Digital payments are changing how we handle money. Now, people want easy, safe, and quick ways to pay with their phones. This guide will show you how to make a wallet app that works well, including digital banking and e-wallet apps.

If you’re starting a fintech company, working for a bank, or have tech skills, knowing about digital wallets is key. We’ll cover everything from market trends and tech needs to keeping your app safe and easy to use. This guide will help you make a top-notch wallet app that today’s users will love.

Table of Contents

Key Takeaways

- Gain insights into the types of digital wallets and their key features

- Understand the essential prerequisites for wallet app development

- Explore the technical requirements and technology stack selection

- Ensure compliance with security protocols and industry standards

- Discover the development phases, from planning to deployment

Understanding Digital Wallet Applications

Digital payments have changed a lot with mobile wallets, cryptocurrency wallets, and peer-to-peer payments. These new tools make managing money easier and safer. They help people and businesses deal with money in a smooth and secure way.

Types of Digital Wallets

There are many types of digital wallets, each for different needs. Mobile wallets like Apple Pay and Google Pay store card info on phones. This makes paying in person and online easy. Cryptocurrency wallets, however, are for handling digital currencies like Bitcoin and Ethereum. They offer a safe place to keep and manage these digital coins.

Key Features of Modern Wallet Apps

- Seamless user experience with intuitive interfaces

- Secure storage and encryption of financial data

- Support for mobile payments, peer-to-peer transfers, and cryptocurrency transactions

- Integration with digital banking services and account management tools

- Intelligent features like budgeting, spending tracking, and transaction history

Market Overview and Trends

The digital wallet market is growing fast. This is because more people are using mobile payments and cryptocurrencies. They want easy, safe, and efficient ways to manage their money. Reports say the global mobile wallet market could hit over $3 trillion by 2025.

Essential Prerequisites for Wallet App Development

Creating a solid wallet app means knowing the financial rules, payment standards, and API guides. These basics are key to making sure your app works well and follows the rules set by regulators.

First, learn about the financial regulations for your area. This includes getting the right licenses, following AML and KYC rules, and keeping user data safe and private.

Next, keep up with the newest payment industry standards. Knowing about PCI DSS and EMV helps make sure your app’s payments are secure and follow the rules.

Lastly, understand the API documentation for payment gateways and other services you’ll use. This knowledge helps you connect these services smoothly into your app, making it work better for users.

| Prerequisite | Importance | Key Considerations |

|---|---|---|

| Financial Regulations | Ensures compliance and legal operation | Licensing requirements, AML/KYC policies, data privacy and security |

| Payment Industry Standards | Maintains security and interoperability | PCI DSS, EMV, and other industry-accepted protocols |

| API Documentation | Enables seamless third-party integrations | Familiarity with APIs from payment gateways, financial institutions, and other services |

By understanding and meeting these key needs, you can start building a wallet app. It will meet user needs and follow the changing rules of the digital payments world.

Technical Requirements and Technology Stack Selection

Building a wallet app needs a solid technical base. The choice of frontend, backend, and database techs is crucial. It affects the app’s performance, growth, and safety. Let’s look at what’s important for a wallet app’s success.

Frontend Technologies

React Native is a top pick for frontend work. It lets developers make apps for both iOS and Android that look and feel native. Using JavaScript and React, they can create engaging interfaces that work well with the device.

Backend Infrastructure

Node.js is great for the backend of wallet apps. It’s designed to handle lots of connections at once, making it scalable and efficient. Plus, Node.js has a big library of tools, like Express.js, for building secure APIs.

Database Solutions

MongoDB is a strong NoSQL database for wallet apps. It’s good at storing and getting user data and transactions. Using MongoDB with cloud services like Amazon Web Services (AWS) or Google Cloud Platform (GCP) adds scalability and reliability.

| Technology | Benefits |

|---|---|

| React Native |

|

| Node.js |

|

| MongoDB |

|

Choosing these key technologies helps developers make a strong wallet app. The mix of React Native, Node.js, and MongoDB with cloud services is a solid base for success.

Security Protocols and Compliance Standards

In today’s digital world, wallet app development must focus on security and following rules. Encryption is key to keeping user data safe. It uses strong methods like AES, RSA, and ECC to protect transactions.

