Table of Contents

Introduction to FinTech Business Models

In today’s digital age, the financial landscape is rapidly evolving, thanks to the emergence of FinTech, short for Financial Technology. FinTech has revolutionized traditional financial services by leveraging technology to provide innovative solutions that are more efficient, convenient, and accessible to consumers and businesses alike. At the heart of every successful FinTech venture lies a well-crafted business model that drives its operations and growth. In this article, we will delve into the fascinating realm of FinTech business models, exploring their intricacies and highlighting key examples of their application in the industry.

- Payment Processing Models: Payment processing is one of the foundational pillars of FinTech, encompassing a wide array of services that facilitate the transfer of funds between individuals, businesses, and financial institutions. FinTech companies operating in this space often adopt business models based on transaction fees, subscription models, or a combination of both. For instance, companies like PayPal, Square, and Stripe earn revenue by charging merchants a small percentage of each transaction processed through their platforms, making it a win-win solution for all parties involved.

- Peer-to-Peer (P2P) Lending Platforms: P2P lending platforms have disrupted traditional lending channels by directly connecting borrowers with investors through online marketplaces, eliminating the need for intermediaries like banks. These platforms typically generate revenue through origination fees, servicing fees, and interest spreads. LendingClub and Prosper are prime examples of FinTech companies that have thrived by embracing this business model, offering borrowers lower interest rates and providing investors with attractive returns on their investments.

- Robo-Advisory Services: Robo-advisors have democratized investment management by leveraging algorithms and automation to provide personalized financial advice and portfolio management services to investors at a fraction of the cost charged by traditional financial advisors. These platforms usually charge a management fee based on a percentage of the assets under management (AUM), making it affordable for individuals with varying investment sizes. Wealthfront and Betterment are leading players in this space, catering to tech-savvy investors seeking hassle-free investment solutions.

- Blockchain and Cryptocurrency Exchanges: With the rise of blockchain technology and cryptocurrencies, FinTech companies have ventured into the realm of digital asset exchanges, enabling users to buy, sell, and trade cryptocurrencies securely and efficiently. These platforms typically generate revenue through trading fees, withdrawal fees, and listing fees for new tokens. Coinbase and Binance exemplify successful FinTech business models in the cryptocurrency exchange space, offering a wide range of digital assets and advanced trading features to users worldwide.

- InsurTech Innovations: In the insurance sector, InsurTech companies leverage technology to streamline processes, enhance customer experience, and mitigate risks more effectively. These companies often adopt business models based on subscription fees, commission income, or partnerships with traditional insurers. Lemonade and Oscar Health are prime examples of InsurTech startups that have disrupted the insurance industry with their user-centric approach and innovative use of technology.

Marketplace Lending: Revolutionizing Borrowing and Lending

In the ever-evolving landscape of finance, traditional borrowing and lending methods have undergone a remarkable transformation with the advent of marketplace lending. This innovative approach, often referred to as peer-to-peer lending or crowdlending, has revolutionized the way individuals and businesses access capital, providing an alternative to conventional banking systems. From offering competitive interest rates to fostering financial inclusion, marketplace lending has emerged as a game-changer in the realm of finance.

Understanding Marketplace Lending: Marketplace lending operates on a simple premise: connecting borrowers directly with investors through online platforms, thereby bypassing traditional financial intermediaries like banks. This model leverages technology to match borrowers with suitable lenders, facilitating transactions efficiently and transparently. By cutting down on overhead costs associated with brick-and-mortar institutions, marketplace lending platforms can offer borrowers lower interest rates while providing investors with attractive returns.

Empowering Borrowers: One of the most significant advantages of marketplace lending is its ability to empower borrowers of all backgrounds. Whether individuals seeking personal loans or small businesses in need of capital, these platforms offer accessible financing options that may otherwise be unavailable through traditional channels. Moreover, the streamlined application process and quick approval timelines make marketplace lending an attractive choice for those looking for hassle-free borrowing experiences.

Diversification for Investors: For investors, marketplace lending presents a compelling opportunity to diversify their portfolios and earn attractive returns. By spreading their investments across various loan products and risk profiles, investors can mitigate risks and potentially achieve higher yields compared to traditional investment avenues. Additionally, many marketplace lending platforms offer tools and analytics to help investors make informed decisions, further enhancing transparency and trust within the ecosystem.

