Our payment methods change as the world gets more digital. Many individuals use Venmo, PayPal, and Cash App to transfer money, and digital payment systems are becoming increasingly common. Zelle is one of the more recent entrants to electronic payments. Since its 2017 launch, Zelle has become a well-liked method for users to send and receive money straight from their bank accounts. This post will look more closely at Zelle’s business strategy and revenue stream.

Table of Contents

What is Zelle?

Users of the P2P payment platform Zelle may send and receive money straight from their bank accounts. While other P2P payment platforms are not linked with banks, Zelle is. This indicates that consumers may need to set up a separate tab or connect their debit or credit card to use the service. Customers may transfer funds from their bank accounts to send and receive payments.

One of the major P2P payment networks in the US, Zelle is accessible to users of more than 1,000 banks and credit unions. Users must have a bank account with a partnering bank to use Zelle. Also, they must download the Zelle app or go through their bank’s website or mobile app to use the service.

By assessing a charge to partner institutions for each transaction, Zelle makes money. Although the precise charge structure may vary depending on the bank, the cost is normally a percentage of the transaction value. Although some banks may charge their consumers for utilizing the service, Zelle does not charge users any fees for sending or receiving money.

Transaction Fees:

For each transaction executed over the network, Zelle charges banks a fee. Although the precise charge structure may vary depending on the bank, the cost is normally a percentage of the transaction value. Banks are prepared to pay the price since it enables them to provide their clients with a quick and easy money transfer. Also, it gives them an edge over other banks that offer comparable services.

For each Zelle transaction, Bank of America, for instance, imposes a fee equal to 1% of the transaction value. In contrast, JPMorgan Bank charges a flat cost of $0.25 for each transaction, regardless of the size of the transaction. Depending on the bank and the magnitude of the transaction, the charge structure could change.

Security Services:

Offering security services to its member banks is another revenue stream for Zelle. Because Zelle is connected with the banks’ fraud detection programs, fraudulent transactions are reduced. Zelle may charge banks a fee for these security services, which might boost its income.

Zelle’s quick and practical payment technique is a major contributor to its success. Due to Zelle’s integration with banks, users do not require a separate account or to link their debit or credit card to use the service, unlike other P2P payment platforms. Because consumers do not have to provide their financial information to a third-party service, Zelle is safer and more dependable.

Zelle Business Model

Transaction fees and corporate partnerships are how Zelle makes money. For Zelle, transaction fees are a substantial source of income. For each Zelle transaction, Bank of America, for instance, imposes a fee equal to 1% of the transaction value. In contrast, JPMorgan Bank charges a flat cost of $0.25 for each transaction, regardless of the size of the transaction.

Participating banks are assessed transaction fees. Although some banks may charge their consumers for utilizing the service, Zelle does not charge users any fees for sending or receiving money. Depending on the bank and the magnitude of the transaction, the charge structure could change.

Zelle could make money by forming alliances with other companies. For instance, some businesses may provide consumers who use Zelle to make purchases discounts or other rewards. By enabling these transactions, Zelle could be compensated with a commission or additional fees.

Zelle and Bank Partnerships

The success of Zelle has been greatly influenced by its integration with banks. Zelle may expand its user base and transaction volume by collaborating with banks and other financial organizations. One of the biggest P2P payment networks in the US, the service is accessible to users of more than 1,000 banks and credit unions.

Moreover, Fidelity National Information Services (FIS), the parent firm of Early Warning Services, the business that owns Zelle, has collaborated with Zelle. Banks may now provide Zelle to their consumers without requiring further integration thanks to FIS’ integration of Zelle into its banking platform. Through this alliance, Zelle can reach more clients and increase transaction volume.

Competition and Future of Zelle

Other P2P payment providers like Venmo and Cash App compete with Zelle. With a bigger user base, these businesses could provide additional features like social sharing and payment demands. Zelle may need to continue to develop and offer new services to remain competitive.

By extending its services outside P2P payments, Zelle is one way it is attempting to remain competitive. A new service named Zelle for Business was introduced by Zelle in 2020, enabling companies to receive payments from clients over the Zelle network. This service allows companies to provide clients with a more practical payment choice and may boost sales. Like PayPal, Zelle for Business levies a fee of 1% of the transaction amount.

Partnering with other businesses is another strategy Zelle is using to grow its service offering. The ability to send and receive money over the Zelle network will be made available to Visa cards through a collaboration that Zelle and Visa announced in 2020. Through this alliance, Zelle can reach more people and process more transactions.

Zelle is also attempting to enhance its user experience by adding new features and upgrading its current ones. Request Money, a new part that Zelle introduced in 2020, enables users to ask friends and family for financial assistance. Users now find it simpler to ask for payment for shared costs like meals or a group present.