Wallet apps need to follow rules like the Payment Card Industry Data Security Standard (PCI DSS). This rule set covers payment security, network safety, and how data is handled. Following PCI DSS shows an app is trustworthy and meets legal standards.

Also, with more focus on data privacy, following the General Data Protection Regulation (GDPR) is crucial. GDPR requires strong KYC/AML (Know Your Customer/Anti-Money Laundering) steps. Developers must protect user privacy and follow these GDPR rules.

| Security Protocol | Description | Key Benefits |

|---|---|---|

| Encryption | Robust data protection methods, such as AES, RSA, and ECC | Ensures confidentiality and integrity of transactions |

| PCI DSS | Industry-specific regulation for secure payment processing | Enhances user trust and meets legal requirements |

| GDPR | Comprehensive data privacy regulation | Protects personal information and user privacy |

| KYC/AML | Customer identification and anti-money laundering procedures | Compliance with GDPR and financial regulations |

By focusing on security and rules, wallet app developers can create trusted solutions. These solutions protect user data and meet complex regulations.

How to Develop a Wallet App, Digital Banking App, e-wallet app

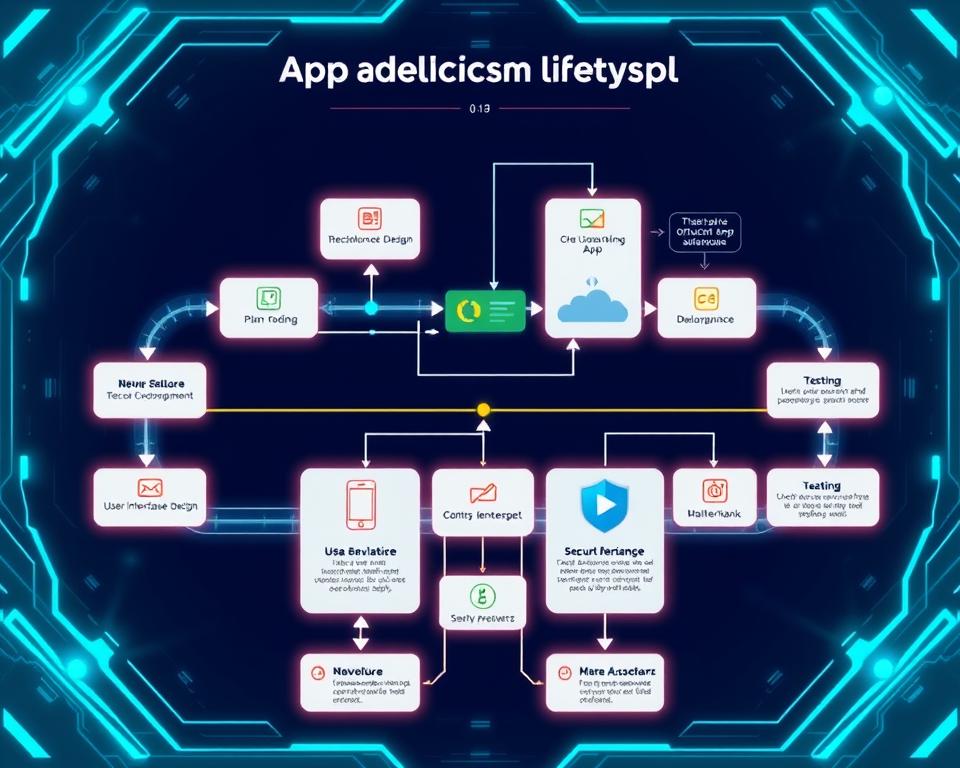

Making a wallet app, digital banking app, or e-wallet app needs a clear plan. The process includes planning, design, and development. Each step is key to getting what you want.

Planning Phase

The planning phase is the start of your app’s journey. It’s about doing market research, knowing your audience, and deciding on features. Using agile methods, like sprint planning, makes tasks easier and keeps things on schedule.

Design Phase

In the design phase, you make your app look good and easy to use. You decide on the app’s layout, design elements, and look. Working with skilled UX/UI designers is crucial for a great user experience.

Development Phase

This is when your app starts to come together. Your team uses the right tech and follows best practices. Agile methods help improve the process and meet user needs.