Democratizing Finance: Perhaps the most profound impact of marketplace lending is its role in democratizing finance. By breaking down barriers to entry and promoting inclusivity, these platforms open up opportunities for individuals and businesses that may have previously been underserved by traditional banking institutions. Whether it’s providing loans to borrowers with limited credit history or supporting small businesses with growth capital, marketplace lending fosters financial inclusion and socioeconomic empowerment.

Regulatory Landscape: As marketplace lending continues to gain traction, regulatory frameworks are evolving to ensure consumer protection and market integrity. Regulatory bodies around the world are actively monitoring these platforms, implementing measures to safeguard investor interests and maintain the stability of the financial system. While regulations may vary across jurisdictions, industry participants are committed to upholding compliance standards and fostering a trustworthy marketplace for all stakeholders.

The Future of Finance: Looking ahead, marketplace lending is poised to play an increasingly prominent role in the global financial ecosystem. As technology advances and consumer preferences shift, we can expect to see further innovation in this space, with enhanced credit assessment tools, blockchain integration, and expanded product offerings. Moreover, marketplace lending has the potential to bridge the gap between traditional banking systems and emerging digital currencies, facilitating seamless financial transactions on a global scale.

Payment Processing Innovations: The Backbone of FinTech

In today’s dynamic financial landscape, the fusion of technology and finance has birthed a revolutionary force known as FinTech. At the heart of this revolution lies payment processing innovations, acting as the cornerstone upon which the entire FinTech ecosystem thrives. From seamless transactions to enhanced security measures, these innovations are reshaping the way we perceive and conduct financial transactions.

Gone are the days of cumbersome paper checks and slow bank transfers. With the advent of payment processing innovations, transactions have become instantaneous, allowing businesses and consumers alike to operate in real-time. This speed not only fosters efficiency but also opens doors to new opportunities for businesses to scale and expand globally.

One of the most notable advancements in payment processing is the rise of mobile payment solutions. Services like Apple Pay, Google Pay, and Samsung Pay have transformed smartphones into digital wallets, allowing users to make secure transactions with just a tap of their device. This shift towards mobile payments has not only simplified the checkout process but has also spurred the growth of e-commerce by enabling seamless transactions across various digital platforms.

Furthermore, the integration of artificial intelligence (AI) and machine learning algorithms has bolstered the security of payment processing systems. These technologies analyze vast amounts of data in real-time to detect and prevent fraudulent activities, safeguarding both businesses and consumers against potential threats. By continuously evolving to counter emerging risks, AI-powered security measures provide peace of mind in an increasingly digital world.

Cryptocurrency and blockchain technology have also emerged as disruptive forces in the realm of payment processing. With blockchain’s decentralized ledger system, transactions are recorded securely and transparently, eliminating the need for intermediaries and reducing processing times. Cryptocurrencies like Bitcoin and Ethereum offer borderless transactions, enabling cross-border payments without the hassle of currency conversions or hefty transaction fees.

Moreover, the rise of application programming interfaces (APIs) has facilitated seamless integration between different financial systems, enabling interoperability and enhancing the overall user experience. APIs allow FinTech companies to collaborate with banks, payment processors, and other institutions, creating a unified ecosystem where data can flow freely and securely.

Looking ahead, payment processing innovations will continue to drive the evolution of FinTech, unlocking new possibilities and reshaping the way we interact with money. As technology continues to advance, we can expect to see further integration of biometric authentication, tokenization, and contactless payment methods, further enhancing security and convenience.

Digital Banking: Redefining Traditional Banking Services

In the era of rapid technological advancement, the landscape of banking services is undergoing a profound transformation. Gone are the days of long queues at the bank and cumbersome paperwork. With the advent of digital banking, traditional banking services are being redefined, offering customers unparalleled convenience, efficiency, and accessibility like never before.

Digital banking, also known as online banking or internet banking, encompasses a wide array of financial services that are accessible through digital platforms such as mobile apps, websites, and other electronic channels. From checking account balances to transferring funds, paying bills, applying for loans, and even investing, digital banking allows customers to manage their finances anytime, anywhere, with just a few taps on their smartphones or clicks on their computers.

One of the most significant advantages of digital banking is its convenience. Instead of having to visit a physical branch during limited operating hours, customers can now conduct their banking transactions 24/7, 365 days a year, from the comfort of their homes or while on the go. This convenience not only saves time but also eliminates the hassle and stress associated with traditional banking methods.

