Creating a loan lending and credit score app is a detailed task. It needs careful planning and execution. The aim is to make a user-friendly platform for accessing credit and managing finances. A credit score app is key, as it helps lenders see if someone is trustworthy.

To make a loan lending and credit score app, you must go through several steps. First, you need to understand the market. Then, design the app’s architecture. Next, add security measures. Finally, test the app. By doing these, developers can make a strong app that helps users manage their finances well.

Table of Contents

Key Takeaways

- Loan lending app development requires careful planning and execution

- A credit score app is an essential component of the loan lending process

- Understanding the market is a critical stage of loan lending app development

- Implementing robust security measures is essential for a credit score app

- Testing the app is a critical stage of the loan lending app development process

- Effective loan lending app development optimizes user success and financial management

- A deep understanding of the credit score app is necessary for successful loan lending app development

Understanding the Loan Lending App Market

The loan lending app market is changing fast, thanks to fintech and financial technology. To do well here, knowing the latest trends and what’s happening is key. More people want to use apps for their financial needs.

Some big trends in the market are:

- More people using digital payments

- Wanting financial services that fit their personal needs

- New ways of lending, like between people directly

Mobile app development is very important for the future of loan lending. By using fintech and financial technology, developers can make new, helpful apps. These apps will be better, safer, and easier to use.

Knowing the loan lending app market and its trends helps developers make apps that people want. This can lead to success in the fintech and financial technology world.

| Trend | Description |

|---|---|

| Digital Payment Systems | More people using digital payments, like mobile wallets and online platforms |

| Personalized Financial Services | More demand for financial services that fit each person’s needs, like custom loans and planning tools |

| Peer-to-Peer Lending | New ways of lending, like between individuals, where people lend and borrow money directly |

Essential Features for Your Loan Lending & Credit Score App

When making a loan lending and credit score app, it’s key to include features that meet your audience’s needs. A user-friendly interface is crucial. It lets users easily navigate the app. The app must also have a strong security system to keep user data safe.

A main feature of a lending app is calculating credit scores. This is done using an algorithm that looks at payment history, credit use, and credit history. The app should let users apply for loans and track payments. Mobile lending is getting more popular, so your app should work well on mobile devices.

Some important features to think about include:

- User registration and verification

- Loan application and approval process

- Credit score calculation and tracking

- Payment processing and scheduling

By adding these features, you can make a complete loan lending and credit score app. A well-made app helps users manage their finances well. It also makes the experience smooth for lenders. With the right features and security, your app can be a reliable place for credit score and lending app services.

Planning Your App’s Technical Architecture

When you’re making a fintech app, planning the tech architecture is key. It makes sure your app works well, is safe, and can grow. A good plan lets your app handle lots of users and data safely and fast.

In app development, the backend needs to handle lots of user requests and data. Use strong frameworks like Node.js or Django for this. Also, add a credit score algorithm to give users accurate scores and insights.

For the database, use systems like MySQL or PostgreSQL for safe data storage. It should hold user and financial info, and keep data encrypted. Also, make sure your app’s tech meets all rules and standards in fintech.

Key Considerations for Technical Architecture

- Scalability and performance

- Security and data encryption

- Integration with third-party services

- Compliance with regulatory requirements

Think about these points to design a tech architecture that works for your fintech app. It should be secure, efficient, and meet all rules. A good plan also lets you work with other services and follow all laws.

Security Measures and Compliance Requirements

Creating a loan lending and credit score app needs careful thought about security and rules. In fintech, keeping user data safe is key to trust and avoiding losses. Strong security steps like encryption, safe login, and who-can-do-what rules are essential.

Some important security steps include:

- Encrypting user data with a safe method like AES

- Using secure login methods, like two-factor authentication

- Setting up access controls, like who can do what

Also, following rules is a must. This means sticking to laws like GDPR and PCI DSS. By focusing on security and rules, fintech firms can keep their apps safe and protect user data.

By using strong security and following rules, fintech companies can gain trust from users. This is vital for any loan lending and credit score app. Users need to know their info is safe.

| Security Measure | Description |

|---|---|

| Encryption | Protects user data by making it unreadable |

| Secure Authentication | Checks who users are and stops unauthorized access |

| Access Controls | Limits who can see or change sensitive data and systems |

Designing the User Interface

Creating a loan lending and credit score app needs a great user interface. It should be easy to use, with clear language and a design that fits all screens. This is where mobile app design shines, making the app both useful and nice to look at.