By going through planning, design, and development, you can make a top-notch app. Using agile and sprint planning helps keep your app up-to-date and user-friendly. This ensures your app meets your goals and delights your users.

| Phase | Key Activities |

|---|---|

| Planning |

|

| Design |

|

| Development |

|

User Authentication and Authorization Systems

Digital wallet apps rely heavily on user authentication and authorization systems. These systems are key to keeping user data safe. As more people use these apps, it’s important to look at different ways to protect user accounts and transactions.

Biometric authentication is a big player here. It uses unique biological features like fingerprints or facial recognition to confirm who you are. This method is both easy and secure, making it a favorite among users who want to ditch old-fashioned passwords.

Two-factor authentication (2FA) is another popular choice. It adds an extra step to log in, like a code sent to your phone. This makes it harder for hackers to get in, which is great for apps that handle money.

OAuth is also important. It lets users log in with their social media or email, without needing a new password. This makes signing up easier and keeps users coming back.

By using these strong systems, developers can create a safe and easy-to-use wallet app. This builds trust with users and keeps their financial info safe.

“Secure authentication is the foundation of a trustworthy digital wallet application. By leveraging advanced technologies like biometrics and two-factor authentication, we can empower users to take control of their financial data with confidence.”

| Authentication Method | Key Benefits | Adoption Trends |

|---|---|---|

| Biometric Authentication |

|

Rapidly gaining popularity in mobile applications and digital wallets |

| Two-Factor Authentication (2FA) |

|

Becoming a standard security feature in digital wallet apps |

| OAuth |

|

Increasingly integrated into digital wallet applications for seamless authentication |

Payment Gateway Integration Methods

Adding a strong payment gateway is key for a wallet app’s success. By linking your app to Stripe, PayPal, and Square, you give users a safe and easy way to handle money. We’ll look at the best ways to API integrate and test your payment systems.

Popular Payment Gateways

Top payment gateways have features for all wallet app developers. The most used ones are:

- Stripe – It’s easy to use and offers lots of customization, making it a favorite among developers.

- PayPal – Known for digital payments, PayPal makes transactions smooth and is trusted by many.

- Square – Famous for point-of-sale solutions, Square also has APIs for mobile app payments.

Integration Best Practices

For successful API integration, follow these steps:

- Know the payment gateway’s documentation and SDKs well.

- Use strong security like encryption and tokenization.

- Make the checkout process easy for users.

- Keep your integration up to date with industry changes.

Testing Payment Flows

Testing your payment flows is crucial for a smooth user experience. This includes:

- Testing end-to-end to mimic real payments.

- Checking error handling and edge cases for a solid system.

- Working with payment gateways for test access.

“A reliable payment gateway is essential for a wallet app’s success. By picking the right partners and following best practices, you can offer a secure and easy financial experience for your users.”

UI/UX Design Principles for Wallet Apps

In today’s fast-changing digital world, a wallet app’s success depends on its design. It must be user-friendly and easy to use. A good design makes the app easy to navigate and fun to use.

Understanding who will use the app is key. Developers need to know what users want and how they behave. This helps create an app that meets their needs and expectations.

It’s also important to make the app accessible to everyone. This means it should work well for people with different abilities. Adding features like voice commands and easy navigation helps make the app more accessible.

- Prioritize user-centric design to create intuitive interfaces that engage and delight users.

- Conduct comprehensive user research to understand the target audience and their needs.

- Incorporate accessibility features to make the wallet app inclusive and accessible to all users.

“The true sign of intelligence is not knowledge but imagination.” – Albert Einstein

By following these principles, developers can make wallet apps that are not just useful but also enjoyable. They will have a design that is user-centric, intuitive, and accessible.