Moreover, digital banking offers unparalleled accessibility, breaking down geographical barriers and reaching customers in remote areas where brick-and-mortar branches may be scarce. This inclusivity ensures that financial services are available to everyone, regardless of their location or socioeconomic status, thus promoting financial inclusion and empowerment.

Another key feature of digital banking is its emphasis on security. While concerns about cybersecurity are valid, banks invest heavily in robust encryption technologies and multi-factor authentication methods to safeguard customers’ sensitive information and prevent unauthorized access. With secure login credentials and advanced fraud detection systems in place, digital banking is often considered safer than carrying cash or using traditional paper-based methods.

Furthermore, digital banking enhances the overall customer experience by offering personalized services and tailored recommendations based on users’ transaction history, spending patterns, and financial goals. Through data analytics and artificial intelligence, banks can anticipate customers’ needs and provide proactive assistance, whether it’s suggesting suitable investment options, offering budgeting advice, or notifying them of potential fraudulent activities.

In addition to benefiting consumers, digital banking also streamlines operations and reduces costs for financial institutions. By digitizing processes, automating routine tasks, and minimizing the need for physical infrastructure, banks can achieve greater operational efficiency and allocate resources more effectively, ultimately improving their bottom line.

However, despite its numerous benefits, the transition to digital banking is not without its challenges. Technological barriers, cybersecurity risks, regulatory compliance, and the digital divide are some of the issues that need to be addressed to ensure a smooth and equitable transition to the digital era of banking.

Robo-Advisors: Automated Investment Management for All

In today’s fast-paced world, where time is a precious commodity, and financial planning can often seem daunting, the rise of robo-advisors emerges as a beacon of hope for investors of all backgrounds. These automated investment platforms have swiftly carved their niche, democratizing wealth management and making investment opportunities accessible to the masses.

Robo-advisors, powered by sophisticated algorithms and artificial intelligence, offer a streamlined approach to investing. They analyze vast amounts of data, assess risk tolerance, and craft personalized investment portfolios tailored to individual goals and preferences. This level of customization ensures that even novice investors can embark on their financial journey with confidence, guided by data-driven insights and professional expertise.

One of the most significant advantages of robo-advisors is their affordability. Traditional wealth management services often come with hefty fees, making them prohibitive for many investors. In contrast, robo-advisors typically charge lower fees, sometimes a fraction of what traditional advisors demand, making them an attractive option for cost-conscious investors.

Moreover, robo-advisors eliminate the need for extensive market research and constant monitoring of investment portfolios. With automated rebalancing and portfolio optimization, investors can rest assured that their assets are managed efficiently, freeing up time for other pursuits. This hands-off approach appeals to busy professionals and individuals who lack the expertise or time to actively manage their investments.

Accessibility is another key feature of robo-advisors. Unlike traditional wealth management firms that often have high minimum investment requirements, many robo-advisors allow investors to start with minimal amounts, making it possible for anyone to dip their toes into the world of investing. This inclusivity fosters financial literacy and empowers individuals to take control of their financial future, regardless of their income or background.

Furthermore, robo-advisors prioritize transparency and education, providing investors with comprehensive insights into their portfolios and investment strategies. Through intuitive interfaces and educational resources, investors can deepen their understanding of financial markets and investment principles, empowering them to make informed decisions and navigate market volatility with confidence.

Despite these advantages, it’s essential to acknowledge that robo-advisors are not without limitations. While they excel at executing predefined investment strategies, they may lack the human touch and nuanced judgment that traditional advisors provide, especially in complex financial situations. Additionally, some investors may prefer the reassurance of human interaction when managing their finances, which robo-advisors cannot fully replicate.

Blockchain and Cryptocurrency: Disrupting Financial Transactions

In the ever-evolving landscape of finance, one technological innovation stands out amidst the traditional frameworks: blockchain and cryptocurrency. These twin forces have been disrupting financial transactions, reshaping the way we perceive and engage with money. Let’s delve into how they are altering the financial landscape as we know it.

The Genesis of Disruption

Blockchain, the underlying technology behind cryptocurrencies like Bitcoin and Ethereum, operates as a decentralized ledger system. This means that instead of a central authority controlling transactions, they are verified and recorded across a network of computers. This decentralized nature ensures transparency, security, and immutability, making it highly resilient to fraud and tampering.