A good interface puts the user first, thinking about what they need and want. This is where user experience comes in, making the app easy and intuitive. Important things to consider include:

- Simple and consistent navigation

- Clear and concise language

- Responsive design that adapts to different screen sizes and devices

Designing each screen carefully is key for a smooth user experience. This means making the login, dashboard, and other important screens easy to use. The app’s flow should be clear and simple, guiding users through with easy steps. By focusing on these elements, you can make a user interface that is both enjoyable and effective.

| Design Element | Description |

|---|---|

| Simple Navigation | Easy to use and consistent navigation throughout the app |

| Clear Language | Clear and concise language used throughout the app |

| Responsive Design | Design that adapts to different screen sizes and devices |

Implementing Credit Score Algorithms

The credit score algorithm is key in loan lending and credit score apps. It shows how trustworthy a borrower is. A good credit score algorithm helps lenders make smart choices and lowers default risk. It looks at payment history, credit use, and credit history.

In the fintech world, credit score algorithms keep getting better. They use new data and machine learning. This makes credit scoring more accurate and reliable for everyone. Important things to think about when using these algorithms include:

- Transparency: The algorithm should be clear and easy to understand.

- Accuracy: It needs to be updated often to stay precise.

- Security: It must protect sensitive borrower information.

Using a strong credit score algorithm helps lenders make better choices. This is crucial in the fintech world. As the industry grows, we’ll see even better algorithms. They will use more data and advanced technology.

| Factor | Weightage |

|---|---|

| Payment History | 30% |

| Credit Utilization | 20% |

| Credit History | 50% |

Integration with Credit Bureaus and Financial Institutions

To make a loan lending and credit score app work well, it needs to connect with credit bureaus and financial institutions. This link lets the app check credit reports, confirm user identities, and handle secure transactions. The fintech world has grown a lot, with tech helping to offer new financial services.

The app should team up with credit bureaus like Equifax, Experian, and TransUnion to get credit reports and scores. This info is key to figuring out if a user can get a loan and what offers they might get. Also, the app must follow strict security rules, like the Payment Card Industry Data Security Standard (PCI DSS), to keep user data safe.

Some important things to think about when linking up with credit bureaus and financial institutions include:

- Secure ways to share data to keep user info safe and sound

- Following rules, like the Gramm-Leach-Bliley Act (GLBA)

- Using strong security steps, like encryption and access controls

By working with credit bureaus and financial institutions, the app can make things easier for users. It can also better judge credit risks and make the loan process more efficient. As fintech keeps changing, it’s key to keep up with new trends and tech to stay ahead.

Building the Loan Assessment Module

The loan assessment module is key in a loan lending and credit score app. It checks if users are creditworthy based on their credit score, income, and job history. It gives loan suggestions that fit the user’s credit profile. This is done with a machine learning model that gets better over time, making it a core part of fintech development.

Some important features of the loan assessment module are:

- Automated credit scoring

- Personalized loan recommendations

- Transparent and explainable loan assessment process

The module should explain the loan assessment clearly. This helps users understand their creditworthiness and make better choices. By using fintech and machine learning, the module can work better and improve the user experience. This is crucial for the loan lending industry, where credit score is very important.

Creating a strong loan assessment module helps businesses stand out. It offers users a smooth and personalized experience. This can make customers happier and more loyal, helping the app succeed. Success in the loan assessment process is key.

| Feature | Description |

|---|---|

| Automated Credit Scoring | Uses machine learning algorithms to assess creditworthiness |

| Personalized Loan Recommendations | Provides users with tailored loan options based on their credit profile |

| Transparent Loan Assessment | Offers clear and concise explanations of the loan assessment process |