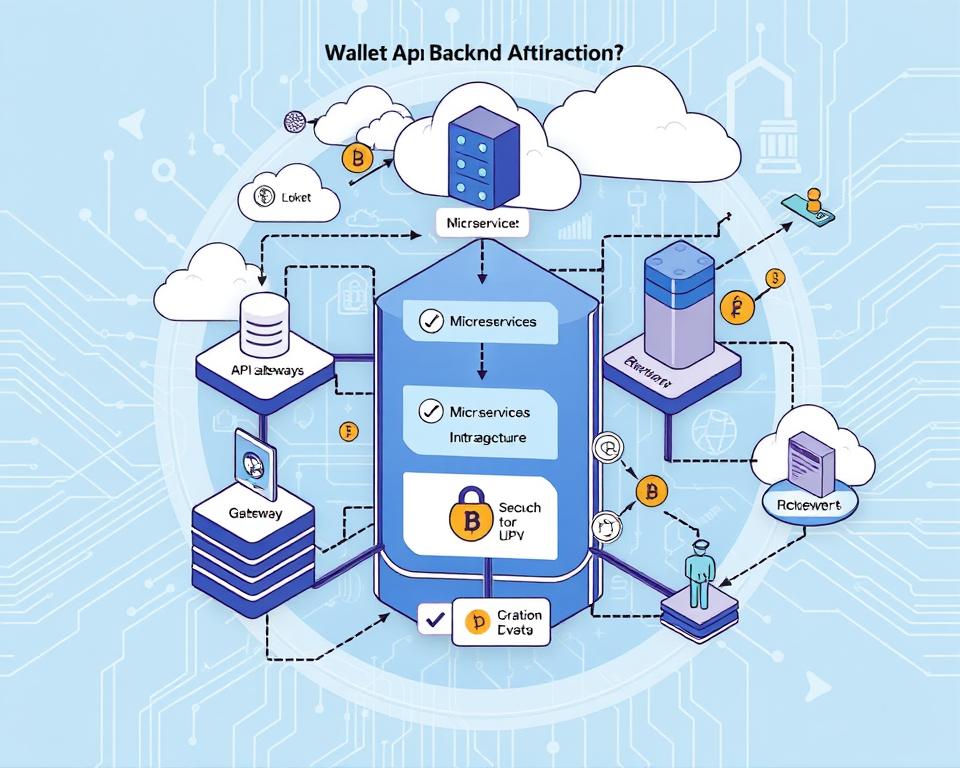

Backend Architecture and API Development

Creating a solid wallet app needs a strong backend and API setup. RESTful APIs are key, making sure the app’s parts talk smoothly. Using microservices helps build systems that grow with your app’s needs.

API Documentation

Good API documentation is vital for wallet app making. It should cover endpoints, data formats, errors, and how to log in. Clear docs make working with other services easier and better for developers.

Scalability Considerations

As more users and transactions come in, the backend must grow with them. Microservices and load balancing are key for handling more traffic well. Breaking the app into smaller parts makes it more scalable and reliable.

Performance Optimization

Wallet apps need to be fast and reliable. Improving the backend with caching, smart database use, and load balancing helps a lot. Using RESTful APIs and microservices ensures the app runs smoothly and can grow.

| Backend Technology | Benefits |

|---|---|

| RESTful APIs | Standardized communication, seamless integration with third-party services |

| Microservices | Scalable, fault-tolerant architecture, easier maintenance and updates |

| Load Balancing | Improved performance, higher availability, and better resource utilization |

“Designing a scalable and performant backend is crucial for the success of a digital wallet application. By embracing RESTful APIs, microservices, and load balancing techniques, developers can build a robust and flexible infrastructure that can adapt to the growing demands of the market.”

Testing Strategies and Quality Assurance

Creating a solid wallet app needs a detailed testing plan. This includes unit testing, integration testing, and security audits. These steps help make sure the app works well and keeps user data safe. A thorough testing process finds problems early, leading to a top-notch app that users can trust.

Unit Testing

Unit testing is key to quality. It checks each part of the wallet app to see if it works right and finds bugs. This way, developers can fix problems early, saving time and money later.

Integration Testing

After checking each part, integration testing comes next. It looks at how all parts of the app work together. This makes sure everything communicates well and data flows smoothly. It also finds any issues with how parts work together, making the app better for users.

Security Audits

Security is very important in the financial tech world, especially for wallet apps. Regular security audits are vital to find and fix weak spots. These audits check things like encryption, who can access what, and how data is stored. This ensures the app is safe and follows the rules.

| Testing Type | Purpose | Key Considerations |

|---|---|---|

| Unit Testing | Verifying individual components | Functionality, edge cases, error handling |

| Integration Testing | Examining component interactions | Data flow, communication, error handling |

| Security Audits | Identifying and addressing vulnerabilities | Encryption, access controls, data storage |

By using these testing methods and security steps in development, you can make a wallet app that is reliable, safe, and easy to use. This meets the high standards of today’s digital users.