Cryptocurrencies, on the other hand, serve as digital or virtual currencies that utilize cryptography for security. They operate independently of central banks and governments, offering borderless, peer-to-peer transactions with lower fees and faster processing times compared to traditional banking systems.

Transforming Financial Transactions

1. Enhanced Security and Transparency: Blockchain’s immutable nature ensures that once a transaction is recorded, it cannot be altered or deleted. This provides a high level of security, reducing the risk of fraud and ensuring the integrity of financial transactions. Moreover, the transparent nature of blockchain allows for real-time tracking and auditing, fostering trust among participants.

2. Reduced Costs and Friction: Traditional financial transactions often involve intermediaries such as banks, payment processors, and clearinghouses, leading to higher fees and longer processing times. With blockchain and cryptocurrencies, the need for intermediaries is eliminated, resulting in lower transaction costs and quicker settlements. This has particularly significant implications for cross-border transactions, where fees and delays can be substantial.

3. Financial Inclusion: Cryptocurrencies have the potential to bank the unbanked by providing access to financial services for individuals who are excluded from traditional banking systems. With just a smartphone and internet connection, anyone can participate in the global economy, empowering marginalized communities and promoting financial inclusion on a global scale.

4. Disintermediation and Decentralization: By decentralizing financial transactions, blockchain and cryptocurrencies challenge the dominance of traditional financial institutions. This disintermediation gives individuals greater control over their finances, reducing reliance on centralized authorities and democratizing access to financial services.

Challenges and Opportunities Ahead

While blockchain and cryptocurrencies hold immense promise, they are not without challenges. Regulatory uncertainty, scalability issues, and concerns regarding privacy and security pose significant hurdles to widespread adoption. However, ongoing research and innovation continue to address these challenges, paving the way for a more robust and inclusive financial ecosystem.

Personal Finance Management Apps: Empowering Users with Financial Insights

In today’s fast-paced world, managing personal finances can often feel like trying to solve a complex puzzle. From tracking expenses to budgeting, saving, and investing, there’s a myriad of tasks that demand attention. However, with the advent of personal finance management apps, individuals now have powerful tools at their fingertips to navigate the financial landscape with confidence and ease.

These apps serve as virtual financial assistants, empowering users with valuable insights into their spending habits, savings goals, and investment opportunities. By aggregating data from various financial accounts, such as bank accounts, credit cards, loans, and investments, these apps provide users with a comprehensive overview of their financial health in real-time.

One of the key features of personal finance management apps is budgeting. These apps allow users to set personalized budgets based on their income, expenses, and financial goals. Through intuitive interfaces and customizable categories, users can easily track their spending and identify areas where they can cut back or save more. Whether it’s dining out, shopping, or entertainment, these apps help users stay within their budgetary limits and make informed financial decisions.

Moreover, personal finance management apps offer insights into saving and investing. Many apps analyze spending patterns and recommend personalized saving goals based on users’ financial profiles. Whether it’s building an emergency fund, saving for a vacation, or planning for retirement, these apps provide actionable recommendations to help users achieve their financial objectives.

Additionally, some apps offer investment management features, allowing users to monitor their investment portfolios, track performance, and receive personalized investment advice. From stocks and bonds to mutual funds and ETFs, these apps provide users with access to a wide range of investment options, helping them build diversified portfolios tailored to their risk tolerance and financial goals.

Furthermore, personal finance management apps prioritize security and privacy, employing robust encryption and authentication measures to safeguard users’ financial information. With bank-level security protocols and regular updates, users can trust that their data is protected against unauthorized access and cyber threats.

Crowdfunding Platforms: Democratizing Access to Capital

In today’s fast-paced entrepreneurial landscape, securing capital remains a significant hurdle for many innovators and small businesses. However, the emergence of crowdfunding platforms has transformed the traditional avenues of fundraising, democratizing access to capital like never before. These platforms have become a beacon of hope for aspiring entrepreneurs, enabling them to turn their ideas into reality by tapping into the power of the crowd.

Crowdfunding platforms serve as virtual marketplaces where individuals or businesses can present their projects or ventures to a global audience, seeking financial support from backers who believe in their vision. Unlike conventional methods of fundraising, such as bank loans or venture capital, crowdfunding offers a decentralized approach, allowing entrepreneurs to bypass the traditional gatekeepers and directly connect with potential investors.