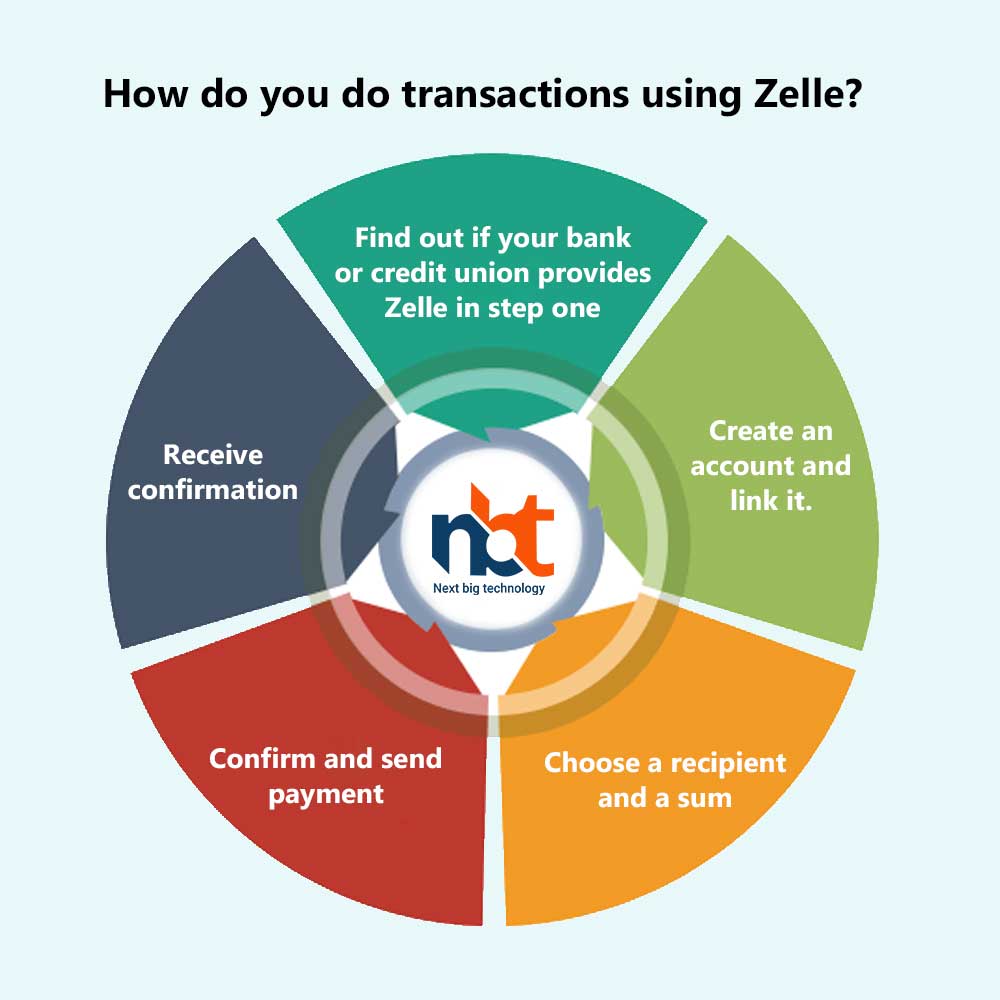

How do you do transactions using Zelle?

With Zelle, sending money is an easy and simple process. The following steps will show you how to send money using Zelle:

Step 1 : Find out if your bank or credit union provides Zelle

Check to see if your bank or credit union provides Zelle before you begin using it. You may check if Zelle is available to send money by entering into your online banking account or mobile banking application. If your bank or credit union does not provide Zelle, you may still use the service by downloading the Zelle app and connecting it to a debit card.

Step 2: Create an account and link it.

If Zelle is offered through your bank or credit union, you must sign up for the service and link your bank account. Your name, email address, and phone number connected to your bank account must be provided to register. With your Zelle account, you must also create a username and password. After registering, you must provide your account number and routing information to link your bank account.

Step 3: Choose a recipient and a sum

You must pick a recipient and an amount to send before using Zelle to send money. You may select a recipient by providing their phone number or email address. If the receiver has a Zelle account, the funds will be sent to their bank account. The receiver will get a text or email with instructions on signing up for a Zelle account if they don’t already have one, allowing them to receive the money.

Step 4: Confirm and send payment

After selecting the recipient and the amount, you must verify the payment information and send the money. Before sending money using Zelle, you must confirm the recipient’s name and the amount you wish to send. The funds will be sent from your bank account to the recipients once you approve the payment details. A notice that the money has been shipped will be given to the receiver.

Step 5: Receive confirmation

You will receive a confirmation that the payment has been sent when you send it. You may also check the payment information and transaction history on your Zelle account or online banking application.

Transferring money to friends and relatives is quick and simple with Zelle. You may send and receive payments without cash or checks as long as your bank or credit union supports Zelle.

Also Read : How Much Does It Takes to Develop a P2P Payment App? Know Here!

Conclusion

Users of the P2P payment platform Zelle may send and receive money straight from their bank accounts. One of the biggest P2P payment networks in the US, the service is connected with more than 1,000 banks and credit unions. Transaction fees and corporate partnerships are how Zelle makes money. Although there may be competition from other P2P payment providers, the service is attempting to remain ahead of the pack by enhancing its user interface and offering more services. One of the reasons Zelle has been successful is that it has been integrated with banks, and as more banks and companies use the service, its popularity is sure to increase.

Thanks for reading our post “Know the Process and Working of Zelle App”. Please connect with us to know more about Zelle App.