During the Covid-19 pandemic, medical coverage has turned into a need of time, and the matter of insurance agency is blasting more than ever. A new report has uncovered a few stunning insights concerning why individuals fear protection, and one of the main motivations is the tedious and extended process.

Be that as it may, insurance agency has thought of an answer as an insurance agent mobile application through which one can easily buy a contract in a couple of steps. The following is a bit by bit manual for developing your insurance agent mobile application. To start with, we want to gain proficiency with the upsides of versatile applications for the two clients and insurance agency prior to settling on any choice. With Next Big Technology you can develop your application that helps you and improves your business.

Table of Contents

Why Insurance Agent Mobile App Development?

These days, individuals invest much of time on their mobile phones. With 258 billion downloads of mobile applications in 2022, approx. 90% of the time spent on mobile applications. An insurance application:

- Improves correspondence between an organization and its clients

- Naturally complete assignments of protection specialists and clients

- Takes out the manual assignment of filling strategy archives

- Assist you with gaining new clients

- Brings down functional expenses and increments income for an insurance agency.

Also read : Top 10+ On-Demand Insurance App Development Companies in India

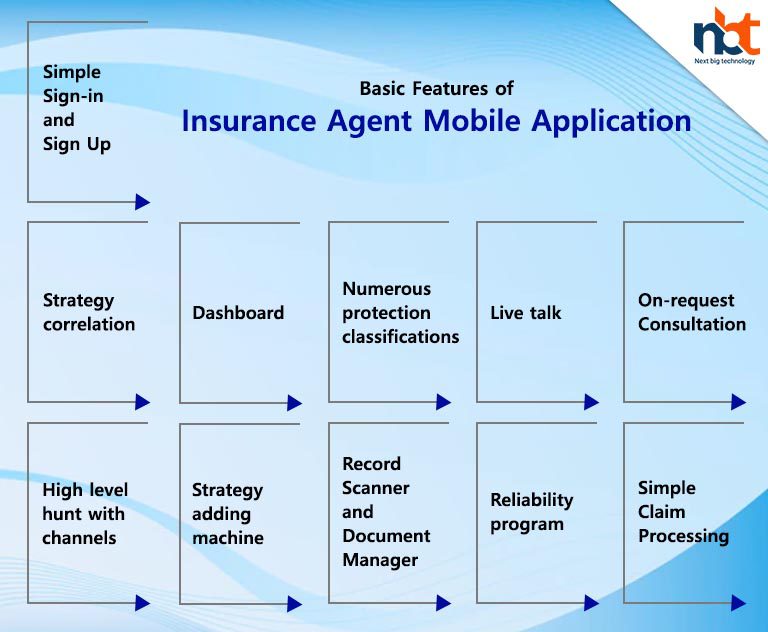

Basic Features of Insurance Agent Mobile Application

Assuming you intend to develop your insurance agent mobile application to tap the Trillion-Dollar protection market, here are the elements that you can ask to add to your application to make it effective.

-

Simple Sign-in and Sign Up

Clients ought to make a record to synchronize their information and access all their other shrewd gadgets by signing in to their records. They can likewise utilize their web-based entertainment records to login into the application with a solitary touch or enter their email and secret key for a more secure methodology.

-

Strategy correlation

There are many insurance arrangements accessible these days, and it is provoking for clients to choose the right contract for them as they have no information about the business. The strategy correlation highlight comes right into it here as clients can look at different arrangements and purchase the right approach at the best rate.

-

Dashboard

The client dashboard includes every one of the experiences about clients’ exercises with insights regarding arrangements they have purchased, their ongoing equilibrium, premium date, receipts, and most loved strategies.

-

Numerous protection classifications

It is probably the case that insurance contracts are accessible these days for most situations, and insurance agency partitions them into different classifications. Your application ought to be a one-stop answer for all the insurance issues of your clients so they can purchase all the protection contracts that they need.

-

Live talk

Live visit with an insurance specialist to pose them every one of the inquiries connected with your protection contract and offer interactive media records with them as connections. The live visit highlight is best for the people who are reluctant to talk with the specialist on the telephone.

-

On-request Consultation

You have the choice to demand a get back to from an insurance specialist who will clear the entirety of your questions with respect to a protection contract. The application will naturally organize the get back to for you when you demand it.

-

High level hunt with channels

Rather than going through the rundown of the relative multitude of accessible strategies to choose the right strategy for you, you can enter a catchphrase on the inquiry bar to look for the arrangement and apply channels to sort query items.

-

Strategy adding machine

Clients can work out the expense of the insurance contract and the wide range of various minor estimations without leaving the application and offer the information with their protection specialist to comprehend them better.

-

Record Scanner and Document Manager

Filter every one of the important reports utilizing your telephone’s camera to purchase a strategy and save every one of the records on an internet based server to get to them later. Inherent record directors can save a great deal of exertion for policyholders as they don’t need to look for reports and sweep them over and over.

-

Reliability program

With Loyalty Program, you will actually want to give limits, coupons, and offers to your policyholders in light of their exhibition to educate them that you care regarding expanding your deals. Client relationship the board is more straightforward with a faithfulness program as you can interface straightforwardly through the application.

-

Simple Claim Processing

Before, clients needed to genuinely record a protection guarantee with the assistance of a protection specialist, yet they could undoubtedly document a case through the protection application in a couple of steps. The insurance agency will handle their case quicker in light of the fact that it is robotized generally.

How much is the cost of developing insurance agent mobile app?

A group of task supervisors, UI planners, engineers, front-end designers, back-end designers, QA subject matter experts, and engineers for different working frameworks is expected for Android App Development. With regards to the advancement cost of the protection application, there is no definite figure, yet beneath are a few things that will influence the improvement cost.

- Project point

- Features

- Platform (iOS, Android, or both)

- Number of hours contributed

- Project size

- Assortment

- The group you enlist

- Area

In view of the above factors, developing an insurance agent mobile application will cost you around 5000 – 20,000 USD.

Also read : Finance Insurance Website Development Company

End

Mobile applications are without a doubt the protection business’ future due to every one of their advantages, including fulfilled clients, information investigation, and the board. Specialists have anticipated that arrangement proprietors are more than prepared to deal with their insurance contracts on their cell phones as it doesn’t expect practically any paper work.

How about we assist you with your insurance agent mobile application development process by making a protection arrangement that meets your business and specialized necessities.

At Next Big Technology, we’ll configuration, create, and convey an Insurance agent mobile application. Go through our portfolio and page on Clutch.

Thanks for reading our post “Insurance Agent Mobile App Development – A Complete Guide”, please connect with us for any further inquiry. We are Next Big Technology, a leading web & Mobile Application Development Company. We build high-quality applications to full fill all your business needs