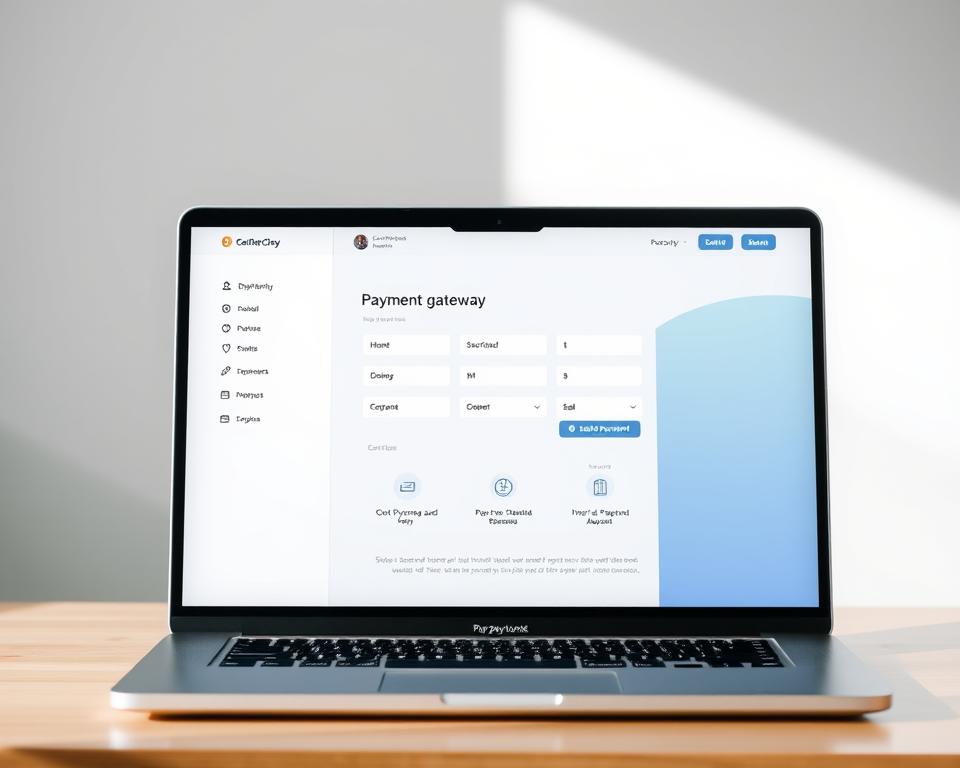

Payment Gateway Integration

Adding a secure payment gateway is key when making a loan lending and credit score app. Payment providers offer services for easy transactions. The aim is to make payments simple, secure, and use the latest fintech to protect data.

When picking a payment gateway, look at security, fees, and compatibility. Stripe, PayPal, and Square are top choices. Stripe has strong APIs for custom integration, while PayPal is easy to use for payments.

Important things to think about for payment gateway integration include:

- Transaction security: Keeping user data safe with encryption and secure protocols.

- Payment flow design: Making the payment process simple and easy to follow to lower cart abandonment.

- Compatibility: Supporting different payment ways, like credit cards, debit cards, and bank transfers.

A good payment gateway improves the user experience. It offers a smooth and safe way to make payments. By using the latest fintech and working with trusted payment providers, developers can create a standout app.

| Payment Gateway | Transaction Fees | Payment Methods |

|---|---|---|

| Stripe | 2.9% + $0.30 | Credit cards, debit cards, bank transfers |

| PayPal | 2.9% + $0.30 | Credit cards, debit cards, bank transfers |

| Square | 2.6% + $0.10 | Credit cards, debit cards, bank transfers |

Testing Strategies for Financial Apps

When making financial apps, like those for loans and credit scores, testing strategies are key. They make sure the app is safe, works well, and is efficient. The fintech world is growing fast. This means we need strong financial apps that can handle tough transactions and keep user data safe.

To get this right, developers use different testing methods. These include:

- Unit testing to check each part

- Integration testing to make sure parts work together well

- User acceptance testing to see if the app works as it should and feels good to use

These strategies help find and fix problems. For example, they can spot errors in payments or mistakes in credit scores. This makes the financial app better overall.

By using these testing methods, financial apps can offer a safe and reliable experience. This is key for gaining trust and getting more users in the fast-paced fintech world.

User Authentication and Data Protection

For a loan lending and credit score app, user authentication and data protection are key. The app must have strong security to keep user data safe and prevent unauthorized access. This is very important in the fintech world, where financial info is very sensitive.

Some important things to think about for user authentication include:

- Two-factor authentication to add an extra layer of security

- Secure password storage to protect user credentials

- Regular security updates and patches to prevent vulnerabilities

Also, data protection is vital. This means encrypting user data and controlling who can see it. By focusing on user authentication and data protection, fintech companies can earn their users’ trust.