One of the most notable advantages of crowdfunding is its ability to democratize access to capital. Historically, accessing funding was largely restricted to those with established networks or substantial financial resources. Crowdfunding platforms break down these barriers by providing a level playing field where anyone with a compelling idea and a solid execution plan can attract investment.

Moreover, crowdfunding transcends geographical boundaries, enabling entrepreneurs from diverse backgrounds and regions to access funding opportunities. This inclusivity fosters innovation by harnessing the collective wisdom and resources of a global community. Whether you’re in a bustling metropolis or a remote village, crowdfunding platforms offer a platform to showcase your ideas and garner support from backers worldwide.

Another key aspect of crowdfunding is its role in validating market demand. By presenting their projects to a wide audience, entrepreneurs can gauge interest and receive valuable feedback before fully committing to their ventures. This real-time market validation not only helps mitigate the risk of failure but also increases the likelihood of success by aligning products or services with actual consumer needs.

Furthermore, crowdfunding platforms promote transparency and accountability in the fundraising process. Backers have visibility into how their contributions are being utilized, fostering trust and confidence in the project creators. This transparency is reinforced by the platform’s review mechanisms and communication channels, which facilitate ongoing engagement between creators and backers.

In recent years, crowdfunding has evolved beyond traditional reward-based models to include various approaches such as equity crowdfunding and peer-to-peer lending. Equity crowdfunding allows investors to acquire ownership stakes in the ventures they support, offering the potential for financial returns. On the other hand, peer-to-peer lending platforms enable individuals to lend money directly to borrowers, circumventing traditional financial intermediaries.

Despite its many benefits, crowdfunding also poses challenges, including intense competition for visibility, regulatory complexities, and the risk of project failure. However, with careful planning, strategic marketing, and a compelling value proposition, entrepreneurs can overcome these hurdles and leverage crowdfunding to propel their ventures forward.

Peer-to-Peer (P2P) Payment Systems: Facilitating Seamless Transactions

In today’s fast-paced digital world, convenience reigns supreme, especially when it comes to financial transactions. Peer-to-peer (P2P) payment systems have emerged as game-changers, revolutionizing the way people exchange money. With just a few taps on a smartphone, individuals can seamlessly transfer funds to friends, family, or even merchants, without the hassle of traditional banking methods.

Understanding P2P Payment Systems

P2P payment systems facilitate the transfer of funds directly between individuals or entities, typically through a mobile app or online platform. Unlike traditional banking transfers that may involve intermediary institutions, P2P payments cut out the middleman, allowing for quicker and more direct transactions.

The Rise of P2P Payment Platforms

The popularity of P2P payment platforms has surged in recent years, driven by several factors. One of the primary drivers is the increasing reliance on smartphones and digital devices for everyday tasks. As mobile technology continues to advance, so too does the ease and accessibility of P2P payment solutions.

Moreover, the rise of the sharing economy and the gig economy has created a demand for convenient payment methods among freelancers, contractors, and small businesses. P2P payment systems offer a hassle-free way for individuals to send and receive payments for goods and services rendered, without the need for cash or checks.

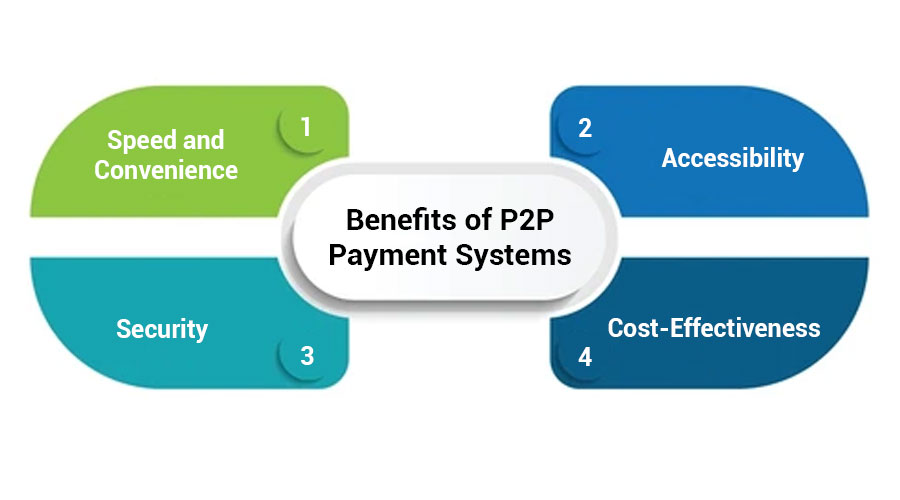

Benefits of P2P Payment Systems

- Speed and Convenience: With P2P payment systems, transactions are processed in real-time, eliminating the delays associated with traditional bank transfers or paper checks. Users can send money instantly, anytime, anywhere, with just a few clicks on their mobile devices.