Deployment and Launch Preparation

Getting your wallet app ready for launch is key. You need to know the rules of the App Store optimization and Google Play Store. This ensures your app goes live smoothly.

App Store Guidelines

Apple has strict rules for the App Store. You must have a catchy title, great screenshots, and a compelling description. Also, pick the right keywords to help people find your app.

Launch Checklist

Here’s a checklist for a smooth soft launch:

- Make sure all app content and features are ready

- Test your app for bugs and user experience

- Get the necessary approvals and certifications

- Prepare your marketing and promotions

- Have a system for handling user feedback

- Pick a good launch date and time

- Keep an eye on your app’s performance

By following these steps and the app store rules, your wallet app will launch well. This ensures a smooth start.

| App Store | Google Play Store |

|---|---|

|

|

By following the app store rules and a detailed checklist, your wallet app will launch successfully. This ensures a smooth start.

Maintenance and Updates

Keeping your wallet app in top shape is key to its success. Regular updates and bug fixes keep users happy and coming back. By fixing problems and making the app better, you stay ahead and win loyal customers.

Bug Fixes and Enhancements

It’s important to listen to what users say and check app data often. Fixing bugs and adding new features quickly shows you care about your users. This makes your app reliable and enjoyable to use.

- Develop a robust bug-reporting system to collect and track user-reported issues.

- Establish a continuous integration and deployment process to efficiently roll out bug fixes and updates.

- Solicit user feedback through in-app surveys, social media, and customer support channels to identify areas for improvement.

Performance Monitoring

Keeping your app fast and smooth is vital for keeping users happy. Watch your app’s performance closely. This helps you find and fix slow spots.

- Implement real-time performance monitoring tools to track key metrics and receive alerts for potential issues.

- Analyze usage patterns and traffic spikes to anticipate and scale your infrastructure accordingly.

- Optimize database queries, server configurations, and caching mechanisms to improve overall app responsiveness.

By focusing on updates and maintenance, your wallet app stays safe and efficient. This keeps your users happy and attracts new ones. Your app will stand out in the digital wallet market.

Cost Estimation and Timeline Planning

Creating a wallet app is a detailed task that needs careful planning and budgeting. It’s important to accurately estimate costs and manage time well. Let’s look at the main points for budget planning, resource allocation, and setting project milestones.

When budgeting for a wallet app, consider the team size, feature complexity, and technology stack. A detailed budget plan should cover all costs, like design, development, testing, and deployment. Proper resource allocation helps keep your project on schedule and within budget.

Good resource allocation is key for timely wallet app development. You need a skilled team and the right tools. Planning team roles and milestones helps use resources well and avoid delays.

Setting project milestones is vital for planning. Divide your project into phases like planning, design, development, and deployment. Set deadlines for each milestone and check progress often. This helps spot and fix problems early.

| Milestone | Timeline | Budget Allocation |

|---|---|---|

| Planning Phase | 2 weeks | 15% of total budget |

| Design Phase | 4 weeks | 20% of total budget |

| Development Phase | 12 weeks | 50% of total budget |

| Deployment Phase | 2 weeks | 15% of total budget |

By planning your budget, allocating resources, and setting milestones, you can keep your wallet app project on track. This ensures a quality product is delivered on time and within budget.

“Proper planning and budgeting are the keys to successful wallet app development. It’s essential to have a clear understanding of the costs and timeline to ensure the project’s success.”

Conclusion

The world of digital wallets is changing fast. People want secure, easy, and new ways to pay with their phones. This has led to many types of digital wallets and apps that are always getting better.

The future of digital wallets looks bright. We’ll see more contactless payments and mobile banking. New tech like biometric authentication and blockchain will also play a big role. This means digital wallets will keep getting better and more secure.

As mobile payments keep changing, digital wallet apps need to keep up. They must offer easy use, top security, and meet market needs. By doing this, they can grow and lead in the digital finance world.