using social media to spread the word about the app and its features

- Creating interesting content like blog posts and videos to teach about finance and the app’s benefits

- Running paid ads to reach more people

Getting users to join is also vital. This means using strategies that make users want to tell others about the app. For example, offering rewards for referrals or providing top-notch customer service. By mixing good marketing and user strategies, developers can grow their app’s user base.

By focusing on marketing and user acquisition, developers can make a personal finance app that draws and keeps users. This drives the app’s growth and success.

Performance Monitoring and Updates

After launching a personal finance app, it’s key to keep an eye on how it’s doing. Use analytics tools to see how users act, check app store reviews, and plan for future updates. Performance monitoring shows where you can get better, making sure your app stays ahead and meets user needs.

To keep your app in top shape, follow these steps:

- Watch important metrics like how often users open the app, how long they stay, and if it crashes

- Make updates often to fix problems, add new stuff, and make the app better for users

- Look at what users say and app store reviews to find ways to improve

By focusing on performance monitoring and regular updates, you can keep your app reliable, safe, and up-to-date. This makes users happy, leads to good reviews, and boosts your app’s reputation.

For a personal finance app to succeed, it needs constant performance monitoring and updates. This lets developers stay on top and offer a great experience to users.

Conclusion

To make a successful personal finance app like Mint, you need to understand the market well. You must also develop key features, ensure security, and market the app effectively. This guide shows how to build an app that meets user needs and stands out in the market.

The need for easy-to-use financial tools is growing fast. With new tech, these apps can offer more personalized and smart financial experiences. By innovating, developers can make apps that are crucial for people’s financial health.