- Accessibility: P2P payment platforms are often user-friendly and accessible to anyone with a smartphone and internet connection. This accessibility makes them particularly appealing to younger generations who are accustomed to managing their finances digitally.

- Security: While security concerns are always paramount when it comes to financial transactions, P2P payment systems employ robust encryption and authentication measures to safeguard users’ sensitive information. Many platforms also offer additional security features such as biometric authentication and fraud detection algorithms to further enhance protection.

- Cost-Effectiveness: Compared to traditional banking methods or wire transfers, which may incur hefty fees, P2P payments are often free or come with minimal transaction fees. This cost-effectiveness makes them an attractive option for individuals looking to save money on transfer fees.

The Future of P2P Payments

As technology continues to evolve, so too will P2P payment systems. We can expect to see further innovations aimed at enhancing the user experience, improving security, and expanding the functionality of these platforms.

Additionally, the integration of emerging technologies such as blockchain and cryptocurrencies could further disrupt the landscape of P2P payments, offering even greater efficiency, transparency, and decentralization.

Top 6 FinTech Business Models Companies

In the fast-paced realm of finance, technology is revolutionizing the way businesses operate and customers interact with their finances. With the rise of FinTech (Financial Technology) companies, traditional banking and financial institutions are facing unprecedented competition. These innovative startups are not just disrupting the industry; they are also introducing novel business models that are reshaping the landscape of financial services. Let’s delve into the top six FinTech business models that are making waves in the industry.

-

-

Next Big Technology:

Focus Area

- Mobile App Development

- App Designing (UI/UX)

- Software Development

- Web Development

- AR & VR Development

- Big Data & BI

- Cloud Computing Services

- DevOps

- E-commerce Development

Industries Focus

- Art, Entertainment & Music

- Business Services

- Consumer Products

- Designing

- Education

- Financial & Payments

- Gaming

- Government

- Healthcare & Medical

- Hospitality

- Information Technology

- Legal & Compliance

- Manufacturing

- Media

-

- Digital Payment Solutions: Digital payment solutions have revolutionized the way transactions are conducted globally. Companies like PayPal, Square, and Stripe offer seamless payment processing services, allowing businesses of all sizes to accept payments online and offline. With the growing popularity of e-commerce and mobile shopping, these FinTech companies have become indispensable for facilitating secure and convenient transactions.

- Robo-Advisors: Robo-advisors are algorithm-based investment platforms that provide automated, low-cost portfolio management services. These platforms use advanced algorithms to analyze investors’ financial goals, risk tolerance, and investment preferences, and then recommend diversified investment portfolios tailored to their needs. Wealthfront and Betterment are leading examples of robo-advisors that are democratizing investment management and making it more accessible to the masses.

- Blockchain and Cryptocurrency: Blockchain technology and cryptocurrencies have emerged as disruptive forces in the financial industry. Blockchain, the underlying technology behind cryptocurrencies like Bitcoin and Ethereum, offers transparent and secure transaction processing without the need for intermediaries. Companies like Coinbase and Binance have capitalized on the growing interest in cryptocurrencies by providing cryptocurrency exchange and trading platforms, as well as other blockchain-based financial services.

- InsurTech: InsurTech startups are leveraging technology to innovate and streamline processes within the insurance industry. These companies utilize data analytics, artificial intelligence, and machine learning to assess risks more accurately, personalize insurance offerings, and automate claims processing. Companies such as Lemonade and Oscar Health are reimagining insurance by providing digital-first, customer-centric insurance products that offer greater transparency and efficiency.

- RegTech: Regulatory Technology (RegTech) companies are addressing the increasing regulatory compliance burden faced by financial institutions. These companies develop software solutions that help businesses comply with regulations more efficiently and cost-effectively. By automating compliance processes, monitoring transactions for potential risks, and ensuring data security, RegTech companies like ComplyAdvantage and Onfido are helping financial institutions stay ahead of regulatory requirements and mitigate compliance-related risks.