By using strong security, fintech companies can keep their users’ info safe. This is key for the success of any loan lending and credit score app.

| Security Measure | Description |

|---|---|

| Two-factor authentication | Requires users to provide two forms of verification to access their accounts |

| Data encryption | Protects user data from unauthorized access by converting it into an unreadable format |

| Regular security updates | Ensures that the app’s security measures are up-to-date and effective against emerging threats |

Monetization Strategies

Creating a loan lending and credit score app needs a good plan for making money. In the fintech world, apps can earn through loan interest, fees, and ads. It’s key to have a solid plan to keep the app running financially.

Some good ways to make money with financial apps include offering extra services. For example, credit monitoring and financial planning. These help users manage their money better and make money for the app. Also, working with banks and credit agencies can help grow earnings.

Important things to think about when making money with apps include:

- Being clear about how the app makes money

- Making sure the app’s money system is safe and works well

- Following rules and standards in the industry

With smart money-making plans, financial apps can do well for a long time. It’s important to keep up with new ways to make money in the fintech world.

Marketing Your Loan Lending App

A good marketing strategy is key for a loan lending and credit score app’s success. It needs a plan that uses social media, email marketing, and paid ads to reach people. This helps the app find its target audience.

Getting users is also important. This includes using referrals, partnerships, and content marketing. These methods help the app grow its user base. This growth boosts revenue and increases its share in the fintech world.

It’s vital to track important metrics like user costs, retention rates, and revenue growth. This lets app developers see how well their marketing is working. They can then adjust their marketing strategy based on data to improve user acquisition.

By keeping an eye on these metrics and tweaking the marketing plan, the app can succeed in the competitivefintech market for the long term.

App Maintenance and Updates

Keeping a loan lending and credit score app running smoothly is key. This means fixing bugs, updating security, and making the app faster. A good maintenance plan keeps the app stable, safe, and quick.

In the fintech world, updates are vital to keep up and follow rules. A smart update plan should use push notifications, in-app updates, and emails. This way, users know about new features, fixes, and better performance.

Important parts of app upkeep and updates include:

- Regular security checks and tests

- Improving app speed for a better user experience

- Fixing bugs and solving problems

- Following rules and standards in the industry

By focusing on app maintenance and updates, fintech companies can gain user trust. They can also keep their app safe and stay competitive in the fintech market.

Scaling Your Application

Scaling your fintech app is key to its success. You need a system that can handle lots of users and data. This means designing a system that can grow with your app.

Infrastructure is crucial for scaling. A good infrastructure ensures your app works well with many users. Cloud-based services offer flexibility and scalability.

Infrastructure Scaling

To scale your infrastructure, try these strategies:

- Use cloud-based services to save money and be flexible

- Implement load balancing to spread traffic evenly

- Use auto-scaling to adjust resources as needed

It’s also important to grow your user base. You can do this through marketing, partnerships, and referrals. These strategies help increase your user base and grow your business.

User Base Growth

To grow your user base, consider these strategies:

- Develop a marketing plan that targets your audience

- Partner with other fintech companies to reach more people

- Start a referral program to encourage users to invite others

By focusing on scaling and growing your user base, your app will stay competitive. It will also provide a great experience for users.

| Scaling Strategy | Benefits |

|---|---|

| Infrastructure Scaling | Increased efficiency, reduced costs |

| User Base Growth | Increased revenue, expanded market reach |

Legal Considerations and Regulatory Compliance

When making a loan lending and credit score app, you must think about legal considerations and follow regulatory compliance. You need to meet rules like the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS). Knowing these rules is key in fintech and credit reporting.

In the fintech world, following regulatory compliance is crucial to avoid big problems. You need a strong compliance system that can handle lots of regulatory requirements. Important things to look at include:

- Terms and conditions

- Privacy policy

- User agreements

By focusing on legal considerations and making sure you follow regulatory compliance, you can gain trust from your users. This can help your fintech business grow and keep users interested.

In the end, a good compliance system will help your app deal with the complex world of regulatory compliance and legal considerations. This lets you focus on giving great service to your users.

Conclusion

Creating a successful loan lending app needs careful thought. You must consider market trends, user experience, and rules. A good loan lending app offers a smooth user experience, makes money, and stands out in the market.

In the United States, more people want loan lending and credit score apps. This is because they need easy and accessible financial services. By making a detailed loan lending and credit score app, businesses can take advantage of this trend. They need to focus on making the app easy to use and safe, while following all the rules.

The secret to success is finding a balance between user experience, safety, and following the rules. By doing this, developers can make an app that meets users’ needs and has a strong market presence. This is key in the competitive world of financial technology, where a well-made app can really stand out.