FAQs On 6 FinTech Business Models

The fintech industry is revolutionizing financial services, providing innovative solutions that enhance efficiency, security, and accessibility. Whether you’re an entrepreneur looking to enter the fintech space or simply curious about the different business models, this FAQ guide will help you understand the fundamentals. Let’s dive into the most frequently asked questions about the six key fintech business models.

1. Digital Payments

What are digital payments?

Digital payments involve the transfer of funds or transactions conducted through digital or online modes. This can include mobile wallets, online banking, and digital currency transactions.

How do digital payment systems work?

Digital payment systems work by linking a user’s bank account, credit card, or mobile wallet to an online platform, enabling seamless transactions. Payment gateways and processors facilitate the secure transfer of funds between the buyer and seller.

What are the benefits of digital payments?

- Convenience: Transactions can be completed quickly and easily from anywhere.

- Security: Enhanced security features protect against fraud.

- Cost-Effectiveness: Lower transaction costs compared to traditional methods.

2. Peer-to-Peer Lending

What is peer-to-peer lending?

Peer-to-peer (P2P) lending platforms connect borrowers directly with lenders, bypassing traditional financial institutions. Borrowers can often obtain loans at lower interest rates, while lenders can earn higher returns.

How does P2P lending work?

Borrowers apply for loans on the P2P platform, which evaluates their creditworthiness. Investors can then choose to fund these loans, earning interest over the repayment period.

What are the risks and rewards of P2P lending?

- Rewards: Higher interest rates for investors compared to traditional savings accounts.

- Risks: Potential for borrower default, which can lead to financial loss for investors.

3. Robo-Advisors

What are robo-advisors?

Robo-advisors are automated platforms that provide financial planning and investment management services with minimal human intervention.

How do robo-advisors operate?

Robo-advisors use algorithms and data analytics to create and manage investment portfolios based on the user’s risk tolerance, financial goals, and timeline.

Why choose a robo-advisor?

- Cost Efficiency: Lower fees compared to traditional financial advisors.

- Accessibility: Easy to use and accessible for investors of all levels.

- Personalization: Tailored investment strategies based on individual preferences.

4. InsurTech

What is InsurTech?

InsurTech refers to the use of technology to innovate and improve the insurance industry. This includes everything from customer experience to underwriting and claims processing.

How does InsurTech benefit customers?

- Speed: Faster processing of claims and policy management.

- Customization: Personalized insurance products tailored to individual needs.

- Transparency: Improved clarity and understanding of insurance policies and coverage.

What are some examples of InsurTech innovations?

- Telematics: Usage-based insurance policies for vehicles.

- AI and Machine Learning: Automated underwriting and fraud detection.

- Blockchain: Enhanced security and transparency in policy management.

5. RegTech

What is RegTech?

RegTech, short for regulatory technology, leverages technology to help businesses comply with regulatory requirements efficiently and effectively.

What solutions does RegTech provide?

- Compliance Management: Automated tracking and reporting of compliance issues.

- Risk Management: Tools to identify and mitigate risks.

- Regulatory Reporting: Streamlined processes for submitting regulatory reports.

Why is RegTech important?

- Efficiency: Reduces the time and cost associated with regulatory compliance.

- Accuracy: Minimizes errors in compliance processes.

- Adaptability: Quickly adapts to changing regulations.

6. Blockchain and Cryptocurrency

What is blockchain technology?

Blockchain is a decentralized, digital ledger that records transactions across multiple computers securely. It underpins cryptocurrencies like Bitcoin and Ethereum.

How does cryptocurrency work?

Cryptocurrencies use cryptographic techniques to secure transactions and control the creation of new units. They operate independently of a central bank.

What are the advantages of blockchain and cryptocurrency?

- Security: Enhanced security features due to decentralized and immutable ledgers.

- Transparency: Transactions are visible and traceable on the blockchain.

- Efficiency: Faster and cheaper cross-border transactions.

What are the challenges facing blockchain and cryptocurrency?

- Regulation: Uncertainty and evolving regulations.

- Volatility: High price volatility of cryptocurrencies.

- Adoption: Wider adoption requires overcoming technological and educational barriers.

Thanks for reading our post “6 FinTech Business Models – A Complete Guide”. Please connect with us to learn more about Best 6 FinTech Business Models.